By Gary Aiken | May 9, 2024

For the first time in seven months, following an impressive rally that saw the S&P 500 surge by nearly 28% from last year’s October lows, stocks declined this April. In my October 2023 analysis, I noted how much negativity was embedded in market participants’ positioning and alluded to the idea that buying stocks might not be a terrible thing to do. Here we are in early May after a fantastic run of stock market returns.

There’s an old saying, “Sell in May and go away.” Your broker might attend their child’s graduation from college and hightail it for the Hamptons – the beach, their yacht, and the country club for the summer. Clients also tend to lose focus on the markets as lounging poolside and enjoying warm weather barbeques hold more appeal than watching their portfolios. The saying assumes that nothing good can come of a summertime market.

That was certainly true last year. Selling in May and going away meant you missed an 11% increase in stock prices through July that evaporated into the lows of October. You could have realized the saying: sold your stocks, stuck the money in treasury bills, and bought stocks back at the same price in October as you sold them in May – thus enjoying your summer while your financial advisor (or their Chief Investment Officer) sweated it out.

A Year in the S&P 500 Index

Sources: Bloomberg Finance, L.P.

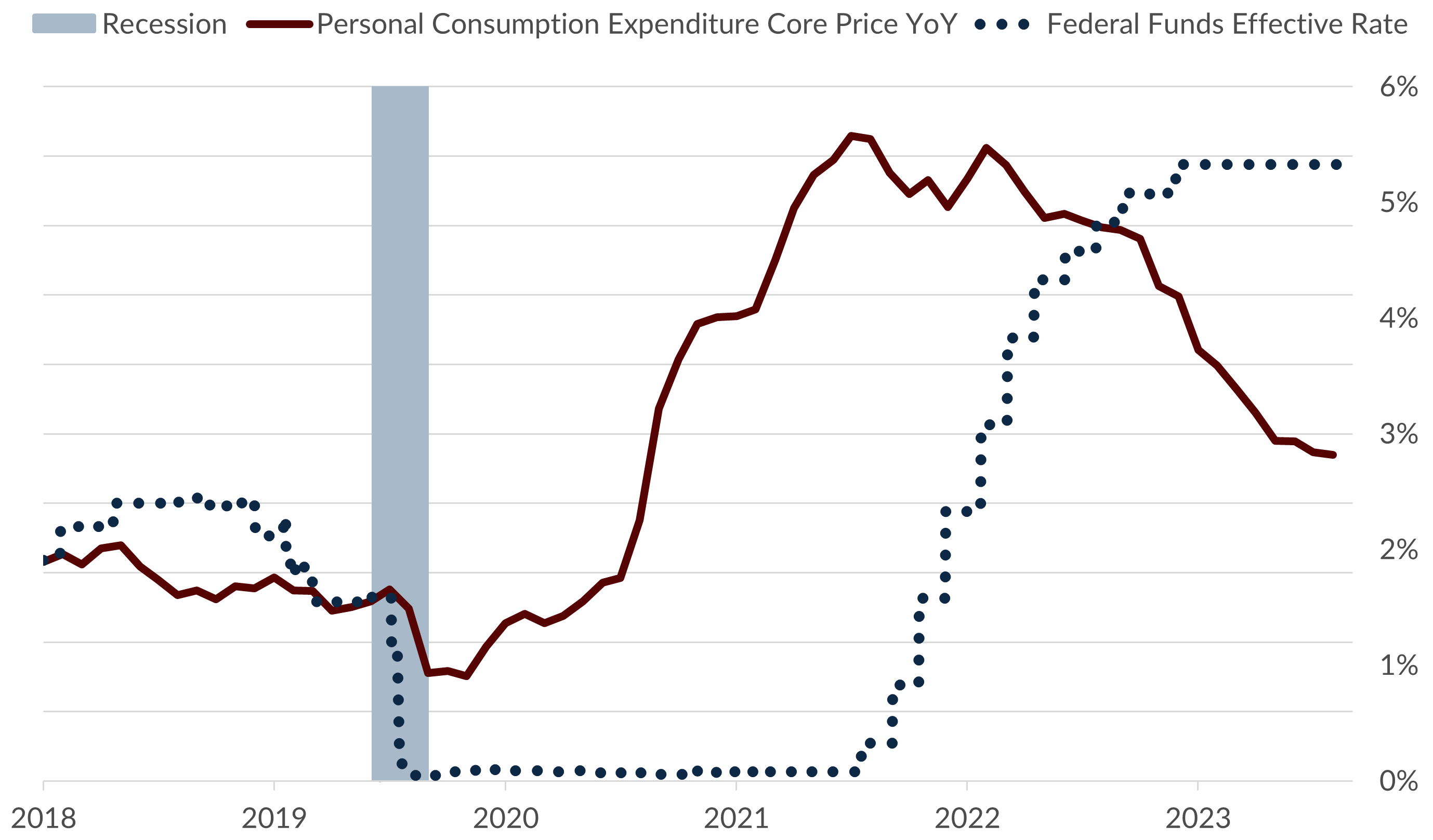

Despite coincidentally living up to the hype last year, there’s no statistical validity to this speculator’s old wives tale. This summer, economic statisticians will focus on inflation and jobs, especially those at the Federal Reserve. Some measures of inflation have accelerated in recent months, but the Federal Reserve’s preferred measure, the U.S. Personal Consumption Expenditure Core Price Index (Core PCE), has stalled at a 2.8% annual rate. When this inflation rate is substantially below the Fed Funds interest rate as it is today, monetary policy is deemed to be tight. Monetary policy has been officially tight for over a year now, as the chart below indicates.

Inflation Rate Decelerates Amid Tight Monetary Policy

Sources: Bloomberg Finance, L.P.

Tight monetary policy usually leads to slowing economic growth. The first quarter of 2024 saw U.S. growth slow to a 1.6% annual pace – well below the recent trend. However, this slowing of economic growth may not be much to worry about. The bulk of the slowdown came from the difference between exports and imports. Importantly, consumer spending and business investment were strong. Consumers spent money on durable goods, healthcare, and travel. Businesses invested in manufacturing, industrial equipment, computer hardware and software.

Concord clients benefited from these trends in their portfolios during the first quarter as well. We were overweight technology and healthcare stocks – especially around the two dominant trends of Artificial Intelligence and GLP-1 drugs for diabetes and obesity. We found value in consumer durables stocks as we have been largely bullish about household formation and all the things that come along with owning a home. According to the Bureau of Economic Analysis, investment in single-family home construction rose 18.1% in the first quarter – the third quarter in a row of significant double-digit growth. The reported earnings of companies in sectors with strong GDP growth have largely reflected that reality. While sometimes the data confounds us, the data makes good sense, at least for now. To the extent that interest rates remain higher for longer, valuations of high-flying technology and healthcare stocks may face pressure. Similarly, the housing market is still dependent on buyers with steady income – if the economy were to turn down and unemployment to rise significantly, consumer stocks would also potentially suffer.

For now though, as companies continue to profit, they also hold on to workers. The unemployment rate, at 3.9%, reflects a labor force where employers seem not to want to lose the workers they have but also seem less interested in hiring additional workers. Anecdotally, company executives are starting to take notice of interest expense on loans to fund their day-to-day operations. While not yet focused on reducing costs substantially, they are paying attention to something that wasn’t much of an issue for the past few years – interest expense. They’re thinking harder about new projects and the hurdle rates of return required to put new capital to work before taking on more debt. This is responsible behavior. In economic terms, it’s rational.

That Econ 101 principle is exactly what the Federal Reserve is hoping to see. A slowdown in the pace of economic growth ought to translate to lower inflation. At the press conference after the May 1st meeting, Federal Reserve Chair Powell was asked two questions pertinent to ponder this summer. First, Jennifer Schonberger with Yahoo Finance asked about Powell’s commentary in August 2022 to expect pain in the economy as the fight over inflation heated up. The reporter noted that the pain never came and basically asked the question from Kenan Thompson’s Saturday Night Live Game Show: “What’s up with that?!” Powell noted that the Federal Reserve still expected unemployment to tick higher as inflation went lower but was generally happy that the pain he expected never came. Aren’t we all?!1

The second question was from Claire Jones from the Financial Times. She asked whether slowing economic growth combined with accelerating consumer inflation might be categorized as the dreaded “stagflation.” Powell nearly laughed as memes formed simultaneously on finance Twitter. Powell replied, “I was around for stagflation, and it was 10 percent unemployment, it was high single digits inflation . . . and very slow growth. So right now, we have 3 percent growth, which is pretty solid growth, I would say, by any measure, and we have inflation running under 3 percent. So, I don’t really understand where that’s coming from.”1

But is Powell right to slough off these questions? After all, reporters are asking the questions that people who must pay higher prices for everyday items like food, fuel, electricity, rent, and insurance are asking. There are also questions whose premises reflect the survey readings in the University of Michigan Consumer Sentiment Index on inflation expectations (rising again), confidence (falling), and, importantly for politicians come November: Are you better off than you were five years ago? Despite rising stock prices, lower inflation, and a growing economy with plentiful jobs, the survey says no. What’s up with that?

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Sources:

1Transcript of Chair Powell’s Press Conference, May 1, 2024

2University of Michigan Surveys of Consumers, Final Results for April 2024, May 3, 2024

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.