By Gary Aiken | August 6, 2024

I’m sweating. What happened to summer break?! I deleted a last-minute slide from my Halftime Report presentation. The slide in question showed the incredible rise of technology stocks leading U.S. and global stock markets higher from January through June of last year, before a summer sector rotation. The first six months of this year repeated a significant rise in the prices of technology stocks as the Artificial Intelligence hardware and software race continued unabated.

I questioned on this slide whether we might see another summer sector rotation. No sooner than I had deleted it than the summer rotation I posited might begin, started. A combination of narrative and technical analysis seems to explain, in hindsight, the recent moves and maybe give us some idea of whether this is a regime change or just a temporary deviation from the prevailing trend. Let’s discuss briefly three of many reasonable explanations:

1. The Story of the Yen Carry Trade

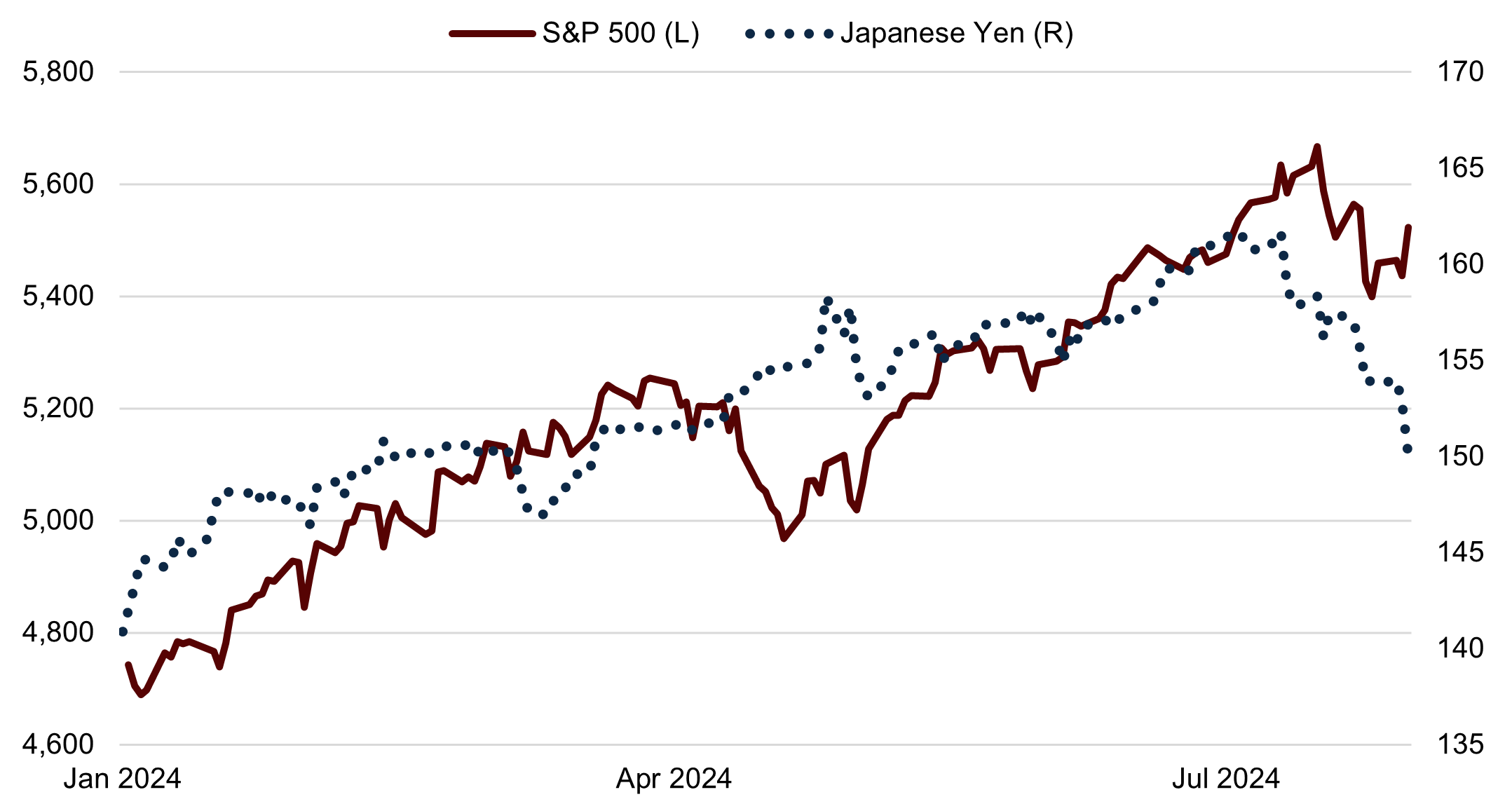

Correlations between asset classes that don’t seem connected can sometimes imply something else is happening. The Japanese Yen and the S&P 500 (US Stock Market) were highly correlated this year. Hedge funds and institutional investors were using something called a carry trade – borrowing in one currency to buy assets in a different currency. As the funding currency (the Yen) depreciated, more dollar assets could be purchased. This trade would become more and more profitable the longer it went on.

A Positive Correlation Between the Yen and U.S. Stocks

Source: Bloomberg Finance, L.P.

However, the leverage in this trade would mean that its unwinding (forced selling and buying) could provoke very dramatic moves in both markets. In advance of its July meeting, the Bank of Japan started to intimate that it would raise interest rates for the first time since 2008. Contemporaneously, concerns emerged challenging the benefits of Artificial Intelligence applications and the pace of hardware infrastructure capital expenditures. The Yen started to appreciate in early July followed closely by selling in U.S. technology shares ahead of earnings.

Interestingly, on the last day of July, this correlation seemed to break down. While the Yen appreciated further on the day the Bank of Japan announced its policy decision, large-cap tech stocks abruptly stopped going down and rallied. The Yen carry trade unwinding was not over. The Yen has now appreciated to the point where almost all its losses against the dollar for 2024 have been erased. The physics of this trade requires an equal and opposite violent reaction on the other side of the ledger. This has come in the form of a broad-based sell off in global stocks.

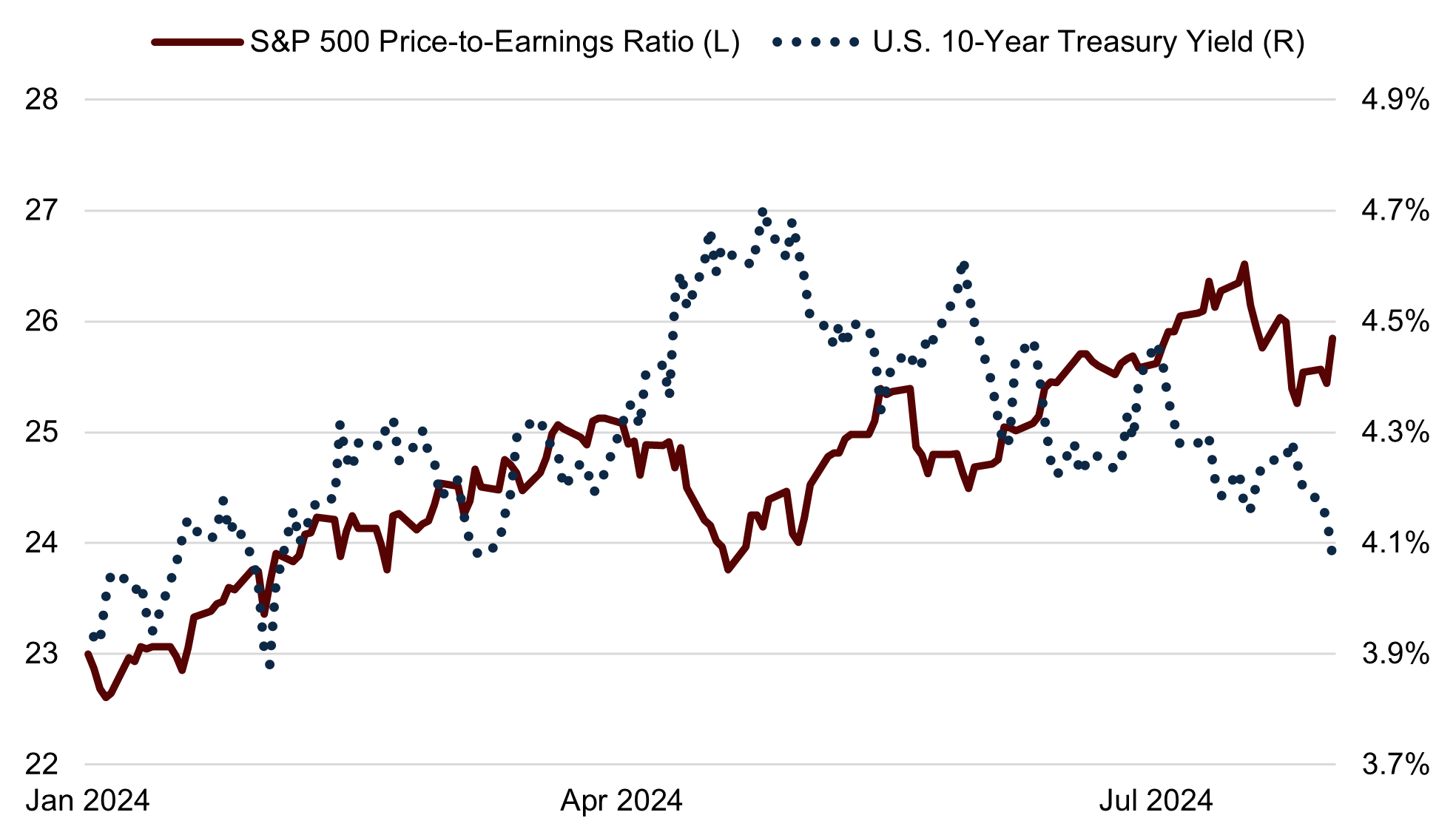

2. The Story of the Inverse Relationship

The first quarter of 2024 was marked by increasing price-to-earnings (P/E) ratios and increasing yields. This positive correlation owed to a combination of a good economy, an inflation resurgence and healthy profit growth expectations enabled this positive correlation. The second quarter held a different and unfortunately familiar narrative. As they did for much of 2022, the prices of long duration assets (such as stocks and long-term bonds) reacted inversely to interest rates. Bond investors will remember the mathematical relationship that as yields go up, prices go down. The “inflation is back” narrative pushed rates higher in early April. When positive inflation data and shakier employment data came in, rates began to retreat. The rate cuts narrative became more mainstream again and stocks resumed their upward march.

Shifting Relationships in Stock and Bond Prices

Source: Bloomberg Finance L.P.

July proved a hyper microcosm of the second quarter. P/E ratios went on an inverse interest rate rollercoaster ride. Interest rates fell in the first two weeks, only to rise in the third and fall again into the Fed meeting at the end of the month. Tech-heavy stock index volatility ramped up in response, and small-cap stocks came to life. The Russell 2000 Index of small company stocks was up 10.2% in July, while the S&P 500 eked out a 1.2% gain that was in question until the final day of trading.

The Federal Reserve made no substantive changes to its statement on July 31, and Jerome Powell sheepishly provided answers at the press conference. The market is convinced that rate cuts are coming as early as September. Per our Halftime Report discussion on the same subject, we happen to agree that is likely.

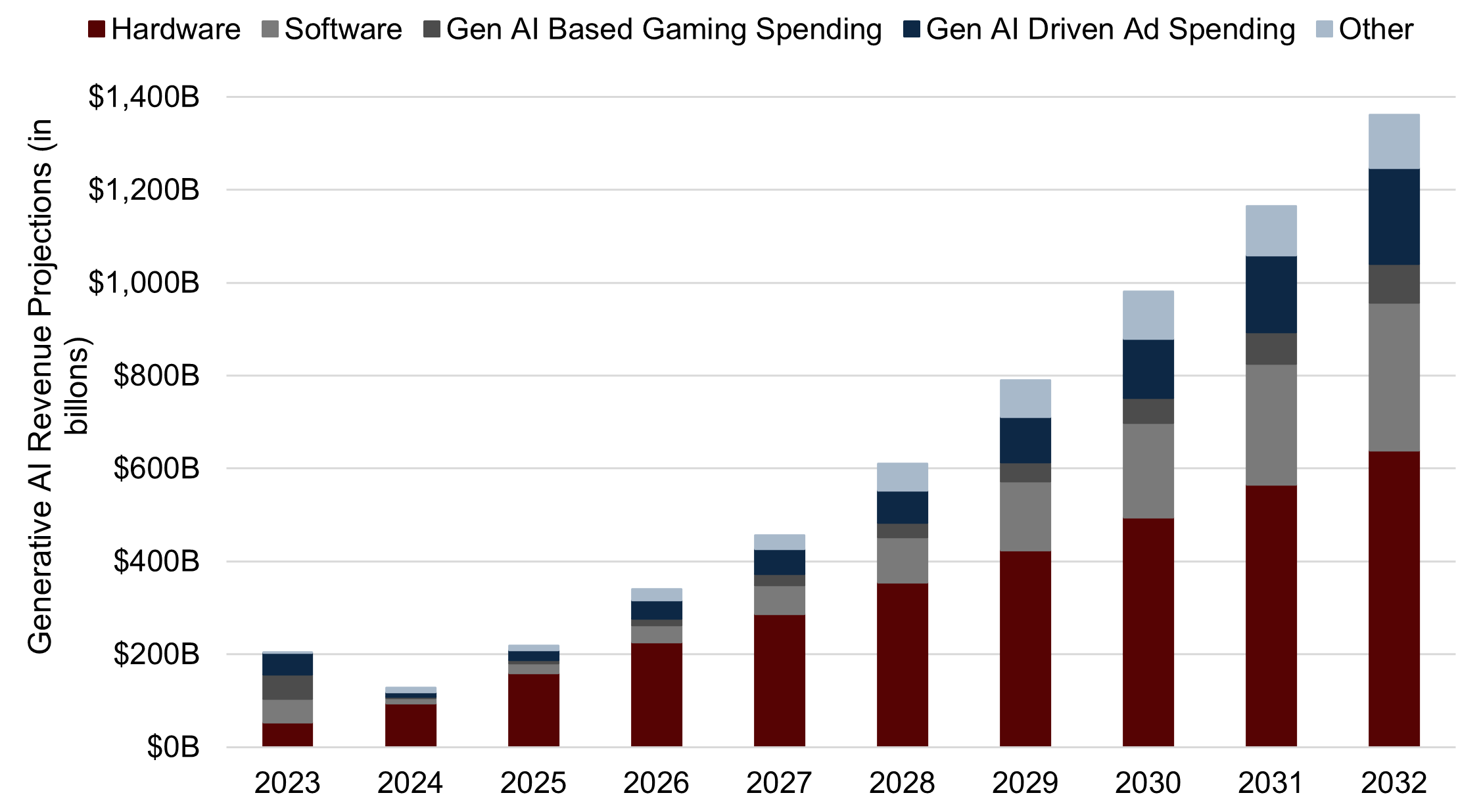

3. Artificial Intelligence (AI) Capital Expenditures

A scary thought entered the minds of technology company analysts during July – or at least they started to talk openly about this fear. What if there’s no “killer app” for AI or the market begins to realize that it may take longer to realize the potential of AI? In that scenario, capital expenditures would shrink. Maybe the number of chips companies like Nvidia are baking into their projections makes no sense. Maybe there’s no real end user, and it’s the same ecosystem of companies selling to themselves. Maybe the hyperscalers (Microsoft, Amazon, Google, Meta) curb their spending to satisfy investors who don’t like the spending without an unambiguous revenue attached to it. These fears manifested in a sharp drop in the entire tech complex in July. The S&P Semiconductor Select Industry Index dropped 15% within a matter of days, while software indices fell 8%.

Projected Generative Artificial Intelligence Spending

Source: Sources: Bloomberg Finance, L.P., Bloomberg Intelligence, IDC, eMarketer, Statistica

The swiftness of this drop was abated by a simple reality. The number of applications that AI holds is still growing. It’s not just about a better chatbot. Uses extend from identifying cancer earlier to faster drug approvals in healthcare. It will lead to more efficient crop production to optimize pesticide delivery or integrating weather patterns into timely planting, watering, and harvesting. The fears were ultimately abated by Microsoft and Meta Platforms, which stated that they were not slowing down capital expenditures for the next two years. We are convinced that there’s nothing unreal about Artificial Intelligence.

We were wrong to pull our “summer sector rotation” slide. The violent downward moves in global stock markets are providing better prices for the stocks of highly profitable companies, including technology stocks. In the meantime, as in many times of market stress, long term investors must endure a painful continuation of July’s heat and market tumult. Instead of a fun summer break, we’re going to need a break from summer.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.