By Gary Aiken | September 5, 2024

My family and I finally caught Hamilton on Broadway this weekend, ticking off a plan we had back in 2020 before the pandemic hit. The pandemic shutdown not only interrupted our lives but kicked off an unprecedented economic policy response. The Federal government approved trillions of dollars of stimulus which the Federal Reserve funded through a rapid increase in money supply. Predictably, this resulted in historic inflation. To unwind the inflation it created, the Fed raised interest rates to decrease the money supply, slowing the pace of inflation and the overheated economy. Here we are in 2024 having come full circle. The economic lows and highs of the pandemic seem to be fading away and we finally completed our family trek to Broadway. While I watched King George III’s character in the musical sing after the American Revolution, I too wondered as an investor, “What comes next?”

Chairman of the Federal Reserve, Jerome Powell, gave us some indication of what comes next regarding monetary policy. Following a rise in the unemployment rate and significant revisions to payroll numbers, the Fed will be increasingly focused on the “full employment” part of its mandate. We should expect lower short-term interest rates soon, but a rising unemployment rate is often a lagging signal that the recession is here. How fearful should investors be that our 20% probability recession call needs to rise? Let’s count the ways.

First, monetary policy has been restrictive for a long period. The Fed may be further behind the curve than recognized. A central bank policy mistake is one of the main historical reasons we have had recessions. Second, the Sahm rule was breached. Economist Claudia Sahm proposed this “rule” that implores the government to do something to prevent an economy from going into recession around the time that the three-month average unemployment rate has risen by half a percentage point or more. Third, the yield curve has been significantly inverted for some time (long-term rates lower than short-term rates discourage investment for the future and slow current economic growth). The inversion is almost cured and, in the past, the resolution of the yield curve inversion to a more normal shape (upward sloping) has indicated that the recession is nigh. Fourth, company earnings were quite good for the second quarter, but there were signs that segments of the American consumer are almost tapped out and significant signs that companies no longer possess their pandemic pricing power. Finally, let’s return to where we started. Unemployment is a lagging indicator – by the time unemployment rises significantly, it’s too late for policymakers to do much to prevent the recession.

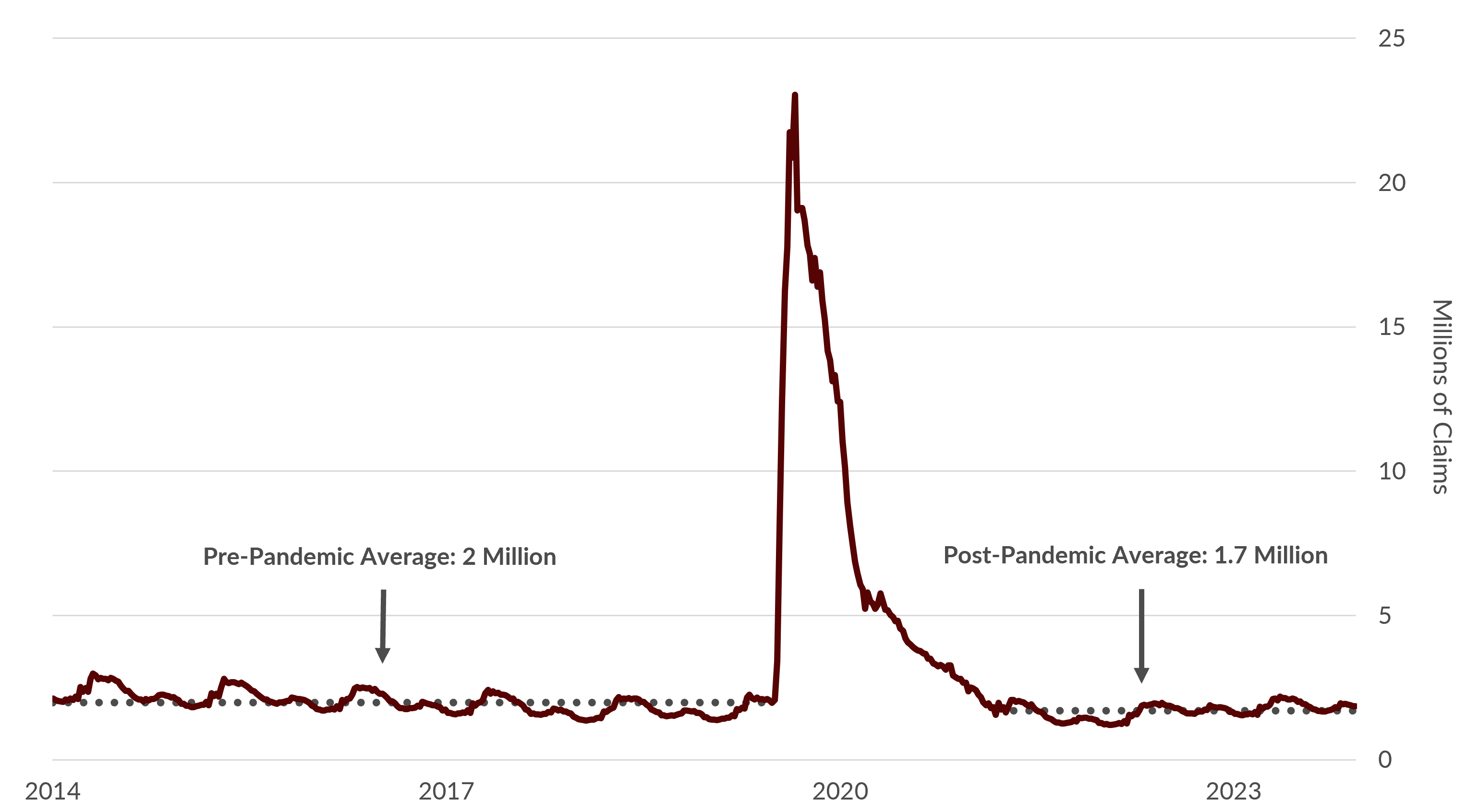

Now that we are sufficiently depressed let’s take a step back. The U.S. economy is still in decent shape. Talking with other Chief Investment Officers, it seems like many of us (who have to actually buy and sell securities for clients) are focused on one statistic in particular. The chart below shows U.S. Continuing Jobless Claims. Continuing claims indicate that a person actively went to a state unemployment agency and filed to receive unemployment compensation for at least two weeks in a row. Taking the pandemic out of the picture, we see that about 2 million Americans were in this transient state between jobs for the five years or so before the pandemic. For the past two and a half years, the average has been about 1.7 million Americans filing continuing claims, and today, that number is approximately 1.9 million – still below the pre-pandemic average.

U.S. Continuing Jobless Claims Below Pre-Pandemic Average

Source: Bloomberg Finance, L.P.

You may have seen news that the Bureau of Labor Statistics revised the number of jobs created in the United States downward by 818,000 jobs for the prior year. The reasons for this large negative revision are many. Analysis shows the main culprits are the treatment of “undocumented” workers in the official numbers and that survey-based measures’ reliability in general have become increasingly fraught as individuals and businesses give up phone landlines. Initial and continuing jobless claims don’t use assumptions – workers who have been laid off or fired must contact their state unemployment offices to get a check. Money talks, and this gives confidence in that statistic above others.

In our view, “what comes next” is an environment where companies can take advantage of lower interest rates for the first time in two years. The economy is already on solid footing, and companies’ earnings have been good. According to FactSet, through mid-August, 93% of S&P 500 companies had reported earnings; of those, 79% had earnings that exceeded Wall Street estimates, and 60% had revenues that exceeded estimates. Earnings for the second quarter grew 10.9% compared to the same period a year ago. As we said in our Halftime Report, any recession (albeit a low probability) is likely to be short and shallow, and if the stock market declines, retreating prices would present a chance to buy great companies at good prices.

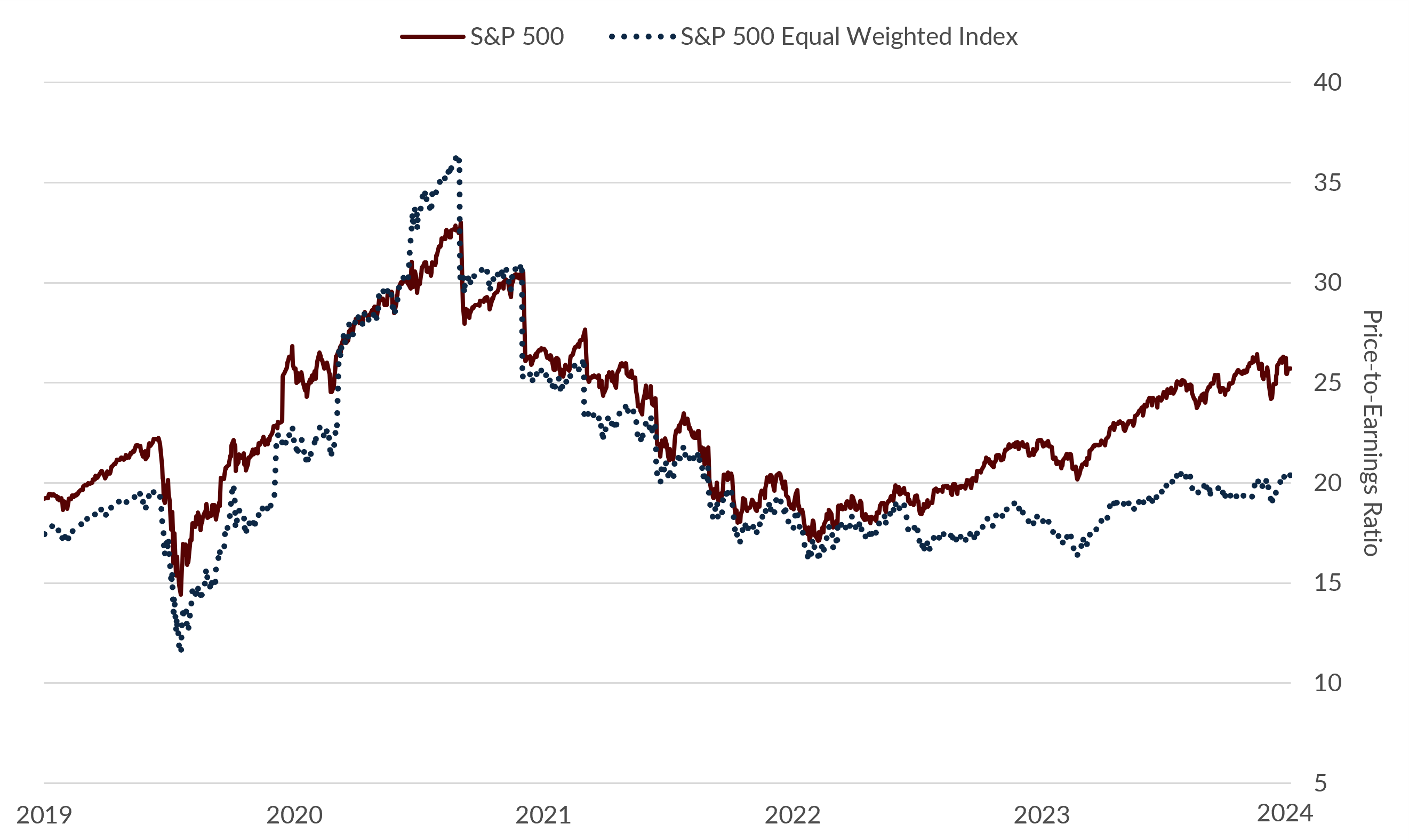

Lower Interest Rates Rationalize Current Price-to-Earnings Ratios

Source: Bloomberg Finance, L.P.

In 1989, Warren Buffett wrote, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” On average, U.S. stocks seem mostly wonderful and priced fairly for now. Stock buyers today are not coming in at terrific bargains. Price-to-earnings ratios are higher today than in the past three years. Companies may justify those price multiples because managements deliver significant value to shareholders. Further, lower interest rates will bring opportunities to grow through acquisition and debt refinance, and future profits will have higher present values. Periodic declines in stock prices are regular occurrences for stock investors, but amidst a growing U.S. economy, stocks present good relative value for patient investors.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.concordassetmgmt.com. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.