By Gary Aiken | April 3, 2025

I often include relevant excerpts from the University of Michigan survey of households and businesses into my insights and reports. This month, I think it is important to elevate the inflation expectations portion of the survey. Federal Reserve committee members and chairs have pointed to inflation expectations as a vital ingredient among the other hard and soft data in the recipe they use to bake monetary policy. Sometimes, this information is half-baked and at other times, it gives great concern.

There are two types of inflation expectations: market-based and sentiment-based. Market-based measures were harder to define before the U.S. Treasury started issuing Inflation-Protected Securities (TIPS). If you subtract the real yield on a TIPS from the nominal yield Treasury Note of the same maturity, you can call the difference the market’s expectation for inflation over the period to maturity. Sentiment-based measures involve asking people what they think inflation might be over the next year or the next 5-10 years. This is what the University of Michigan does in its survey.

The Federal Reserve has said that it wants inflation to run at about 2% per year and that this targeted level of inflation promotes growth and a healthy economy. Nominal interest rates and the Fed Funds Rate should incorporate this inflation rate and expected economic growth. And yet, despite this promotion and years of Fed chairs insisting that inflation expectations are “well anchored,” the latest data seems to suggest that inflation expectations have become unmoored.

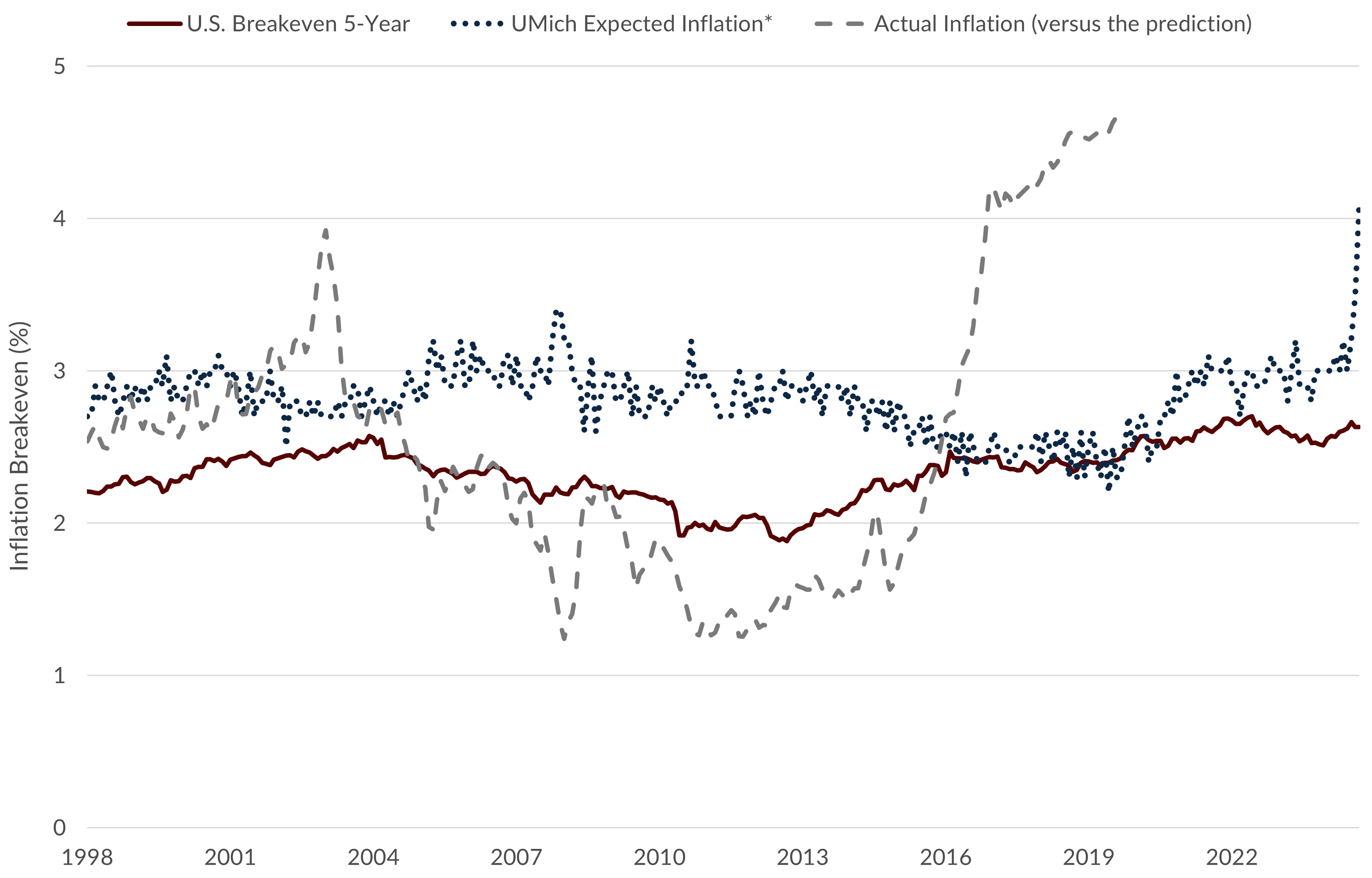

Our chart this month shows three lines. The line with the least volatility is the market-based measure of inflation expectations. The five-year inflation breakeven on TIPS fluctuated between 1.9% and 2.7% (still averaging well above the Fed’s target). The University of Michigan survey pegs inflation historically higher between 2.2% and 3.4% (until recently). Actual inflation though has been much wilder. While at some points (1998-1999), inflation expectations formed a reasonable basis for future inflation, for most of the past 25 years, market and survey-based measures of future inflation have been extremely poor at projecting into the future.

Inflation Prediction vs. Actual Inflation

Sources: Bloomberg Finance L.P., Bureau of Labor Statistics, University of Michigan

Which leads us to today. The University of Michigan survey came out with its highest reading of five-year forward inflation expectations (4.1%) since the first Gulf War in 1991, when oil prices spiked. Similarly, TIPS-embedded five-year forward inflation expectations are also near historic highs (2.6%). The public, whether consumers or investors, doesn’t believe the Fed is winning the war on inflation. The Fed needs the confidence of the marketplace to be taken seriously, but why should the marketplace believe the Fed? Actual inflation (CPI-U) has been running at a 4.7% annual pace versus the mild 2.5% we expected in February 2020. They are failing to provide stable prices per their mandate.

Add tariffs, taxes, DOGE, and war, and it is logical to expect higher bond and stock market volatility, as we predicted in our Forecast Report. Yogi Berra once quipped, “It’s tough to make predictions, especially about the future.” And while this is true, I strongly believe this volatility will yield opportunities to buy financial assets at discounted prices. Combining that fortitude with a solid financial plan is a recipe for long-term financial success, no matter how half-baked forward-looking data may be.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

*Surveys of Consumers, University of Michigan: Consumer Sentiment [CONSP5MD Index] (Accessed on April 1, 2025)

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.concordassetmgmt.com. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.