Stocks Struggle as Investors Shift Focus:

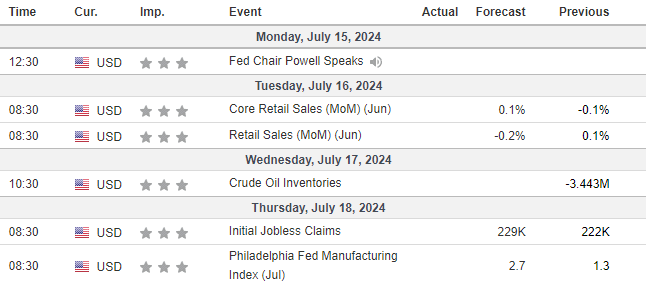

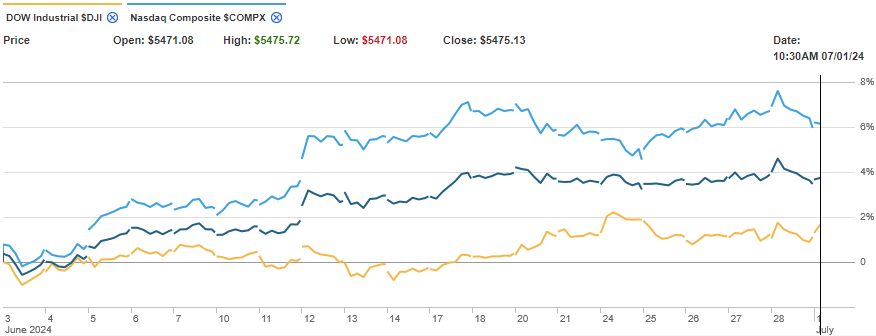

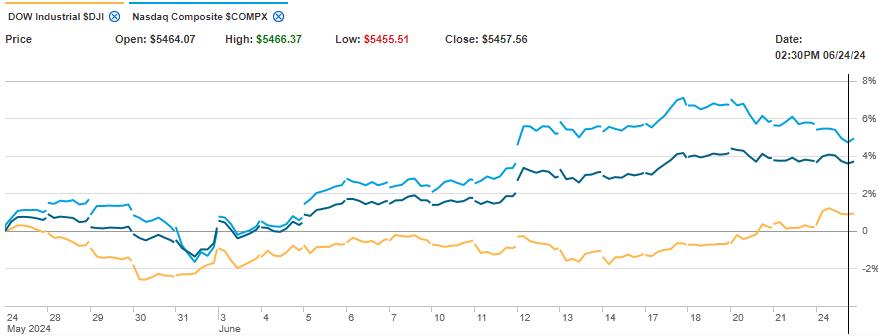

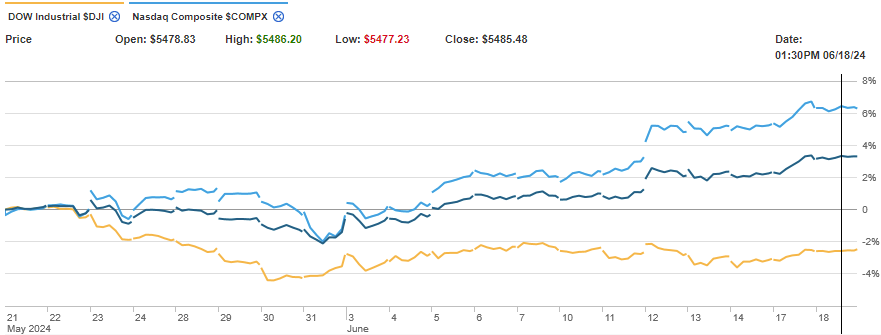

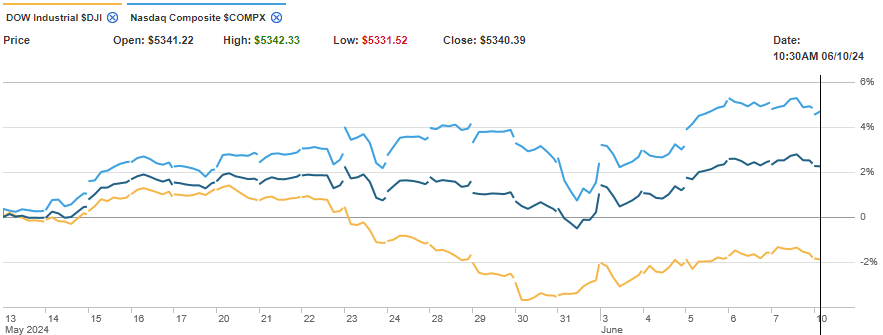

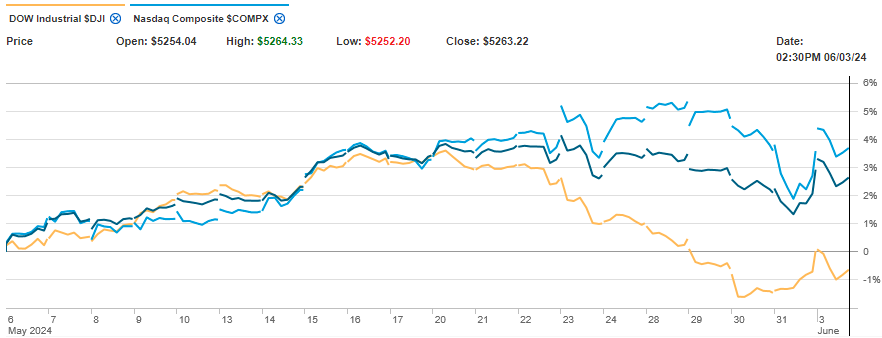

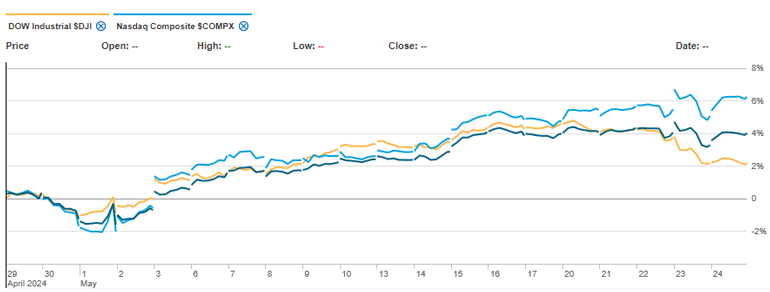

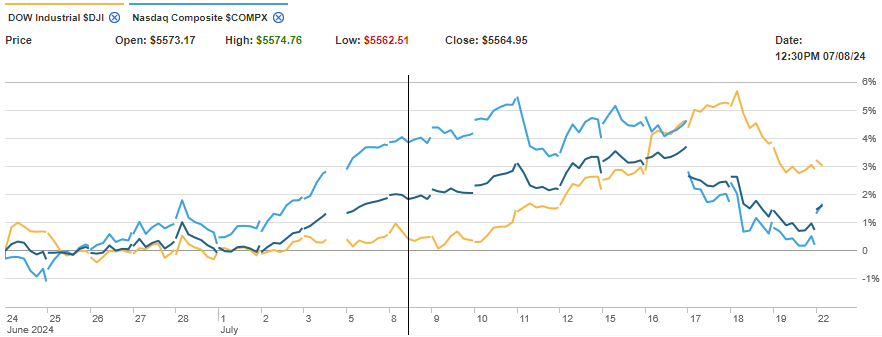

Last week, stocks faced increased pressure as investors appeared to shift away from mega-cap tech stocks and toward sectors that may benefit from lower interest rates.

The S&P 500 Index fell 1.97%, while Nasdaq Composite Index declined 3.65%. The Dow Jones Industrial Average bucked the downward trend, up 0.72%. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 1.48% for the week through Thursday’s close.1

Source: Charles Schwab & Co., Inc

Dow Leads Again

Last week began very differently than it ended. All three averages rallied over the first couple of days this week, with the Dow leading on both days. Fed Chair Powell indicated the Fed may not wait for inflation to reach its 2% target before considering a rate move, buoying the markets.2,3

Then, markets hit a speed bump as investors appeared to take profits and rotated away from mega-cap tech names. The selling broadened beyond tech-related names on Thursday as all but one of the S&P 500’s 11 sectors fell.

Early Friday morning, a global tech outage caused disruptions for businesses, governments, and financial institutions, contributing to the weekly decline. Despite its losses in the second part of the week, the Dow finished in the green.4,5,6

Source: Charles Schwab & Co., Inc

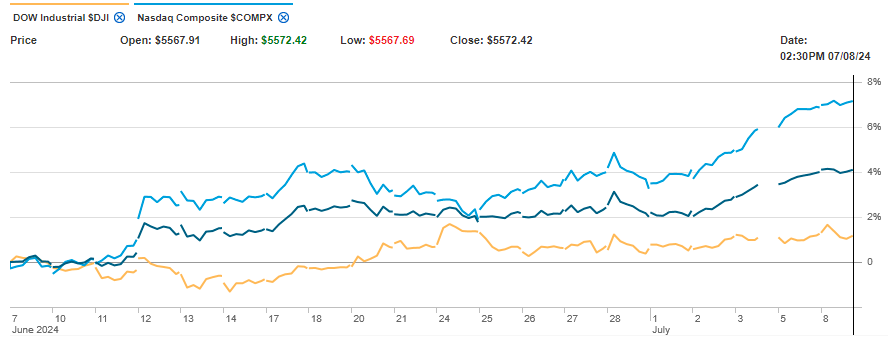

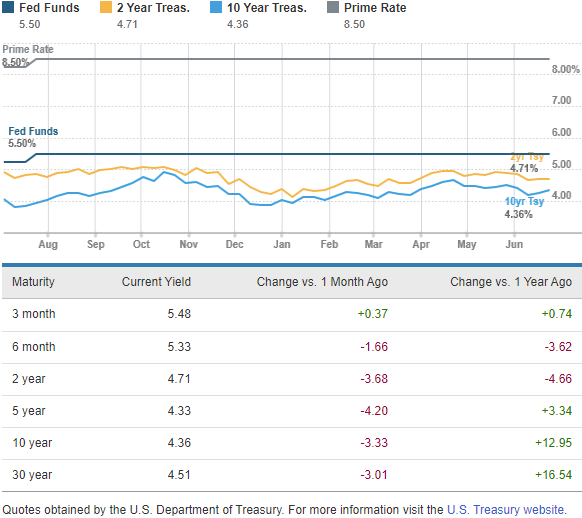

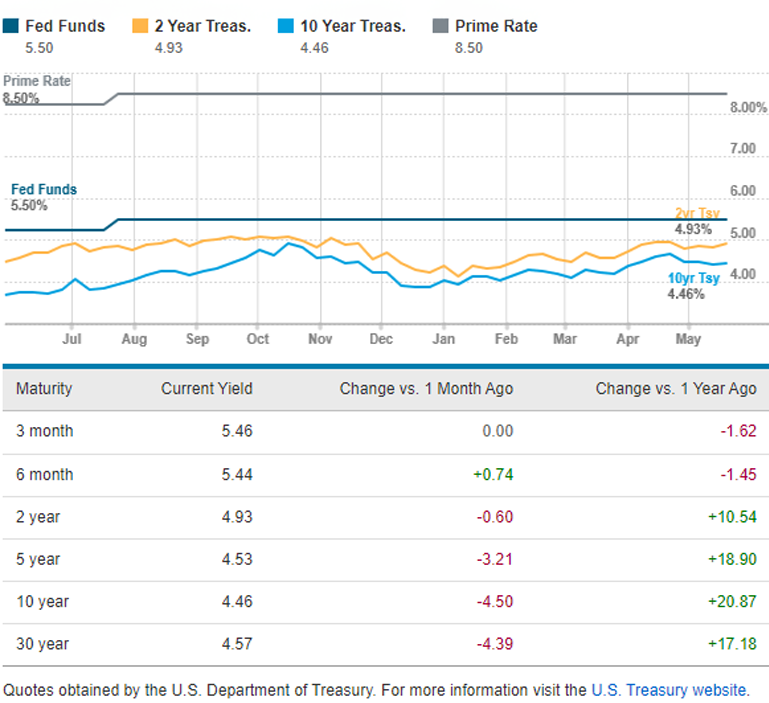

Upbeat Economic Data

Although stocks were under pressure, some investors saw “green shoots” in a few economic reports. Housing starts rose 3% in June and building permits also ticked higher. Retail sales were unchanged in June, which was better than expected. Investors were encouraged that consumers were still spending despite ongoing inflation.7,8

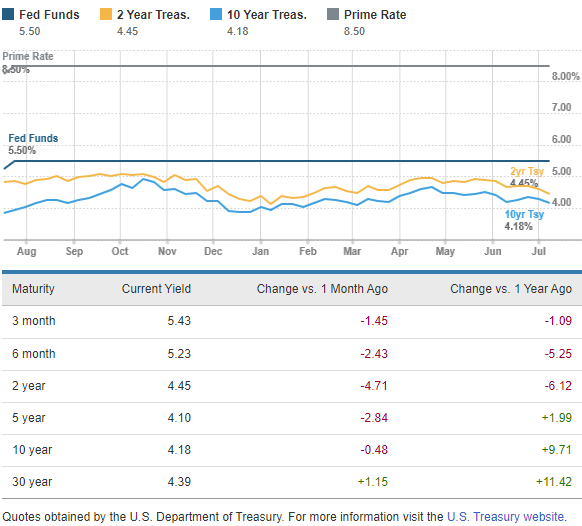

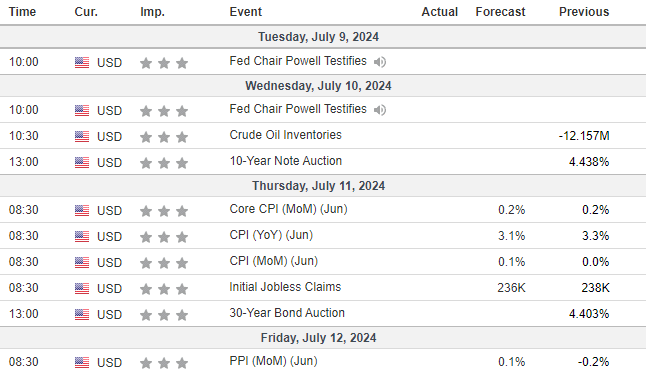

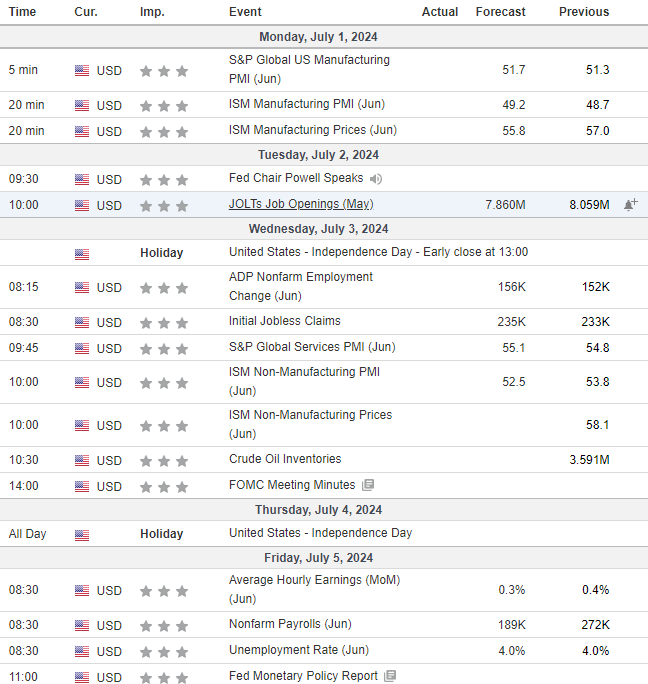

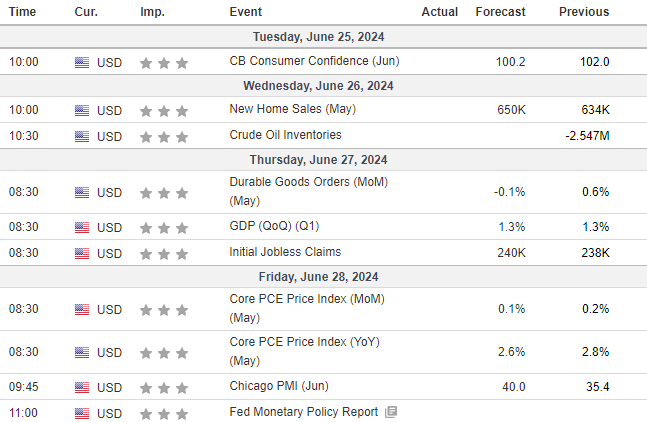

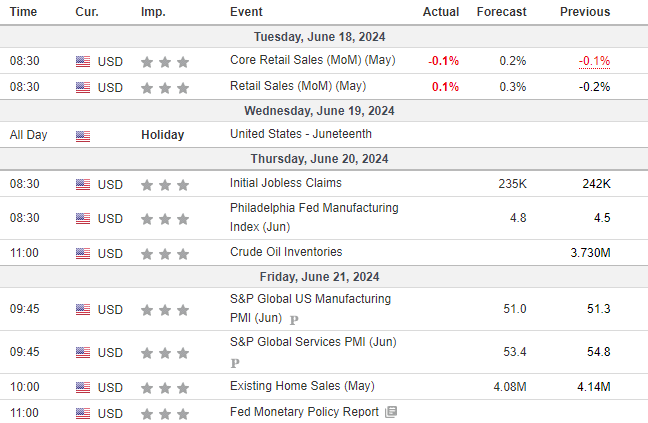

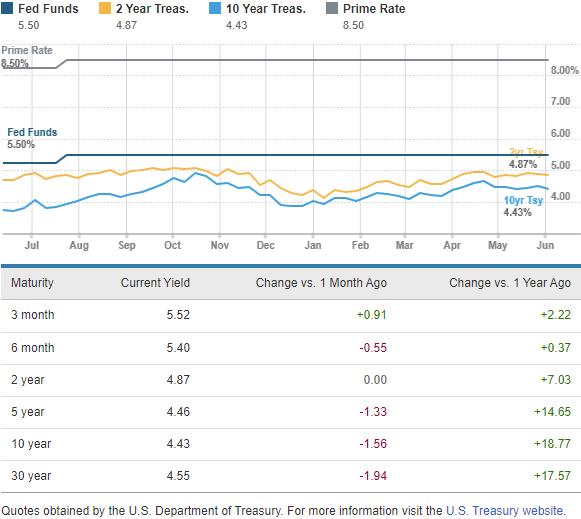

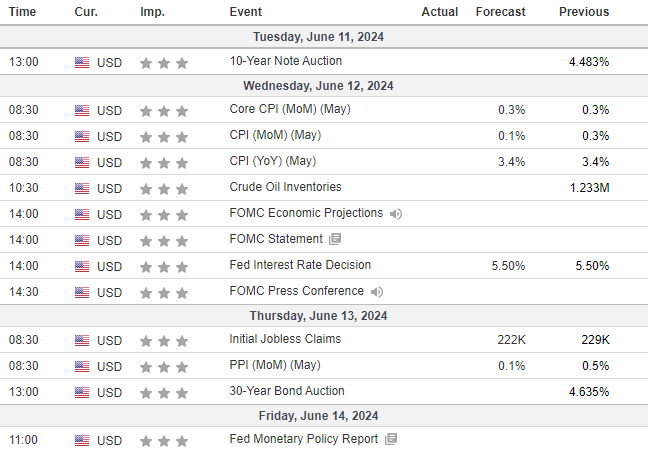

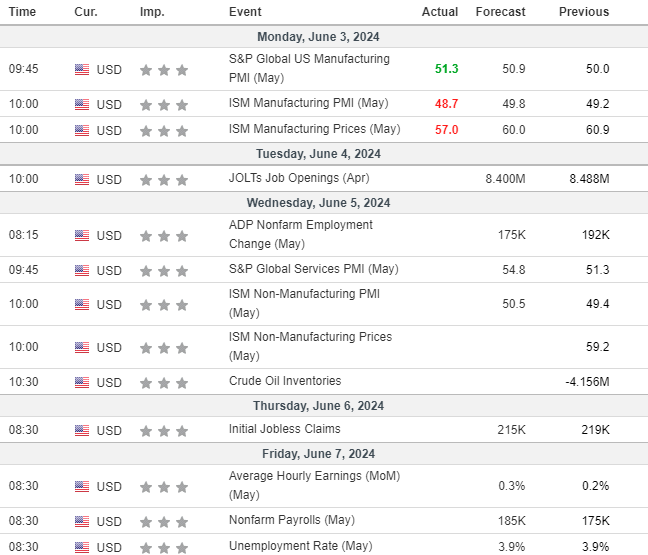

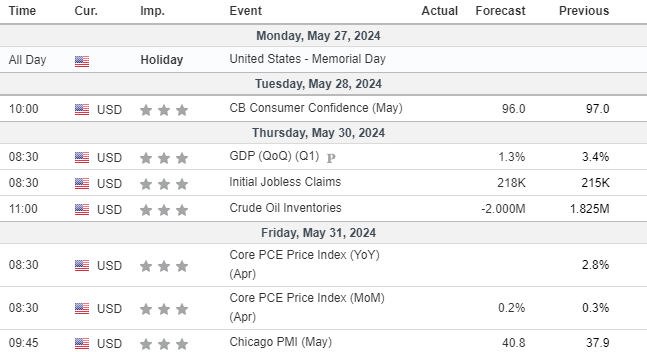

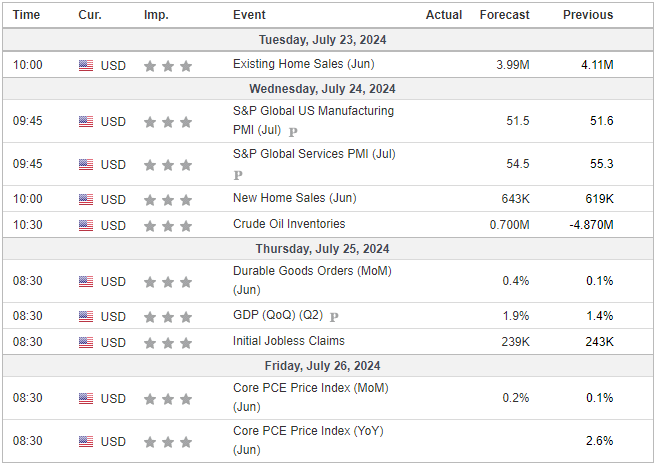

This Week: Key Economic Data

Source: Bloomberg Finance L.P.

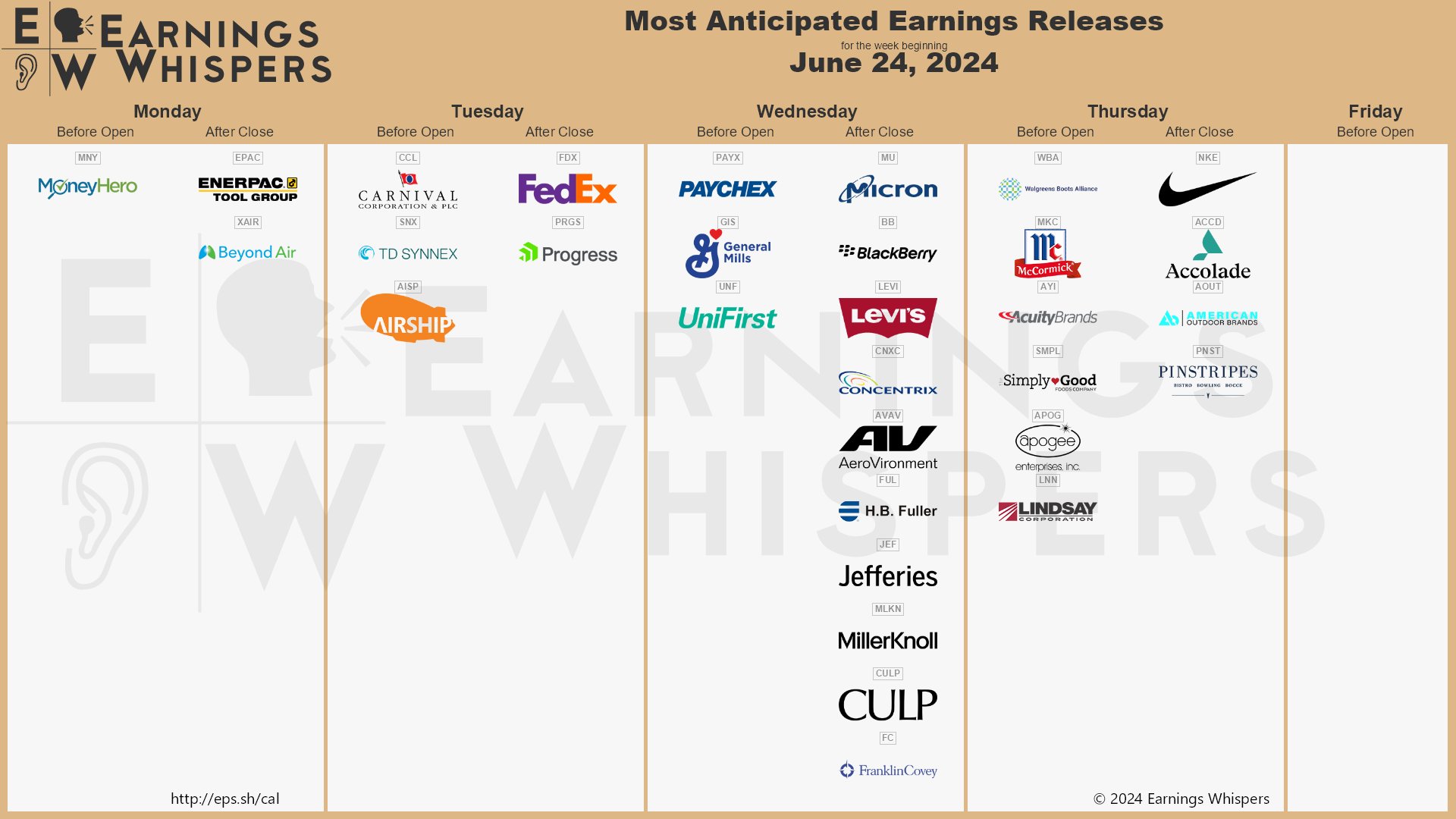

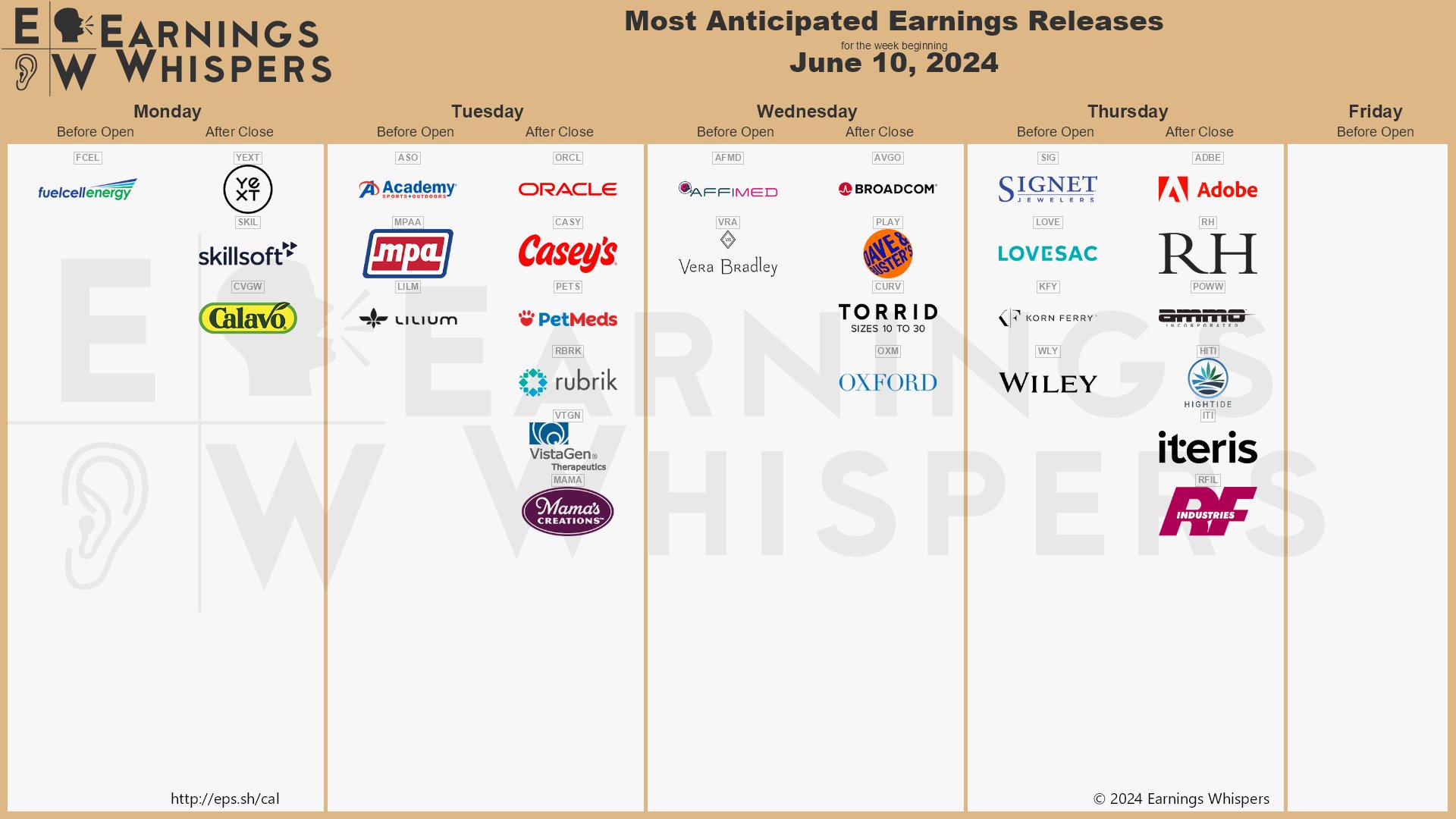

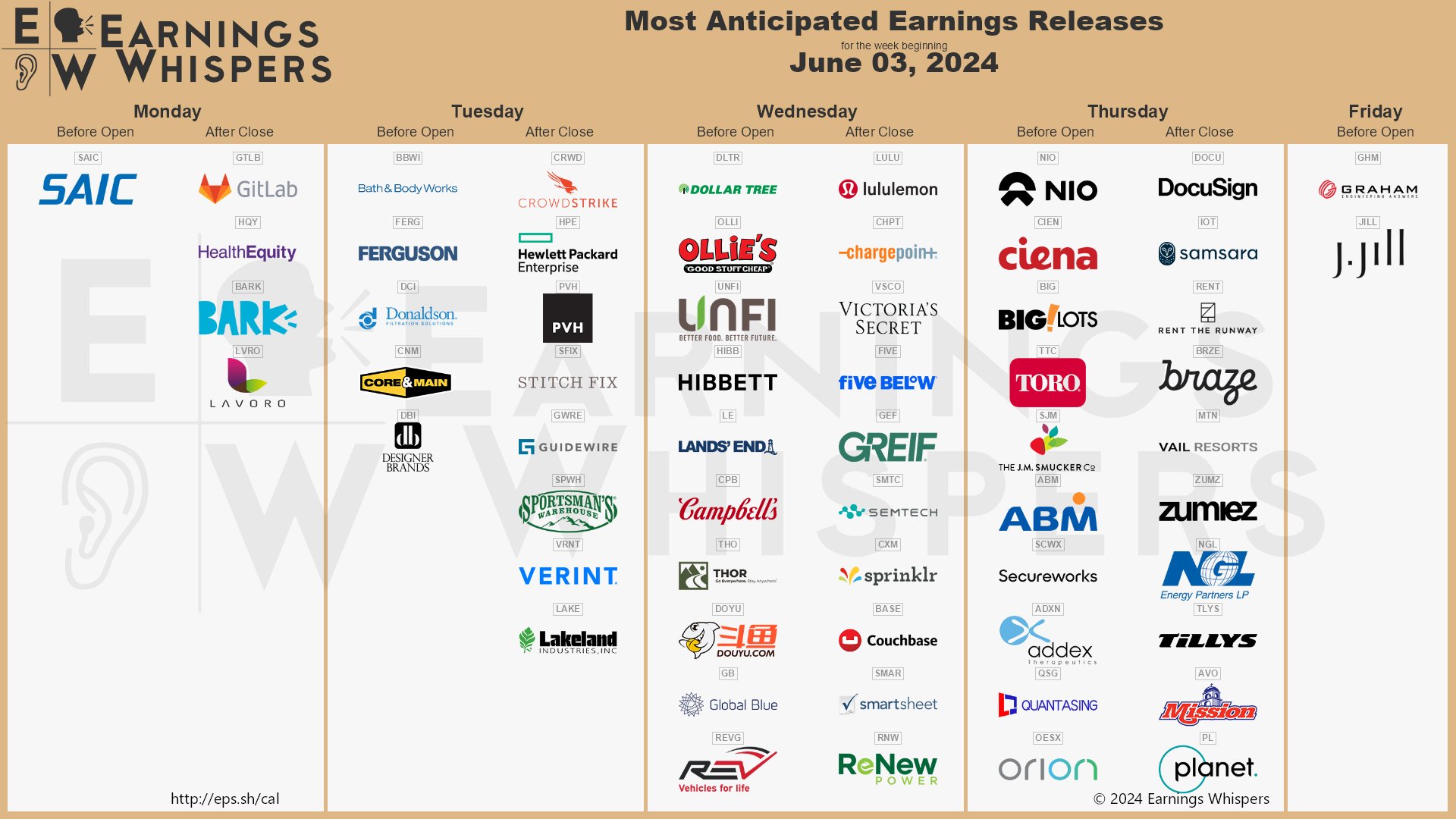

This Week: Companies Reporting Earnings

Source: EarningsWhispers

Author

Gary Aiken

Chief Investment Officer

Concord Asset Management

—

Footnotes and Sources

1The Wall Street Journal, July 19, 2024

2CNBC.com, July 15, 2024

3CNBC.com, July 16, 2024

4MarketWatch.com, July 17, 2024

5CNBC.com, July 18, 2024

6The Wall Street Journal, July 19, 2024

7KPMG.com, July 17, 2024

8AP.com, July 16, 2024

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks, including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications, and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Concord Asset Management, LLC (“CAM”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel with Concord Wealth Partners (“CWP”). CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. CAM and CWP are neither law firms nor certified public accounting firms, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of CAM’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/

Please Note: If you are a CAM or CWP client, please remember to contact us, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. CAM and CWP shall continue to rely on the accuracy of the information that you have provided. Please Note: If you are a CAM or CWP client, strong>please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.