By Mitch York | April 6, 2022

- After a brief flight to quality following Russia’s invasion of Ukraine, U.S. interest rates jumped to three-year highs as inflation fears prevailed.

- The Federal Reserve approved its first interest rate hike in more than three years and indicated many more to come.

- Stocks declined sharply during the first 10 weeks of the year but rallied at the end of March to erase half the losses.

Click to download this report

Economic Commentary

The first quarter wasn’t pretty so let’s say goodbye and good riddance. Like a Clint Eastwood film, this quarter featured the good, the bad, and the ugly.

The good is a strong economy coming back from Coronavirus constraints with very low unemployment and robust demand from households flush with money to spend. The bad is continuing supply chain constraints. And the ugly is the Russian invasion of Ukraine.

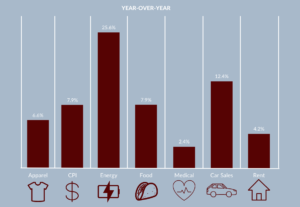

The impact of the war isn’t limited to Europe. It’s affecting wheat, fertilizer, and energy supplies, raising prices around the globe. Even before the invasion, all eyes were on inflation, which hit 7.9% for the 12 months ended in February. It’s the highest rate in 40 years and the dominant economic concern. Nearly all other metrics are being viewed through the lens of inflation.1

We thought inflation had plateaued as supply chain constraints started to ease earlier this year. However, the Russian invasion added another layer to supply chain struggles and confirmed to investors the real risk to the U.S. economy is inflation.

Source: Bloomberg

Take fertilizer for example. Even before the Russians rolled into Ukraine the world was verging on “the worst fertilizer situation in modern history in terms of supply,” Peter Zeihan, a geopolitical analyst and author, told FOX Business. “All three source materials that go into fertilizer (phosphate, nitrogen, potash) are subject to an abject shortage. Even if the war were to stop tomorrow, it’s already too late. It’s too late for the planting season for the Northern Hemisphere this year.” It is possible, if not likely, food prices could rise even further.2

Russia also provides about 30% of the global supply of palladium. This metal used to produce catalytic converters for autos has seen its price rise by 80%. It will now lift the already rising prices of cars. Of course, there are the sanctions on Russian oil. No need to explain this impact as we are all aware of the pain at the pump.3

All of this has the Federal Reserve’s attention. It’s no surprise that soon after raising rates 25 basis points in March, Fed Chair Jerome Powell said the Fed might hike its benchmark short-term interest rate faster than expected if inflation continues to surge. All eyes are now on half percent hikes at the next few meetings.4

If there is a recession, it won’t be started by a banking crisis or declining home values. It will be driven by inflation and rising interest rates. In February the Bureau of Labor Statistics reported average hourly wages increased by 5.3%. However, adjusted for inflation, hourly earnings declined by 2.6%.5 No wonder consumers are feeling the blues. The University of Michigan Consumer Sentiment Survey hit 11-year lows on the back of surging prices.6

And for more ugly news, the yield curve has started to invert. That means shorter-term interest rates are higher than longer-term interest rates. That is often a precursor to recession. And this time it may be different as investors are concerned the Fed’s late start to raising rates could lead to stagflation, a word not heard since the 1970s. Stagflation is a combination of rising prices and declining economic growth.

Market Commentary

After New Year’s Day, the market indexes hit all-time highs, then began a steady decline. The shock of the Russian invasion and surging inflation expectations pushed the Dow Jones Industrial Average and the S&P 500 Index into correction territory, a more than 10% drop from their highs. The Nasdaq posted a decline of more than 20%, which is considered a bear market.

Uncertainty causes investors to pull back and lower their exposure to stocks and other risky assets. Geopolitical risk only adds to the uncertainty. We don’t like it when stocks decline dramatically, but these declines reprice risk in order to increase future expected returns. This is why investors “buy the dip.” Fortunately, dip-buying occurred in late March cutting those staggering equity losses in half.

Typically, bonds become a safe haven when stocks crash, but not this time. The yield on the 2-year Treasury note rose 155 basis points to 2.28% during the first quarter; the largest 3-month increase in 38 years. The 10-year Treasury note advanced 83 basis points to 2.36%. When yield goes up, bond prices go down. According to Bloomberg, the total U.S. bond market lost 5.9% during the first quarter. Long and intermediate-term U.S. Government bonds declined 10.6% and 5.4% respectively. Investment-grade corporate bonds also performed miserably, down an incredible 8.4%.7

The bond market is reacting to expectations of inflation and what the Fed will do. Meanwhile, the stock market is reacting to the bond market, interest rates, the risks of rising inflation, stagflation, geopolitical uncertainty, and the volatile commodities market.

Final Thoughts

The financial markets have started the year on a roller coaster ride. Bonds have sold off sharply and the yield curve has started to invert. Stocks entered correction and even bear market territory only to surge back at the end of Q1. The typically reliable 50/50 stock & bond portfolio declined more than 5%. The wall of worry I often refer to is looking ominous at the moment, so let’s put this in perspective and discuss a prudent course of action.

We don’t know if the Fed’s actions will lead to recession. With interest rates starting at 0%, even if the Fed hikes rates to 2.5%, that’s will still be historically low. While higher rates could slow economic growth, households have a lot of money and want to spend it. This might prevent an economic contraction, at least for now.

An inverted yield curve could indicate a recession is in the cards. Since 1900, the yield curve has inverted 28 times, and about 75% of the time a recession has followed. However, it is worth noting the average lag from inversion to recession was 22 months. The lag time over the last six recessions ranged from 6 months to 3 years. To add even more complexity, stocks tend to perform well in the months following an inverted yield curve.

Source: Truist Advisory Services

What we do know is being out of the market can be very costly. According to Dimensional Fund Advisors, from 1990 to 2020, an investment of $1,000 in U.S. stocks would have grown to $20,400. During that 30-year time period, missing out on the best 25 stock market days would have reduced that amount to $4,400.

It’s important for investors to keep a long-term perspective. There are always reasons to sell stocks, but timing the market is difficult. You have to get it right twice – getting out and getting back in. At Concord Asset Management we have that long-term perspective. Instead of bailing on stocks, we have changed stock allocations by reducing clients’ exposure to growth stocks that are more sensitive to rising interest rates for less sensitive stocks.

In addition, earlier this year we lowered interest rate risk for clients in moderate-risk and conservative portfolios by increasing the allocation to funds that invest in floating-rate securities and reducing the allocation to longer-term, traditional bond funds that perform poorly when rates rise. Some clients still have exposure to U.S. Government bonds. If the war in Ukraine spreads, or other significant unforeseen events transpire, there will be a flight to quality, and you will be thankful you own Treasuries.

Lastly, times like these remind us how important it is to consult with your Advisor to make sure your portfolio is aligned with your risk tolerance. It is this valuable partnership between the Client, Advisor, and CAM that will help guide you through these uncertain times by making prudent decisions and avoiding costly mistakes.

Author

Mitch York

CIO

Concord Asset Management

—

Footnotes and Sources

1US Inflation Calculator, March 15, 2022

5U.S. Bureau of Labor Statistics, March 10, 2022

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications, and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/.

Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided. Please Note: If you are an IA Firm client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.