Coinbase’s IPO Makes a Splash in the Market

Key Observations:

- The IPO of Coinbase is an important milestone in securing the legitimacy of cryptocurrencies.

- Coinbase as a stock is a means to broad exposure into cryptocurrencies.

- The risks on Coinbase are numerous, especially given its current valuation.

What is all the Fuss About Coinbase?

A highlight of 2020 was the incredible resiliency of the market for initial public offerings (IPOs). Firms such as Airbnb, DoorDash, Rocket Mortgage and GoodRx took advantage of the burgeoning stay-at-home economy and booming stock market as their IPOs collected tens of billions in new market capitalization.1 There is no sign of the red-hot IPO market slowing down either. According to Ernst & Young, in Q1 global IPO volumes rose 85% and proceeds rose 271% year-on-year for the strongest first quarter in 20 years.2

So it was no surprise when Coinbase, the largest cryptocurrency exchange in the U.S. and third largest globally, had an incredibly successful launch on April 14. On the close of its first day of trading, Coinbase was valued at $86 billion dollars. To put this in perspective, investors viewed it as more than three times as valuable than the NASDAQ ($26 billion). Even more remarkable, Coinbase was valued significantly higher than Intercontinental Exchange Inc ($67 billion) which owns 12 stock exchanges globally including the NYSE and as a company it was deemed to be worth more than Citigroup and Morgan Stanley.3

Before we start to think dotcom bubble all over again, let’s consider the company’s merits. Coinbase has several lines of business but generates most of its revenue from spreads and fees it charges users when they buy or sell cryptocurrencies such as Bitcoin. And they have a lot of users; 56 million verified and 6.1 million transacting monthly representing year-over-year increases of 30% and 117% respectively. They are bringing their money as well with $223 billion of assets currently residing on the Coinbase platform. Even better, the firm is making money. During the first three months of 2021, revenue came in at $1.8 billion with profits expected to fall between $730-$800 million. In comparison, revenue for all of 2020 was $1.3 billion.4

The obvious question, given its user base and financial performance, does Coinbase deserve an $86 billion valuation? Maybe. As a stock, Coinbase is compelling to investors because it is likely the best pure-play, publicly traded investment providing exposure to the cryptocurrency market. It is inherently a more acceptable investment for traditional investors than Bitcoin. Cryptocurrencies such as Bitcoin do not generate revenue and profits, they will never pay a dividend and thus, they are nearly impossible to value. As an investment, this is an advantage to companies like Coinbase will always have over cryptocurrencies. When you buy a crypto you are accepting its price based on faith and hope. In addition, many investors call Coinbase a “pick and shovel” investment, referring to the California gold rush where the true money to be made was from selling goods and services to those mining the gold, not in the gold itself.

Now for the maybe not. The risks of investing in Coinbase are numerous and the greater the risks the less attractive the lofty valuation. First, future success depends on more users which will be dependent on broader adoption of cryptocurrencies as a basic way to pay for goods and services. In addition, success also depends on a healthy market for Bitcoin and other cryptos; a sustained bear market for these assets will certainly dampen the adoption of crytpos and Coinbase as an exchange. Then there is the risk of government regulation; it has and will be looming over this market for a very long time.

Even if all those concerns are a wall of worry you are comfortable climbing, there is competition. When it comes down to it, Coinbase is an exchange and exchanges have been around for hundreds of years. Coinbase is just trading a new product and trading it an incredible spread. In 2020, Coinbase collected about 0.57% of every transaction in fees (for 87% of the firm’s 2020 revenue). That is at an incredible spread and has resulted in Coinbase’s incredible margins. High margins attract a lot of attention. Just as competition drove online stock trading fees to zero for broker-dealers, it is possible competition in this space will force another race-to-zero. The risk is in Coinbase’s ability to dramatically increase their user base and lines of business in the headwinds of increased competition and diminishing transaction fees.

A more important question than Coinbase’s valuation is “do you believe cryptocurrencies will be more significant 10 years from now?” If you answer yes, as I do, then having exposure to this industry in your investment portfolio is important. How to suitably acquire this exposure is where CAM can provide important direction.

Final Thoughts:

At CAM, we believe investing in disruptive innovation stocks is an important part of our clients’ diversified portfolios. We provide broad exposure to this theme for clients by carving out a portion of their accounts and constructing a portfolio of up to 100 individual stocks. Collectively, these stocks track our proprietary, internal disruptive innovation benchmark. Our benchmark’s universe of stocks includes “pick and shovel” companies associated with cryptocurrencies such as Coinbase, other fintech companies, blockchain firms, etc. For new clients, and as we rebalance existing client accounts, Coinbase is likely to be included in the 100-stock exposure. Disruptive innovation is dynamic and will continue to evolve at a rapid pace, especially in the cryptocurrency space. Our clients can have confidence that we will monitor these changes, adjust our internal benchmark, and rebalance client accounts as necessary.

Sources:

All performance data generated through Morningstar.

-

Morningstar: https://www.morningstar.com/articles/1014850/the-10-biggest-ipos-of-2020

-

EY: https://www.ey.com/en_gl/ipo/ipo-trends-2021-q1

-

NY Times: https://www.nytimes.com/live/2021/04/14/business/stock-market-today

-

Coinbase: https://investor.coinbase.com/news/news-details/2021/Coinbase-Announces-First-Quarter-2021-Estimated-Results-and-Full-Year-2021-Outlook/default.aspx

-

MarketWatch: https://www.marketwatch.com/story/should-you-buy-coinbase-the-valuation-is-ridiculous-11618254467

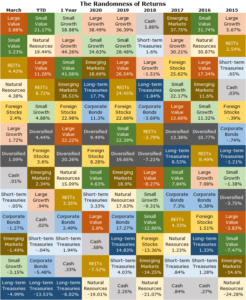

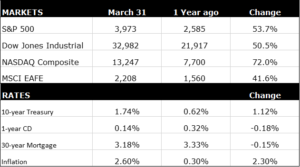

Note: All performance data in the following two charts were drawn from Morningstar.

Disclaimer: Concord Asset Management (“CAM”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CAM and its representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All data is as of the end of April 2021 unless otherwise noted. Data sources include: www.morningstar.com. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Wealth Partners, LLC (“IA Firm”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from IA Firm. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of information that you have provided. Please Note: IF you are a IA Firm client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. You cannot invest directly in an index. Stock markets, and many individual equities, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

The price of bitcoin and other digital currencies has fluctuated unpredictably and drastically. You could experience significant and rapid losses. Profits or losses from investing in bitcoin are virtually impossible to predict. Platforms that buy and sell bitcoins may be unregulated, can be hacked, may stop operating, and some have failed. Unlike banking institutions that can provide FDIC insurance, there are no such safeguards provided to digital wallets. Bitcoin payments are irreversible. Once you complete a transaction, it cannot be reversed. Reversing a transaction depends solely on the willingness of the recipient to do so.