By Gary Aiken | December 6, 2023

As far as investors are concerned, Christmas came early! Looking back over the past 70 years, November has usually been an excellent month for stocks, returning 1.4% on average. This year the S&P 500 Total Return Index clocked in at an impressive 9.1% return for November. The bond market also turned in an outstanding result in November, with the Bloomberg Aggregate Bond Index delivering a 4.5% total return, outpacing over 98% of monthly returns dating back to the index’s inception in 1976.1

In my November commentary, I wrote about the dismal returns in stock and bond markets since July. I tried to contrast price action with the facts of decent real economic growth, slowing inflation, and rising corporate profitability. November gave us several data points to corroborate that view. First, third quarter GDP was revised higher from 4.9% to 5.2%. Next, the Federal Reserve’s preferred inflation measure, Core PCE, declined to a 3.5% year-over-year rate. Last, according to FactSet, as more companies reported earnings, it seems like we are indeed closing in on the first quarter in the past four where companies are reporting higher earnings than they were a year ago.2

High frequency and anecdotal data further our positive narrative. According to Adobe Digital Insights, November’s start of the holiday shopping period is the fastest-paced and highest-grossing ever. The Transportation Safety Administration reported that a record number of travelers passed through airports on Thanksgiving weekend. Finally, and this may be a little contrary, the labor market is getting softer.

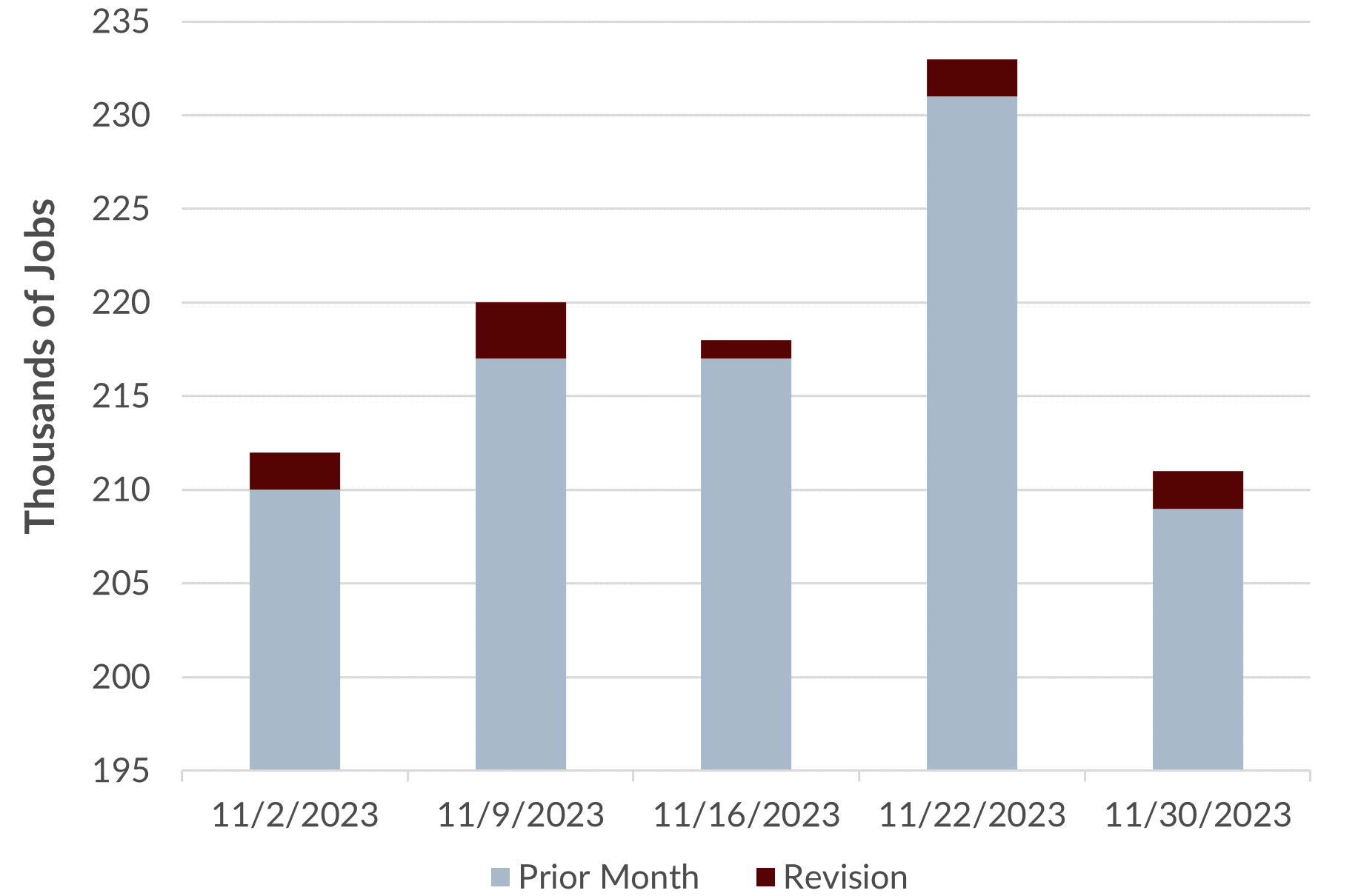

Initial Jobless Claims

Source: Bloomberg Finance, L.P., U.S. Department of Labor

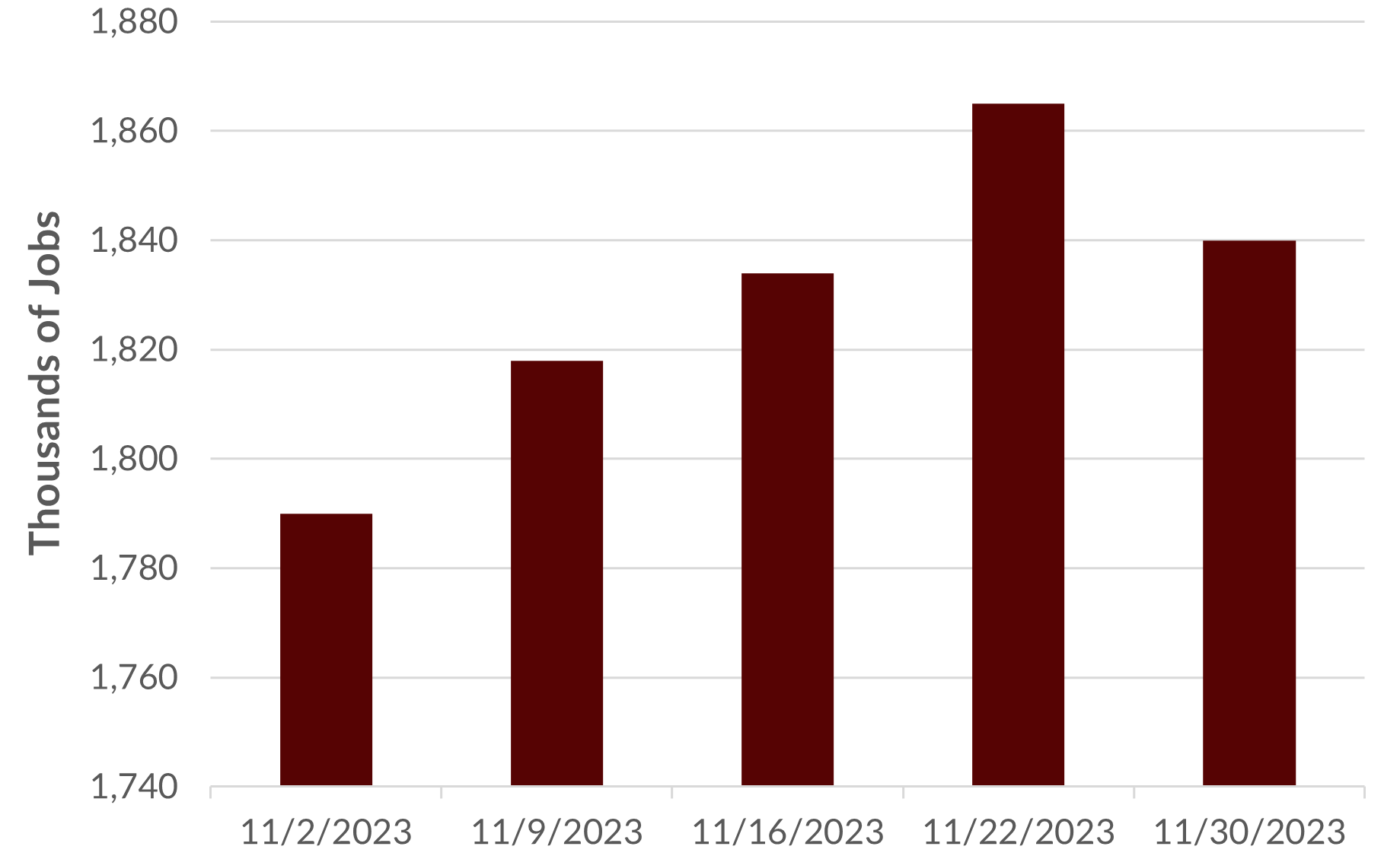

Why would the labor market softening be a “positive” indicator? Each revision to the weekly employment data has been revised to indicate more jobless claims and continuing claims during November. The Federal Reserve wants to see two things happening to confirm that its mission to combat inflation is working. First, it wants to see actual inflation rates decline towards its 2% target. Second, policymakers want to see the evidence of a slowing economy in softening labor market data—that means the unemployment rate inching its way upwards towards its 4.2% target for 2024. While employment data has surely been muddied by strikes in the auto and entertainment industries and the Thanksgiving holiday weekend, the data trend is moving the Fed’s way.

Continuing Unemployment Claims

Source: Bloomberg Finance, L.P., U.S. Department of Labor

The economy growing, inflation cooling, corporations making profits, and eroding labor market wage-price pressures are wonderful ornaments to hang on our tree. Markets increasingly took the November data as signs to erase the gloom and doom of the summer months and get into that holiday spirit. If inflation is heading down towards 2% over time and the economy will eventually cool to a 2% pace, then the central tendency for long-term rates is around 4%. A 10-year Treasury note yielding 4.99% (nearly the highest in the past twenty years) makes for an excellent stocking stuffer. Bond buyers scooped them up, and as prices went up, yields declined 66 basis points (0.66%) to 4.33%.

If the discount rate applied to future, growing earnings can be lower, then a higher Price-to-Earnings (P/E) multiple can be applied to all stocks—even those neglected during the first ten months of this year. Still, the Magnificent Seven (Microsoft, Meta Platforms, Amazon.com, Apple, Tesla, NVIDIA, and Alphabet) rose 11.7% during the month as an equal weight basket. The dominance of these stocks continued— especially as Artificial Intelligence-related revenues continued to live up to the hype for hardware and software applications.

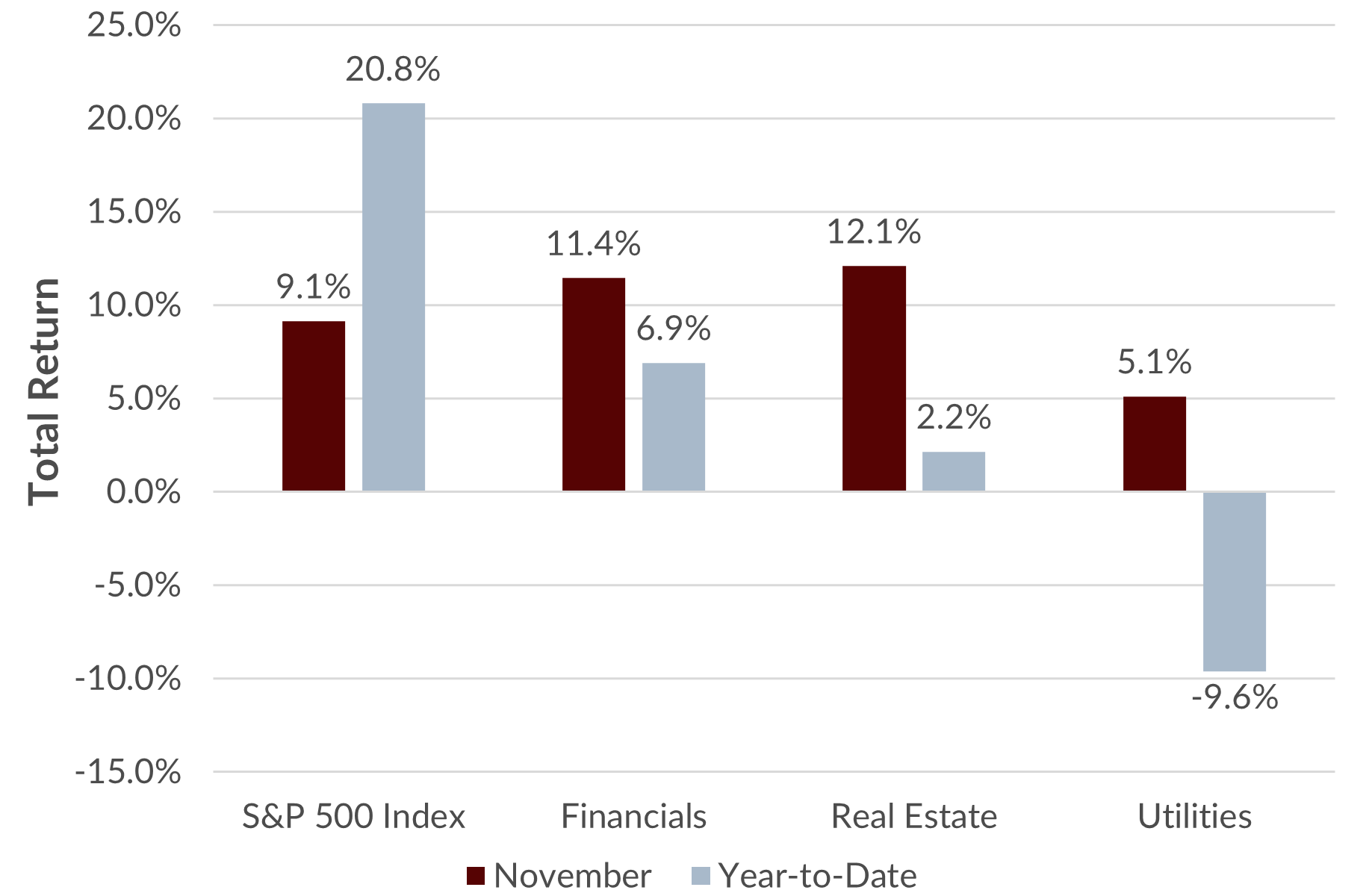

When interest rates go down, interest-sensitive market sectors tend to react very positively. As a result, the MSCI USA Financials Index climbed 11.5%, and the MSCI USA Real Estate Index rose 12.2%. Concord has been underweighting these sectors during 2023, so this was a particularly challenging month for our portfolios. Still, these sectors along with utilities and industrials, have been amongst the worst performing sectors during 2023.

Lagging Sectors Outperformed in November

Source: Bloomberg Finance, L.P.

Let’s look beyond the Santa Claus rally to what the future may hold for stocks. November was a “Top 25” return month for the S&P 500 Index since 1950. Looking at the other 24 top months in the past 70 years may give us insight into future expectations. High-performing months can be inflection points – dividing what came before from what comes next. For instance, the S&P 500 returned 16.3% in October 1974 and preceded a 39.2% stock rise for the next 24 months as the U.S. exited the awful 1973-74 recession.

Similarly, the defeat of inflation (August 1982) and “Morning in America” (August 1984) revealed that 10.2% and 11% jumps in the index preceded 39% and 54% increases in the index in the ensuing two years. On the flip side, the 10.2% rise in the index in November 1980 gave false hope about the easiness of defeating inflation, and the market ambled to a 1.4% loss over the next two years. Of course, many of us today will remember the euphoria of the 9.7% blow-off top in March 2000 that eventually gave way to the dot-com bust and a 23.4% loss for stocks over the next 24 months.

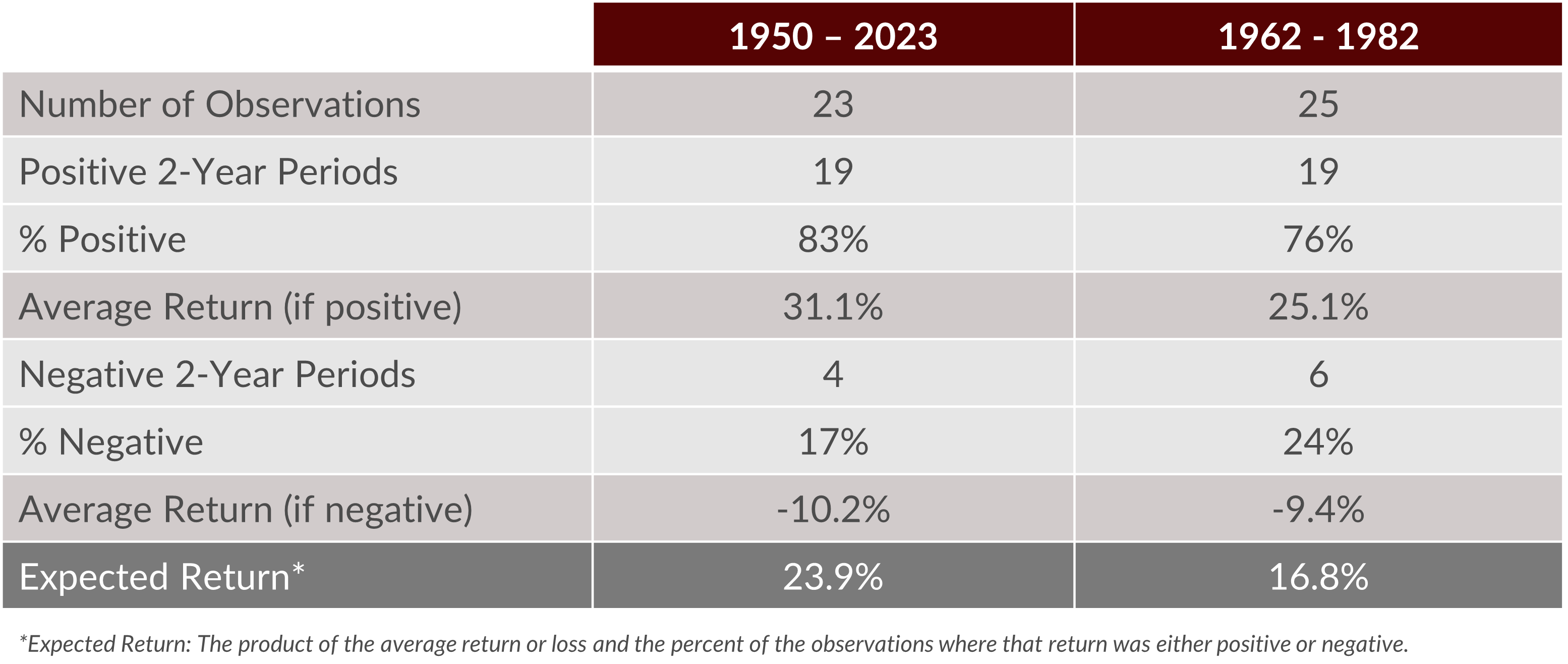

The analysis of the top 25 months from 1950 to the present shows that two years later, 19 of the 23 complete two-year periods following a top month resulted in an average 31.1% gain for the stock market. On the flip side, four subsequent periods resulted in a negative outcome following a month with top performance, averaging a 10.4% loss. Even with those weightings in place, the weighted average expected return given that data set is to expect a healthy 23.9% return over the next 24 months. Of course, many of those top months were in the period after interest rates peaked in 1981. Declining interest rates had the effect of lifting asset prices regardless.

So, what if we tailor the analysis only to examine stocks when interest rates were rising from 1962-1982? The results are found in the table below. Still, despite the inflationary and secular headwinds (Vietnam War, Oil Embargo, and budget deficits from funding the Great Society), the expected average returns analysis indicates that buying stocks after a “Top Month” would have been a winner two years later.

Stock Market Returns 24 Months After “Top Month”

Source: Bloomberg Finance, L.P.

I am looking forward to the holidays. Time with family, friends, and, of course, piles of investment research to prepare for the upcoming 2024 Forecast Event. There will be plenty of time to make predictions about the future, but a historical analysis of past great months would favor the idea that the best is yet to come. The macroeconomic data seems agreeable: cooling inflation, reasonable economic growth, and an America with plentiful jobs. Some investors may worry that a month like the one we just had means it’s too late to buy stocks. If you have a long-term perspective and an equally long investment horizon, often the answer is that the best time to buy stocks is when you have cash.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Sources:

1Bloomberg Finance, L.P., 2023

2FactSet, December 1, 2023

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.