By Gary Aiken | February 7, 2024

There is a saying, “Demographics is destiny” attributed to French philosopher Auguste Comte. Demographers specialize in analyzing and predicting shifts in the size and composition of human populations. Economic historians study the impact of these demographic shifts on wars, scientific advancements, and the evolving political economies of nations. Both disciplines often provide reliable forecasts; however, demographic trends typically take decades, or even multiple decades to fully play out. We as investors, must make decisions in real time and do not have the luxury of waiting for the long arc of history to materialize.

Thus, the important question for investors is how long must we wait? When is the right time to make investment decisions based on looming and seemingly obvious demographic changes? You can be right about the long-term effects of demographics and still never profit from your correct analysis. Some investment firms use demographics as a theme for investing, and while Concord doesn’t paint itself into any one corner, demographic trends certainly factor into our macroeconomic outlook, our sector overweight and underweights, and ultimately, the securities that end up in client portfolios. Again, not every investment has to fit neatly into that framework, but the ones that end up being “obvious in hindsight” often have a demographic element.

In my 2023 and 2024 Forecasts, I mentioned that China has yet to emerge from its COVID-19-induced slump and that we were avoiding direct and indirect investment in China as much as possible. Two factors beyond the pandemic have furthered the slump. First, the Xi regime has embarked on a campaign to put “new thought” at the forefront of all activities of China. The Chinese Communist Party under Xi’s control dismissed many of the leaders of the previous generation that saw China rise technologically and in GDP. Xi aims to return to his version of Mao’s “Common Prosperity.” If history is any guide, a renewed focus on communism rather than capitalism will not end well. Pithily, communists don’t seem to care very much for personal property rights — especially those of foreigners. At Concord, one of our tenets of investing in foreign countries is that they respect both capitalism and the rule of law.

Beyond these overtly political issues, China has another issue that has been long coming to the forefront, and one known well to humanitarians. The “One Child Policy” limited Chinese families to one child for each household and remained in place from 1980 to 2016.1 Further, the ratio of males to females in China is about 104:100 — too many boys.2 While it is unknown why this disparity exists, there are potentially sinister implications. This imbalance and policy have undoubtedly led to a precipitously declining fertility rate well below the replacement rate. Rather than growing, China may shrink over the coming decades. Population growth is a key contributor to GDP growth. Organic population growth or growth through immigration is preferable to population decline and emigration.

China generally presents problems for investors seeking growth opportunities. Our decision to avoid Chinese stocks and bonds was based primarily on skepticism about the country’s economic emergence from COVID-19, issues with overbuilding in the property sector, and bad loans in the banking sector combined with the whole “communism thing.” Demographics is the proverbial nail in the coffin — something we understood should come eventually, but its market impact couldn’t be timed.

The United States, on the other hand, with a growing population, showed strong GDP growth in 2023. As a result, and because of sustained inflation, the Federal Reserve decided to keep its short-term interest rate target at 5.25% at its January meeting. The Federal Reserve has a dual mandate of stable prices and full employment. Inflation is still the main concern in 2024. Chairman Powell has room to maneuver on the employment front partly due to a growing population, which increases aggregate demand, further fueling job growth, household formation, and opportunity.

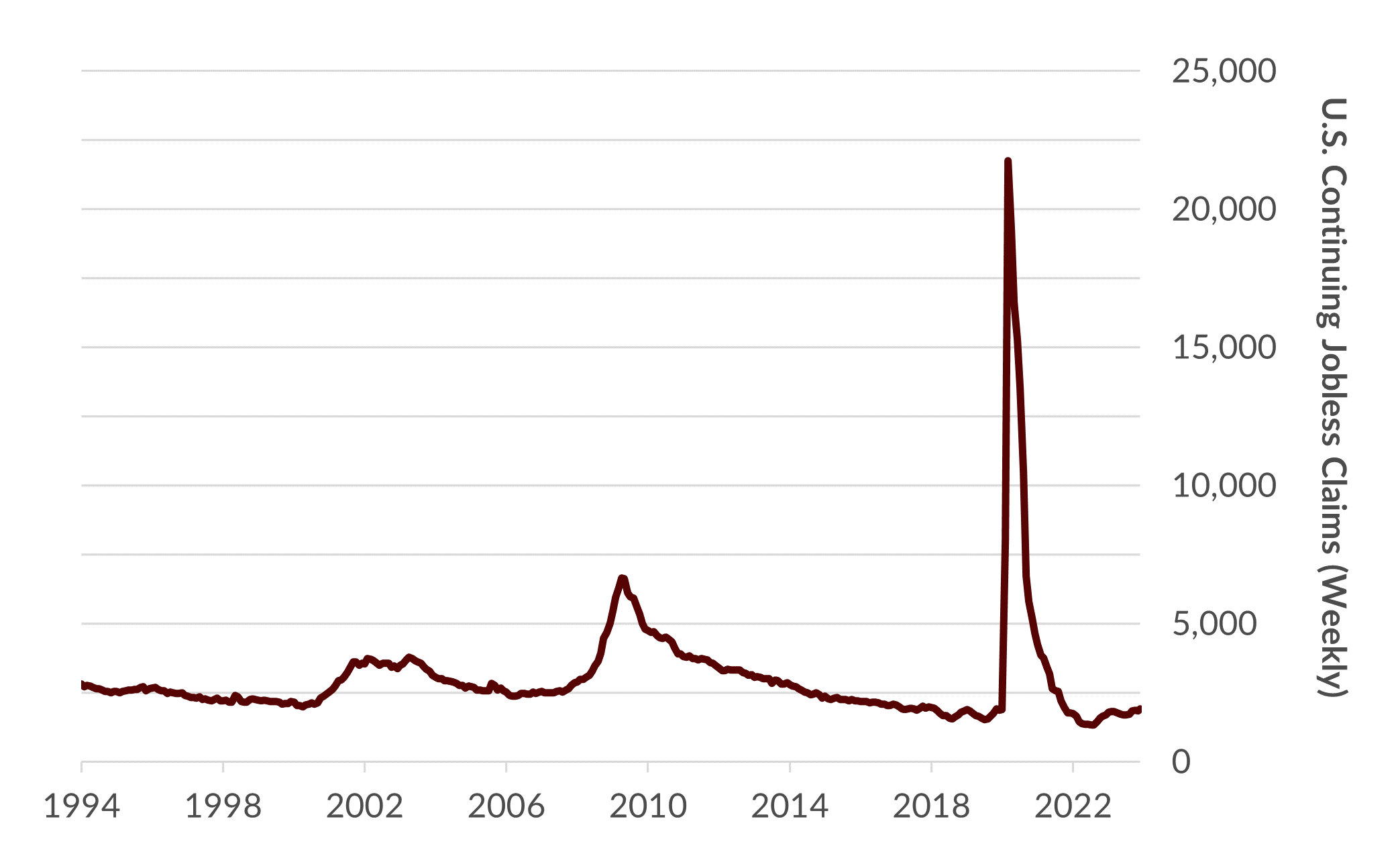

The chart below shows Continuing Jobless Claims in the United States. While the unemployment rate and survey methodology have flaws, jobless claims are tougher to mistake. An unemployment claim is created when an out-of-work person goes to their state unemployment agency and files a claim for unemployment benefits — money talks. Approximately 1.9 million Americans were out of work as of the week of January 20, 2024. While the number of jobless claims is rising, it is still at a level far below any that would be considered recessionary.

U.S. Continuing Jobless Claims

Source: U.S. Department of Labor, Bloomberg Finance L.P.

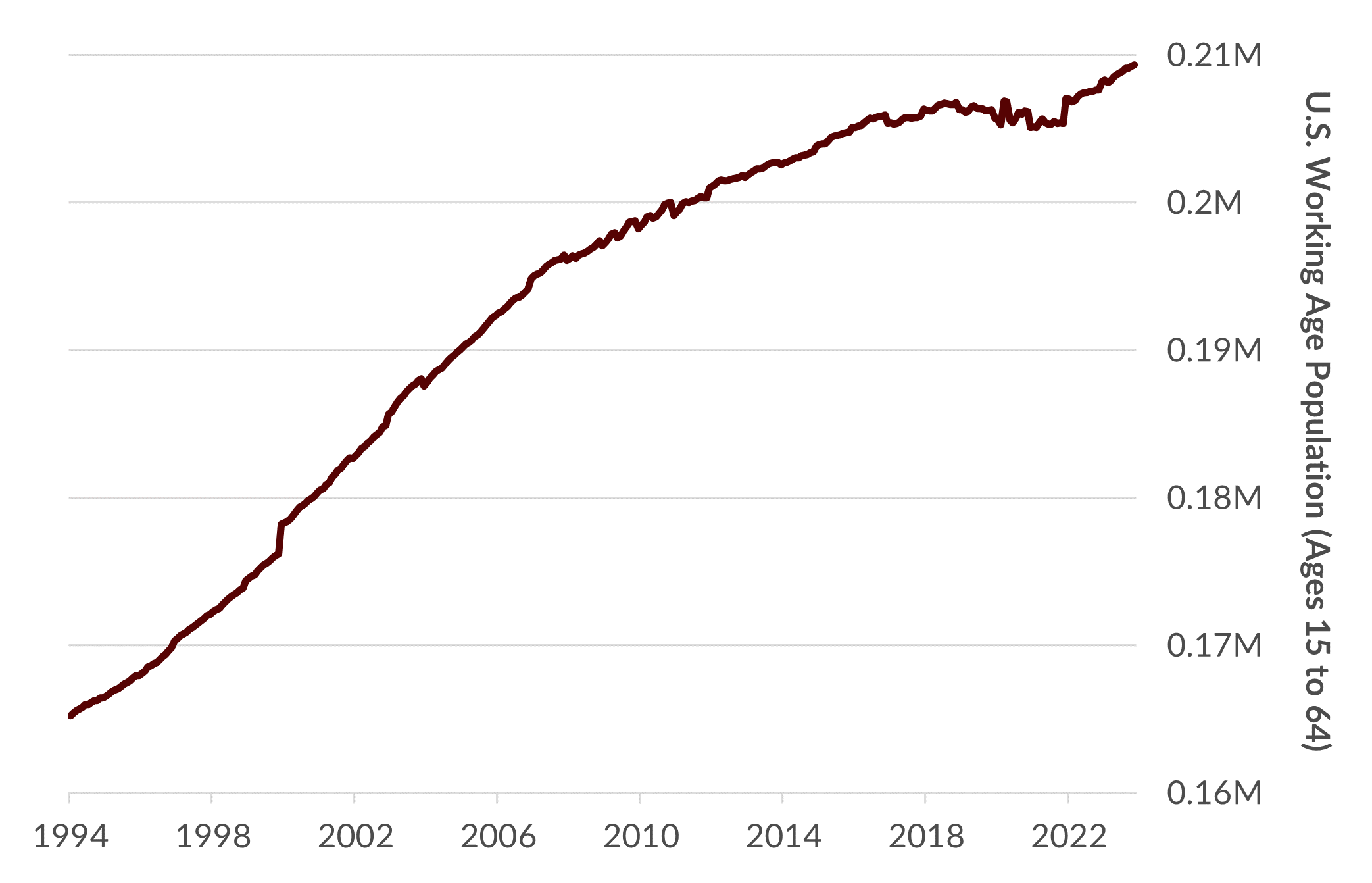

The raw number of unemployed workers is only half the story. There are more Americans today than there were last year. There were more last year than the year before that, and so on. The chart below shows the working-age population of the United States between the ages of 15 and 64.

U.S. Working Age Population (Ages 15 to 64)

Source: OECD, Bloomberg Finance L.P.

Positive demographics push the economy forward even during tough stretches. Population growth puts upward pressure on aggregate demand. Not only is the population growing, but household formation is also trending higher. Household formation means home purchases, loans, goods and services, automobile purchases, and babies. A growing economy means more consumers demanding more goods and services. A capitalist economy with abundant natural, capital and human resources, like the United States, can provide those goods and services better, faster, and cheaper. American stocks enable participation in that growth.

The return of household formation was part of the decision to allocate assets to homebuilder stocks in 2023. While not the entire thesis, demographic trends were a tailwind, not a headwind. Household formation alone is not enough to make homebuilders sustainably profitable. Many large homebuilders changed how they do business after the 2008-10 experience. The ones we own have stronger balance sheets. They do not engage heavily in land speculation. They are careful not to overbuild. They have a new buyer – large institutional single-family landlords. Importantly, they were cheap on an absolute and relative basis. A new generation of homebuyers looking to move out of their parents’ basement (joking aside) formed a demographic tailwind for an investment thesis but was not a key dependency.

The Federal Reserve has an intermediate-term view. Demographics may be an interesting topic for a research paper or an entertaining lecture, but not pertinent to policymaking quarter to quarter. At its January meeting, Chairman Powell clarified that the market was getting ahead of itself concerning falling interest rates. While the inflation data is coming down, long-term inflation is still high. It’s an election year, and this is a highly political and politicized Fed despite the “independence” talk. We expect the Fed to take more time to lower interest rates, likely slower than the market expects. First, they don’t want to give inflation a chance to return. Second, because the economy is still strong and unemployment is low. Third, the economy may structurally adapt to the current level of interest rates without significant cost to growth, something I think is not priced into interest rates.

During our Forecast event, I made what some clients might have thought of as a contradictory statement. I said that I thought decreasing inflation would likely lead to lower rates in 2024, but that our base case was still for higher rates over the next five years. While the Federal Reserve can control rates at the short end of the curve, its yield curve control and quantitative easing experiment is over. Zero percent interest rates distort financial markets and prices. Artificially low interest rates encourage reckless behavior by consumers, businesses, and bankers—especially bad bankers.

Treasury borrowing will increase in 2024 above 2023 levels, and unless changes are made, the debt will grow larger and larger. Just as demographics impact GDP growth – we just don’t know when – growing debts to an unsustainable level will eventually result in higher long-term interest rates. We had a 40-year trend where long-term interest rates declined. That ended in April 2020 with the 30-year U.S. Treasury Bond yield to maturity at 0.98%.

Whether it is inflation sustained above the Fed’s target, the weight of too much debt chasing too few lenders, or just normalization of the yield curve because the U.S. economy is strong enough to handle higher interest rates, our opinion is that longer-term interest rates are more likely to be higher in the future than lower. But even if we are wrong, we take a mathematical approach to risk-taking in bonds.

If we were to buy the 10-year U.S. Treasury Note today (January 31, 2024), we would buy it with a yield to maturity of approximately 3.89%. If interest rates went down 100 basis points (1 percentage point), our total return for the year would be 11.7%. Not too shabby. But if interest rates went up 100 basis points, our total return for the year would be -3.3%. We’d lose money.

On a risk/reward basis, consider the relative performance of buying 2-year Notes instead. While we think rates are more likely to rise, if we are wrong and interest rates decline by 100 basis points, an investor in the 2-year Treasury Note would earn 5.3%, and if interest rates rose 100 basis points, the “downside” would be to earn 3.4%. If these scenarios (2-year or 10-year) were a coin flip, buying the 10-year note has a 4.2% expected return, and the 2-year note has a 4.3% expected return.

Buyers of longer-term bonds seek protection from events that form blocks in the wall of worry. These events though tend to be short-lived or never happen at all. Holding a 10-year bond because of a six-month worry seems illogical for long-term investors like us. Concord’s base case is that the economy will continue to grow in 2024 and beyond. Look beyond the wall of worry; the United States is one of the strongest economies in the world. And demographic trends are going our way, too.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Sources:

1Pletcher, Kenneth. Encyclopedia Britannica, January 3, 2024.

2Minzer, Carl. Council on Foreign Relations, January 26, 2024.

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.