By Gary Aiken | March 7, 2024

My wife and I celebrated our 19th wedding anniversary during Presidents’ Day weekend. Two things about that evening anecdotally describe opposing views on the U.S. economy. As we drove downtown, I prepared myself to pay the exorbitant valet fee to park our car. While we waited for the traffic light to change, my wife spotted an open parking spot on the street about 30 feet from our destination. I swung around and scooped it up. What luck, a prime parking spot in posh Georgetown. The spot shouldn’t have been there, but there it was.

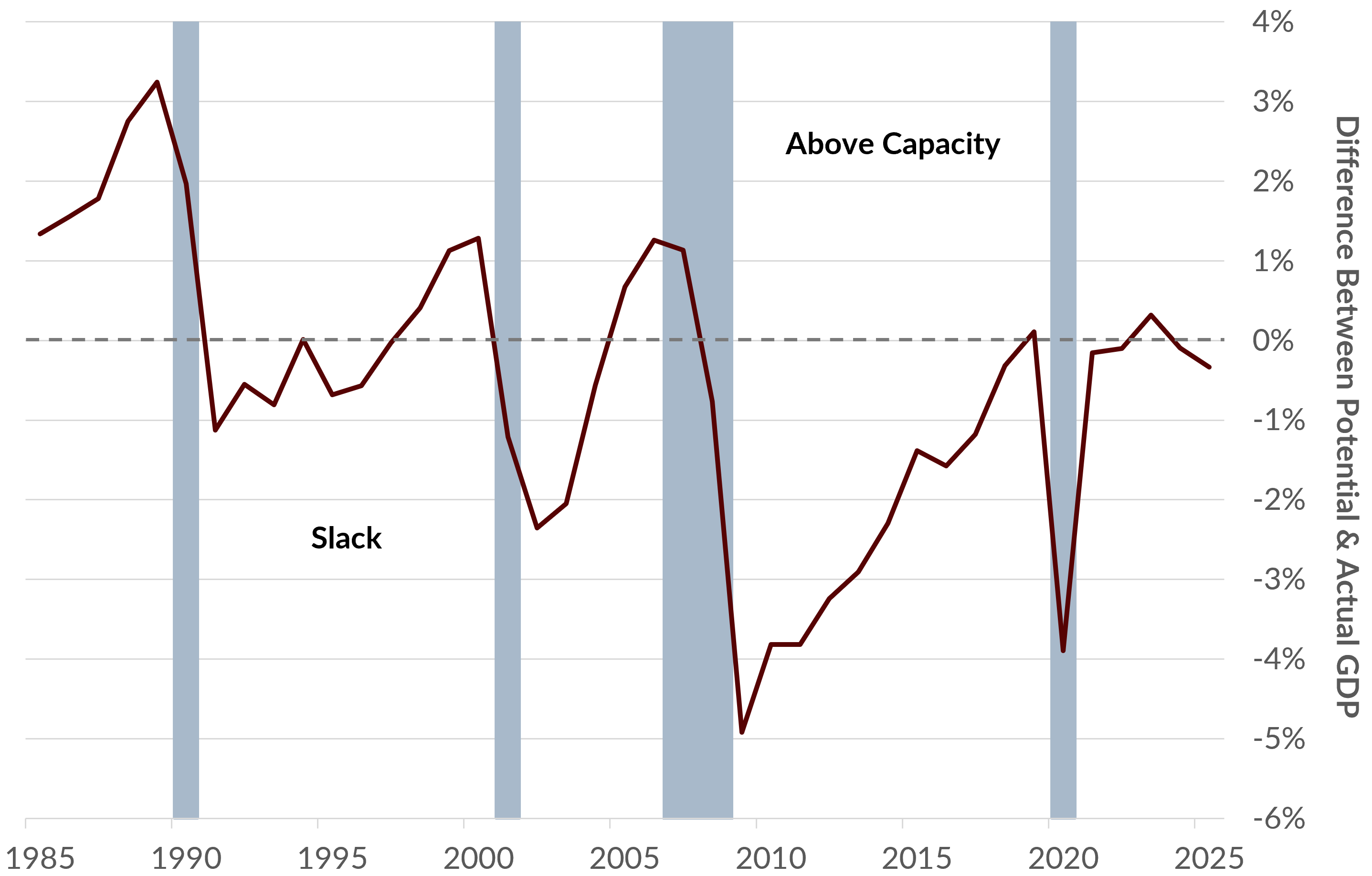

The parking space that shouldn’t have been was a signal that slack existed in the parking market. When economists examine the state of the economy, they look for similar indicators. One such signal is the “output gap.” The output gap is the difference between the potential for production in an economy and the actual production in an economy. If actual production is below potential, then there is deemed to be slack in the economy. There’s an optimistic and pessimistic way to view slack. If there is sufficient slack, that means that the economy will grow in the future: the factors of production will necessarily get less expensive in real terms, making it possible to invest today and produce tomorrow. Today’s slack begets tomorrow’s growth. Glass half full.

The Output Gap Shows Slack in the US Economy

Source: OECD, Bloomberg Finance L.P.

On the other hand, the new emergence of slack in the economy may indicate that the economy has exhausted the limits of current productivity. The means of production have become too expensive. The ability to achieve real returns above the cost of capital is scarce. Businesses choose to hire fewer employees and delay new projects. The economy slows: parking spots have become available because no one is going out anymore.

But the parking spot was available, so we parked and rejoiced in our good fortune. We went inside. Stepping into the bustling lobby, we approached the maître d’ and informed her of our arrival. While waiting for our table, we noticed the restaurant was absolutely packed. Not only that, but in this expensive restaurant, we saw a man in sweats and a hoodie at the bar ordering a pricey drink and steak. Never judge a book by its cover and all that, but it seemed like a pretty good indicator that there was no recession here!

Perhaps the patrons of this restaurant were feeling so exuberant about the economy that they didn’t mind splurging on the valet cost. I’m a capitalist, so I have no issues with this. After all, choice is what makes a market. Still, what we found inside was at odds with what we found outside.

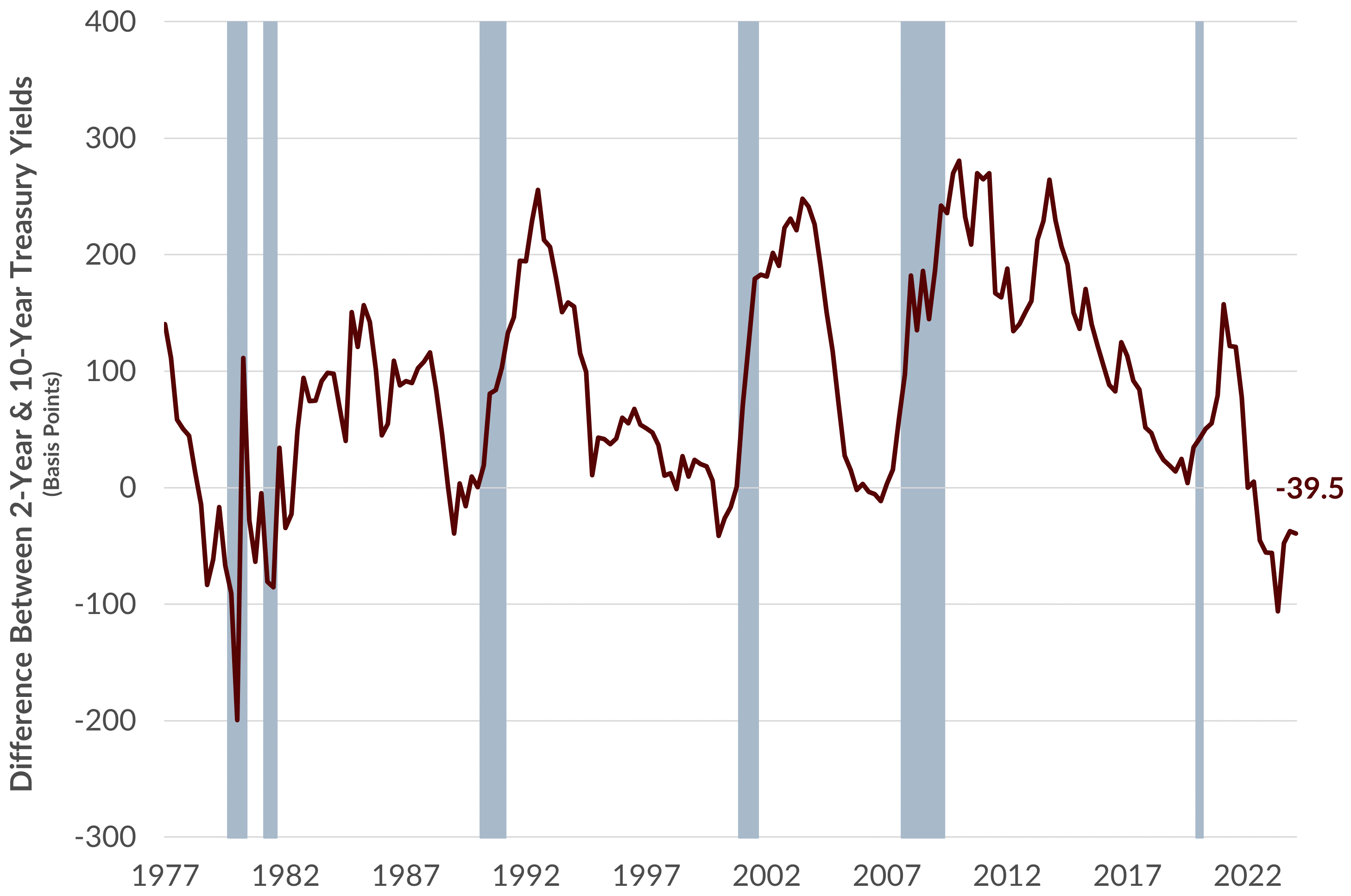

Finding things not as they are supposed to be is a feature of the U.S. economy in March 2024. The Federal Reserve has raised rates from zero to 5.25%. The money supply has declined over the past two years. The unemployment rate bottomed out a year ago, and the yield curve has been inverted for twenty months. These should all be reliable indicators that a recession is right around the corner.

An Inverted Yield Curve Foreshadows a Recession

Source: Bloomberg Finance L.P.

This persistent fear of recession in the face of clear evidence that there isn’t a recession is psychological. Investors must find a way to bypass their mental barriers to see risk clearly. My professional career as an investor started when I graduated from college during the early stages of the dotcom bust. The U.S. stock market dropped 50%. As markets recovered what they’d lost, I graduated from business school in time to witness the Great Financial Crisis and stocks to decline 50% again. My psychological experience, and that of many investors today, is built on a foundation of painfully bracing for the next crisis.

My viewpoint shift came in the shape of a new boss’s truism: in a bull market, the market makes new highs every other day. It’s okay to invest in stocks at “all-time highs.” If the market goes up 1 point tomorrow, it will be another “all-time high.” The wall of worry is steep today, given news headlines containing war, a contentious election, immigration, crime, government shutdowns, and democracy in peril! Ultimately, those headlines will be replaced with new fears du jour. For the stock market, only earnings matter in the long run.

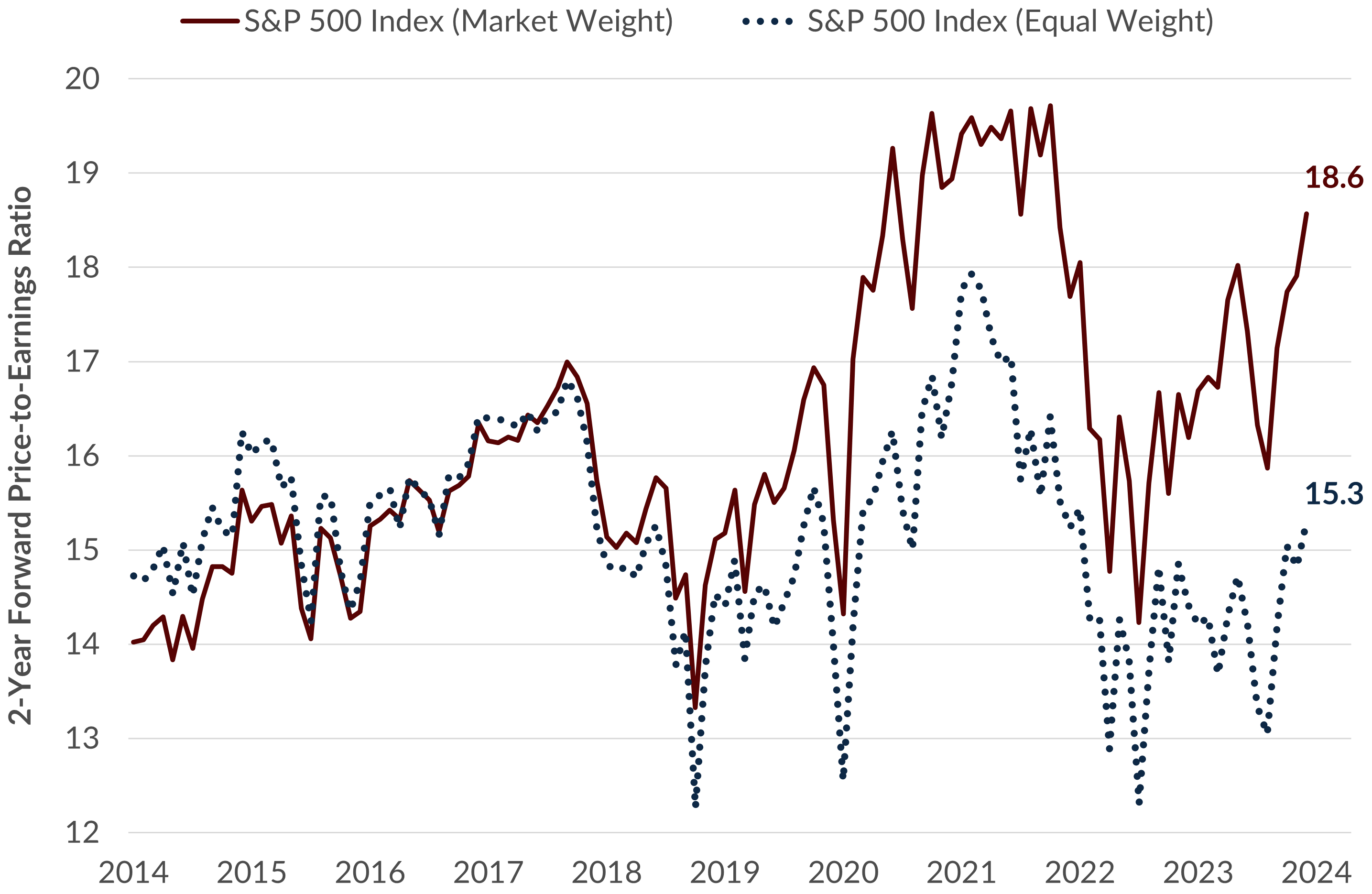

Bloomberg Estimates Price/Earnings Ratio

Source: Bloomberg Finance L.P.

Now that earnings season is mostly behind us, let’s talk about earnings and valuation. The two-year forward price-to-earnings multiple for the S&P 500 stands at about 18.6x. While that is expensive, it’s not nearly as expensive as at the heights a few years ago. Concord’s base case going into this year was to expect that the economy would continue to grow and that earnings growth would accelerate. That thesis has played out so far. Of course, much of that growth has come from companies making semiconductors and software for Artificial Intelligence or GLP-1 drugs to combat obesity and diabetes. The Equal Weight S&P 500 two-year forward price-to-earnings multiple, shown on the chart above, is 15.3x. That’s average for the past ten years. While the highfliers power the market weight index higher, the average stock has not yet participated. We think this represents a future opportunity.

My wife and I were lucky to find a great parking spot, and the restaurant was full. There are signs of slack in the economy and signs of exuberance. It’s past time for investors to put their weariness about the price of stocks and bonds to rest. The economy is good. Interest rates are rising because the economy can handle higher rates. There are pockets of the markets where there will be pain – but that’s always the case in good times and bad. Our approach is to try to identify and avoid these pockets. Overall, the average stock is priced for mediocrity. We think the chances are better than good that most companies can step over this low bar.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.