Fast and Furious…

Key Observations:

- The automobile industry, with a supply and demand imbalance, reflects the broader U.S. economy.

- Strong demand for goods and services is likely to continue as the financial condition of most Americans has improved considerably over the past year.

- The two primary economic risks, inflation, and COVID variants, hang over the market and provide considerable uncertainty for investors.

Fast and Furious – The Auto Industry is Clicking on All Cylinders

We have all seen it – near empty lots as we drive by our local auto dealerships. Just how bad is it? According to the U.S. Bureau of Economic Analysis, supply is at all-time lows. In May, domestic auto inventories fell to 187,000 units, a decline of 71% from 2 years prior, when inventories stood at 641,000. (1). The inventory-to-sales ratio, a measure of the ability to meet consumer demand, also plummeted. A reading of 1.0 means the dealership has enough supply to meet one months’ demand. In May, the ratio hit 0.8, a decline of 63% from two years prior when inventories stood at 2.2 months sales and 68% lower than the pre-pandemic historical average of 2.5 months. (2) Of course, we know the backstory. Supply chain issues, namely a chip shortage, lingers over the industry.

Sticker shock is certainly hitting consumers who are fortunate enough to find the vehicle they want. According to J.D. Power, in July, the average new car sales price is expected to jump 17% to $41,044, the highest on record. Don’t expect the typical incentives either; the average incentive spending per sale is expected to fall to $2,065 from $4,235 in the prior year. There is no relief in buying a used car either. According to Cox Automotive, used vehicle prices have appreciated more at an incredible 30% clip over last year. (3)

You would think basic economics would kick in, and the demand for cars would wane given the incredible price increases. Not so. Mike Jackson, CEO of AutoNation, recently stated, “Consumers are buying vehicles before they even arrive at our stores. We expect the current environment of demand exceeding supply to continue into 2022.” During last week’s earnings report, Ford’s CEO Jim Farley said he expects sales volume to increase 30% in the second half of 2021. He stated, “We are now spring-loaded for growth in the second half and beyond because of those red-hot products, pent-up demand, and improving chip supply.” So, the reopening trade is alive and well for automakers.

The auto industry has a reason to be optimistic. Americans are eager to buy new cars, and they have the resources to do so. According to the Conference Board, consumer confidence increased for a six-straight month in July to a new pandemic high. (4) The details of the survey are telling. The share of consumers who said jobs were “plentiful” increased to a 21-year high, and 20.6% of respondents said they expect their incomes to grow in the next six months, the highest since February of 2020.

Things just don’t feel better; for most Americans, they are better, as shown by household balance sheets and income statements. In 2020, Americans paid off a record $82.1 billion in credit card debt and another $56.5 billion in the first quarter of 2021. (5) On Jun 10, Federal Reserve reported that during the first quarter of 2021, household net worth reached a record $137 trillion, a 23.6% year-over-year increase. (6) Even as housing prices are hitting all-time highs, mortgage debt service is hitting all-time lows thanks to low mortgage rates and larger average down payments. Household debt service payments have dropped to a record low of 8.2% of disposable income, 35% lower than the historical average of 11.1%. (7)

So why all the commentary on autos? The market for new and used cars is an excellent illustration of the state of the U.S. economy. As noted in prior Insights, in 2020, Americans saved more and spent less. Now they are saving less and spending more. Their bank accounts are larger, and their debt service payments are lower. Just like in the auto industry, high prices are unlikely to curb future demand for most goods and services any time soon. This is bullish for the economy, and that is bullish for the stock market.

Final Thoughts:

Given this bullish outlook, how should one position their investment portfolio? One should start by considering the risks. What is on your “wall of worry.” Obviously, inflation fears sit at the top for many. Supply chain challenges are everywhere, broadly putting pressure on prices. Strong demand that is ignoring higher prices threatens to add more fuel to the inflation fire. For others, an even more worrisome brick on that wall is the potential for renewed lockdowns due to new, highly contagious Covid variants. No need to go into the economic damage a new round of lockdowns would cause.

When inflation fears were front and center earlier this year, high-priced growth stocks were harshly punished as assets rotated to value-oriented equities. Conversely, renewed lockdowns would undoubtedly result in a harsh rotation out of reopening trade along with other value-oriented stocks. It is logical to believe this would bode well for growth stocks, especially technology stocks, as they flourished through the lockdowns. Lastly, for those sitting on the sidelines, there is a third risk. What if inflation is truly transitory and the impact of Covid continues to wane? By avoiding all stock market risks, you potentially miss out on strong equity returns and harm your ability to meet your financial goals.

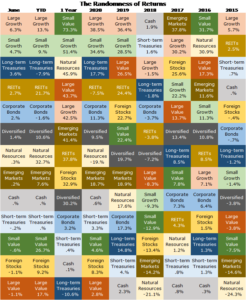

At Concord Asset Management, we believe a well-positioned portfolio is diversified, owning all types of stocks and bonds, so part of your portfolio will always hold the best performing asset classes despite which risks come to fruition or not. Although currently tilted to value stocks, our typical client’s portfolio provides exposure to thousands of stocks and bonds in multiple asset classes and economic sectors. As always, the best way to ensure your portfolio is well positioned is to reach out to your Financial Advisor for a portfolio review.

Author

Mitch York

CIO

Sources:

All performance data is generated through Morningstar.

- https://fred.stlouisfed.org/series/AUINSA, https://fred.stlouisfed.org/series/AISRSA

- https://www.reuters.com/business/autos-transportation/us-auto-sales-pace-weaken-further-july-jd-power-lmc-automotive-2021-07-28/

- https://www.coxautoinc.com/news/wholesale-used-vehicle-prices-peak-according-to-latest-manheim-data/

- https://conference-board.org/data/consumerconfidence.cfm

- https://wallethub.com/edu/cc/credit-card-debt-study/24400

- https://www.nasdaq.com/articles/u.s.-household-net-worth-hits-record-high-in-q1%3A-5-picks-2021-06-14

- https://fred.stlouisfed.org/series/AISRSA

Note: All performance data in the following two charts were drawn from Morningstar.

Disclaimer: Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All data is as of the end of April 2021 unless otherwise noted. Data sources include www.morningstar.com. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided. Please Note: IF you are an IA Firm client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.