Growth is Dead, Long Live Growth!

Key Observations:

- Growth stocks have rebounded with a record return in June.

- The financial markets are pricing in “transitory” inflation.

- The Federal Reserve has calmed inflation fears with a more hawkish tone.

Market Commentary

Growth is dead! Long live growth! Just when most had settled in with expectations that growth stocks would be the laggards of the stock market for the foreseeable future, they staged a historic rebound in June. According to data from Morningstar, after declining 2.0% through May, growth stocks have returned a stellar 7.7% thus far in June. Conversely, value stocks are down 2.0% in June after returning a remarkable 19.1% through May. That is an incredible 9.4% spread in the return of growth versus value. As you might expect, the technology and communication services sectors are leading the way, up 7.4% and 3.7% respectively during the past 30 days. Meanwhile, the value-heavy sectors of basic materials and industrials have declined 5.2% and 1.9% during the same period.

Foreign stocks continue to perform well although lagging U.S. equities. Year-to-date, foreign developed stocks, as measured by the MSCI EAFE Index, are up 7.3% versus 14.4% for the S&P 500 Index Not to be forgotten, emerging market stocks have gained 7.1% so far in 2021.

Following modest positive returns in May, the bond market shows signs of stabilization as interest rates are flat to slightly lower. For June, the Bloomberg Barclays US Aggregate Bond Index rose 0.7% so far in June. Long-term Treasuries lead the way, up 3.6% followed by a strong performance for investment-grade corporate bonds at 2.0%. Short and intermediate-term Treasuries are basically unchanged.

Commodities have certainly cooled. The S&P North American Natural Resources Sector Index is flat in June after returning 7.0% in May and 19.3% during the first five months of 2021. It is far worse for gold. Following a robust 7.5% rally in May, the precious metal has given it all back, declining 7.2% in June.

Economic Commentary

Growth stocks are killing it as the market is shrugging off lofty valuations, the bleeding has stopped in the bond market, and gold is getting crushed. It must be that inflation has waned and the economy is back to slow growth. Right? Not even close. Consumer and producer prices continue to hit historic highs, and the economy continues to grow at an impressive rate. According to the U.S. Bureau of Labor Statistics (BLS), the Producer Price Index (PPI) for final demand increased 6.6% for the 12 months ended in May, the largest increase since that data was first calculated in 2010. Fewer foods and energy, the index jumped 5.3%, the largest increase since this measure was first calculated in 2014. (1)

When the cost of doing business increases (i.e., PPI), businesses tend to pass this cost onto their consumers. We have all become very aware of this reality in 2021, and the data validates it. According to the BLS, the Consumer Price Index soared 5.0% year-over-year, the fastest pace since the summer of 2008. The core inflation rates, a measure that excludes food and energy, rose 3.8%, the sharpest increase in nearly 30 years. (2)

Of course, none of the elevated inflation data would exist if it were not for strong consumer demand. We know the story – in 2020, consumers saved more and spent less and borrowed less. Pent-up demand and the ability to satisfy it appear to be fueling this early-stage economic expansion. According to the U.S. Bureau of Economic Analysis, in Q1 national GDP rose at an annualized rate of 6.4% as GDP rose in all 50 states and the District of Columbia. (3) The consensus is for GDP to remain at elevated levels for the remainder of the year. The Conference Board Economic Forecast for the US Economy projects Q2 GDP will increase to 9.0% and 2021 year-over-year growth to come in at 6.6%.

So what is going on with the stock and bond market given economic data that points to strong growth and high inflation? As highlighted in May’s Insights, the Fed is adamant that current and near-term inflation is transitory. While more market participants may be moving in that direction, the Fed’s most recent two-day policy meeting likely had a greater impact. The Federal Open Market Committee startled investors when it reported that 13 of 18 officials saw a likely need for higher rates by the end of 2023, with seven of them seeing a need to begin raising rates as soon as next year. This was music to the market’s ears as the Fed signaled it is prepared to raise rates if necessary to slow an overheated economy that would give rise to persistent inflation. (4)

Final Thoughts:

Just how impressive is the rebound in growth stocks? You must go way back to October 2001, nearly 20 years, to find a month where growth stocks had better relative performance over value stocks. Don’t forget, this occurred with significant headwinds for growth stocks. Expectations of higher interest rates and an early-stage economic expansion that favors value stocks were the headline risks. Now that growth stocks seem to have climbed that wall of worry and are back in vogue, does it mean investors should pile on once again? Of course not, but that isn’t the lesson we should carry forward from June’s market performance.

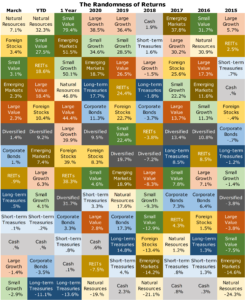

June highlights the most important fundamental of portfolio management – diversification. Consider the opportunity to invest in 10 distinct asset classes. While it is a fact that the person who invests all their money in only one asset class only has a 10% chance of picking the worst performer, it is also a fact that they have a 90% chance of eliminating the biggest winner.

Yes, diversification is a tool for avoiding significant losses by not putting all your eggs in one basket. More importantly, extensive diversification means your portfolio will always include exposure to better-performing securities, and this is the key to long-term success.

At Concord Asset Management, we believe in extensive portfolio diversification that seeks to provide clients a rate of return consistent with their risk tolerance. Sure, we will adjust the exposure to various equity asset classes at times depending on where we are in the economic cycle, valuation levels, and other factors. However, clients’ diversified portfolios will always include exposure to growth and value stocks, small and large-cap stocks, and domestic and foreign stocks. They will also own stocks in every major economic sector from technology to healthcare. At the end of a month like June, our clients can be confident that their diversified portfolio has served them well.

Author

Mitch York

CIO

Sources:

All performance data is generated through Morningstar.

- https://www.bls.gov/news.release/ppi.nr0.htm

- https://www.bls.gov/news.release/pdf/cpi.pdf

- https://www.bea.gov/news/2021/gross-domestic-product-state-1st-quarter-2021

- https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20210616.htm

Note: All performance data in the following two charts were drawn from Morningstar.

Disclaimer: Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All data is as of the end of April 2021 unless otherwise noted. Data sources include www.morningstar.com. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided. Please Note: IF you are an IA Firm client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.