Rising Inflation & a Re-Opening Economy Continues to Favor Value

Key Observations:

- After approaching 0% during the pandemic, inflation is catching up with the economy.

- The Federal Reserve has an upbeat view on the economy projecting falling unemployment and robust GDP growth for 2021.

- The reopening trade continues as more state and local economies open and millions of citizens are vaccinated every week.

Market Commentary:

The reopening trade continues and a pattern has emerged – the broad market continues its ascent led by value stocks while growth stocks, particularly tech names, struggle. Year-to-date the CRSP US Total Market Index is up 4.7%. According to Morningstar, value stocks increased 11.6% and growth stocks lost 1.9%. This certainly persisted over the past month as value outperformed growth by 6.7%. The Morningstar U.S. Value Index returned 4.3% the past 30 days versus its growth counterpart declining 2.4%.

The reopening trade that favors value versus growth, combined with concerns over valuations and higher bond yields, have contributed to technology stocks’ recent poor performance. The Morningstar Technology Index is down 0.8% in 2021 and even consistent high performers Apple, Amazon and Netflix are down 9.0%, 6.5% and 7.0% year-to-date.

Bonds have found their footing recently as inflation expectations have been priced in. After declining 2.2% for the first two months of 2021, the Bloomberg Barclays US Aggregate Bond Index is flat in March. Long-term Treasuries and corporate bonds, down 9.0% and 4.3% during January and February, are down a modest 0.8% each so far in March.

Finally, to no one’s surprise, international stocks are lagging US stocks as much of the world struggles rolling out vaccinations and significant lock downs continue. The MSCI EAFE Index, which represents large and mid-cap stocks across 21 developed markets is up 2.6% year-to-date (versus 6.6% and 4.1% for the DJIA and S&P 500).

Economic Commentary:

There has been a lot of talk about inflation lately, and for good reason. As discussed in last month’s Insights, U.S. households are sitting on a mountain of savings and the U.S. government has been providing incredible fiscal stimulus including the $1.9 trillion stimulus package recently signed into law. Speaking of the latter, over 127 million payments of up to $1,400 have been distributed for a total of nearly $325 billion.1 The economy already had the wind at its back; the Bureau of Economic Advisors (BEA) revised Q4 GDP to 4.3% and the Federal Reserve boosted their 2021 GDP estimate from 4.2% to 6.5%, an incredible 55% increase.2 The employment picture is looking much much better. Just this week the Department of Labor reported new jobless claims hit a pandemic low and continuing claims declined by nearly 7%.3

No wonder the financial news is filled with concerns about the economy overheating and inflation escalating. And in case you haven’t noticed (of course you have) the price of gas is way up, housing prices are surging and the trip to the grocery store costs more. The New York Fed’s February 2021 Survey of Consumer Expectations revealed at 3.1% consumers have the highest level of inflation expectations since 2014.4 This is considerably higher than the current 12-month run rate of 1.7% and the Fed’s 2.4% inflation estimate for 2021.

Amid all this, the Fed is committed in keeping short term rates low and maintaining its accommodating monetary policy. This may seem shocking considering recent economic data and consumer inflation expectations. However, The Fed has made their position clear. Last summer Chairman Powell explained the Fed’s new stance on inflation is a 2% “average inflation target.” So it should be no surprise Chairman Powell has reiterated multiple times recently the Fed is comfortable allowing inflation to run considerably higher than the standard 2% target given it bottomed out at 0.1% in 2020. 5 They are confident higher inflation is transitory – the result of economic reopening and not a longer-term systemic risk.

Final Thoughts:

Maintaining stable prices is one of the Federal Reserve’s two core directives. They take inflation very seriously. It has real life consequences as high inflation is essentially a tax on every consumer. It is particularly damaging to lower income households as they use the vast majority of their income on consumption. This is the same group that has been disproportionately harmed by the pandemic. Of course the Fed knows this and that leads me to two conclusions. First, as Chairman Powell reiterates, long-term inflation is under control and recent upticks will be short-lived. Secondly, if circumstances change and inflation does exceed current expectations, the Fed will be swift to act, raising short-term interest rates and certainly longer-term rates will make another run higher.

What does all this mean for your portfolio? First, we believe it is prudent to avoid long-term (10+ years) U.S. Treasury and corporate bonds as the risk/return profile is unbalanced. Maintaining an intermediate term bond allocation provides proper diversification and sufficient downside protection if there is turmoil in the equity markets and a flight to quality transpires. Secondly, the reopening trade is real and likely to continue for some time. The stock market will continue to react sharply to changes in inflation expectations and rising interest rates. This increases the probability growth stocks will experience greater volatility and under perform value stocks.

Early in March, in CAM’s investment models and client accounts, we reduced the allocation to growth and increased the allocation to deep value. Currently, the average allocation to value stocks is approximately 11% greater than growth stocks. Additionally, even with the recent increase in yields, we continue to avoid long-term Treasury and corporate bonds. At Concord Asset Management we continually monitor the economy and investment markets. We strive to offer long-term, risk balanced portfolios you and your planner can use to help meet your financial goals. We do not make changes frequently, but when we do have confidence, they are made with only your best interests in mind.

Sources:

All performance data generated through Morningstar.

-

USA Today: https://www.usatoday.com/story/money/2021/03/24/stimulus-check-2021-irs-third-covid-payment/6989393002/

-

Federal Reserve: https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20210317.htm

-

Yahoo Finance: https://finance.yahoo.com/finance/news/record-low-jobless-claims-show-104710751.html#:~:text=Signs%20of%20Systematic%20Recovery,week%20ended%20Mar%2014%2C%202020

-

New York Fed: https://www.newyorkfed.org/microeconomics/sce#indicators/inflation-expectations/g1

-

Business Insider https://www.businessinsider.com/economic-recovery-priority-federal-debt-concerns-federal-reserve-jerome-powell-2021-3

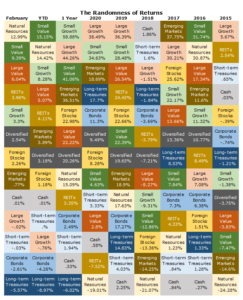

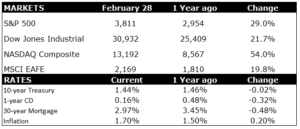

Note: All performance data in the following two charts were drawn from Morningstar.

Disclaimer: Concord Asset Management (“CAM”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CAM and its representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All data is as of the end of February 2021 unless otherwise noted. Data sources include: www.morningstar.com. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.