The Reopening Continues: Is Inflation a Concern?

Key Observations:

- Consumers are fueling the economic recovery as spending and credit usage soar from pandemic lows.

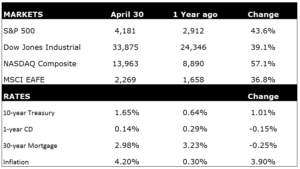

- CPI data surged 4.2% year-over-year in April, but the Federal Reserve is adamant broad price increases are transitory and not a long-term economic threat.

- After a rough first quarter, bond markets have stabilized, and equity markets continue with the “re-opening” trade as value stocks continue to outperform.

Economic Commentary

The re-opening of the US economy is in full swing, evidenced by a surge in American’s travel plans. AAA expects 37 million people to travel over the holiday weekend, a 60% increase from last year’s historical lows.1 Of course, this is to be expected as a greater percentage of citizens are vaccinated, and people begin to satisfy pent-up demand. There is even a new buzzword for this surge in travel demand – revenge travel. People lost a year’s worth of travel for weddings, family vacations, etc. and they are ready to spend to take back this part of their lives.

Speaking of spending, recent economic data confirm what we already know. Americans are opening their wallets (and credit cards) and purchasing goods and services at an incredible clip. Although the Commerce Department reported consumer spending for April was flat, it raised its March’s increase to 10.7%.2 This is not a surprise as most households received the additional $1,400 stimulus checks in March. An additional sign of consumer demand and confidence is credit usage. In early May, the Federal Reserve reported consumer credit increased 7.4% in March, including a 7.9% increase in revolving credit (i.e., credit cards). It is likely spending will accelerate in the coming months as reopening expands and as we highlighted in prior Insights, Americans are flush with savings.

Of course, we have to once again discuss inflation. If you turn on any financial news network or any news for that matter, you will hear a lot of chatter about inflation. And for good reason, the April Consumer Price Index rose 4.2% compared to a year earlier. According to the Bureau of Labor Statistics, this is the largest year-over-year increase since September of 2009.3 Pent-up demand and the economic reopening, combined with supply chain bottlenecks and shortages in the labor supply have created this perfect storm. Despite the surge in prices across most goods and services, the Fed has clearly laid out its position that the current inflation data is “transitory.” And they mean it; the minutes from April 27-28 Federal Open Market Committee meeting references transitory eight times. 4

Market Commentary

After a terrible first quarter, bonds have stabilized across the board. The Bloomberg Barclays US Aggregate Bond Index is up 0.78% so far in May. This includes a return of 2.33% for long-term Treasuries after a loss of 11.50% through April. Commodities continue to perform well, up 6.5% in May following a stellar return of 23.4% for the first four months of the year. Gold has finally started to surge. After returning a dismal 10.65% during Q1, gold rose 4.50% in April and another 7.45% so far in May.

Broadly speaking, equities continue their strong performance. The Dow Jones Industrial Average, S&P 500, and NASDAQ Composite have advanced 13.01%, 12.38%, and 6.89% year-to-date respectively. They have, however, taken a slight breather in May, increasing 1.53%, 0.48% and -1.53%. And yes, value continues to outpace growth. So far in May, value stocks have outperformed growth by 4.6% (2.44% vs. -2.16%).

Foreign equities are doing well. Developed market stocks, as measured by the MSCI EAFE Index, continue solid returns. In May the index has returned 3.01% and is up 9.80% year-to-date. Not faring as well, but still with solid returns are emerging market stocks, up 0.35% in May and 4.92% for the year.

Final Thoughts:

How concerned should we be with inflation and its impact on our investments? Is it transitory or not? While the Fed clearly has an opinion, the markets send mixed signals. The rotation from growth to value stocks, the sharp and steady increases in commodity prices, and the recent surge in gold prices indicate inflation concerns are valid and persist. However, the recent pause and pullback in long-term Treasury yields argue inflation expectations are priced in.

Fortunately, we do not have to know the exact answer to have a well-positioned portfolio. The “re-opening trade” is real, has momentum, and is well suited for an inflationary environment. Value stocks, the beneficiaries of the reopening, are dominated by financial services and commodity-based companies. Accordingly, they are likely to continue their strong relative performance in an inflationary environment. An overweight to value stocks as part of a well-diversified portfolio is prudent.

At CAM, we have implemented this overweight for our clients while recognizing a diversified exposure to all types of stocks and bonds is necessary to maintain a proper risk exposure. Along with your Concord Wealth Advisor, we are constantly monitoring the markets so you can relax, and take advantage of this summer’s great reopening.

Sources:

All performance data generated through Morningstar.

-

AAA: https://media.acg.aaa.com/memorial-day-holiday-travel-to-rebound-to-more-than-37-million.htm

-

CNBC: https://www.cnbc.com/2021/05/14/retail-sales-april-2021.html

-

Bureau of Labor Statistics: https://www.bls.gov/news.release/pdf/cpi.pdf

-

Federal Open Market Committee: https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20210428.pdf

-

Barron’s: https://www.barrons.com/articles/the-treasury-market-just-had-its-worst-quarter-since-1980-51617299808

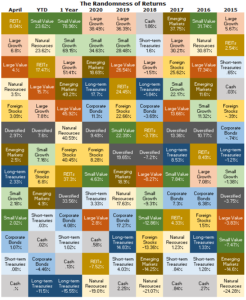

Note: All performance data in the following two charts were drawn from Morningstar.

Disclaimer: Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All data is as of the end of April 2021 unless otherwise noted. Data sources include www.morningstar.com. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided. Please Note: IF you are an IA Firm client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.