Key Observations:

- A more hawkish Federal Reserve has emerged and no longer views inflation as transitory

- The yield curve is flattening as the market is pricing in rate hikes, but strong demand persists for longer-term Treasury bonds

- Economically sensitive stocks sold off in November as the Omicron variant and inflation concerns raised doubts about the sustainability of the U.S. economic recovery

Economic Commentary

Let’s start with some good news. The U.S. Bureau of Labor Statistics reported the unemployment rate dropped to a pandemic low of 4.2% in November. Other encouraging data from the nonfarm payroll includes an increase in labor force participation rate to 61.8%, also a pandemic high. Unemployment is down as more people are wanting a job and finding it. As for the bad news, nonfarm payrolls only increased by 210,000 in November, dramatically below expectations of 573,000. This deceleration is a concern and has increased uncertainty in labor market momentum. It appears this is a hiccup caused mainly by the deceleration of hiring in labor and leisure in COVID impacted geographies. (1)

A greater concern is elevated inflation and its potential impact on households, as clearly displayed in the University of Michigan’s Surveys of Consumers for November. (3) The Consumer Sentiment Index declined 6.0% in November and 12.4% from the prior year to its lowest level in 10 years. Consumer’s assessment of current economic conditions dropped a staggering 5.3% from the prior month and a staggering 15.4% year-over-year. As noted in the survey release, “the decline was due to a combination of rapidly escalating inflation combined with the absence of federal policies that would effectively redress the inflationary damage to household budgets.” The survey presents a real risk to economic growth. If fears of declining real income override the historically high level of cash on hand households are currently enjoying, consumers are likely to cut back on spending and curtail economic growth in the months to come.

The Federal Reserve has certainly taken notice and changed its tune. Just a month after the Fed stated, “inflation is elevated, largely reflecting factors that are expected to be transitory,” Federal Reserve chief Powell stated in testimony to the U.S. Banking Committee, “I think it’s probably a good time to retire that word.” (2) To amplify the Fed’s right turn on inflation, the Fed Chair indicated a more hawkish tone as he expressed it is, “appropriate in my view to consider wrapping up the taper of our asset purchases.”

Market Commentary

The bond market certainly took Powell at his word (4). Anticipating an acceleration in tapering and expedited rate hikes, short-term rates jumped, longer-term rates declined, and the spread between two-year and ten-year Treasury bonds dropped by approximately 0.25% in just a few days. At 0.75%, the spread is at a one-year low. This “flattening” of the yield curve is due to investors betting earlier rate hikes will damper future inflation. In addition, there is still a demand for longer-term Treasuries as a flight to quality trade has picked up due to the uncertainty of the Omicron variant.

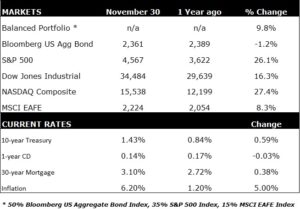

Speaking of Omicron, the variant emerged as a significant concern in late November, and its impact on the market was swift and noticeable. Economically sensitive stocks sold off sharply, led primarily by financials and energy, down 6.2% and 5.3% for the month. Broadly, the Dow declined 3.5%, the S&P 500 lost nearly 1%, and the NASDAQ was flat. Foreign and emerging market equities were hit particularly hard as expectations of significant governmental restrictions weighed on their stock markets. As measured by the MSCI EAFE Index, developed foreign markets lost 4.6% in November, and emerging markets dropped 4.3%.

Final Thoughts

The Omicron variant certainly caused short-term volatility and a November sell-off in stocks. However, as more data comes to light, it appears this variant is not the threat as once feared. It is the emergence of a more hawkish Federal Reserve that has embedded a new level of uncertainty into the stock and bond markets. The Fed is walking a tightrope. Stock valuations are high, and an overly aggressive Fed risks choking economic growth to the extent that it does not support these valuations. A Federal Reserve that does not accelerate tapering and rate hikes encourages sustained high inflation. This will reduce real GDP and dampen consumer spending as households adjust to their new real incomes. Again, bad news for stocks and not good news for bonds either.

As this more hawkish Fed reveals its plan for tapering and rate hikes, a clearer picture of future interest rates will emerge.

At Concord Asset Management, we design portfolios for the long run, with the ability to navigate various market cycles. However, you can have confidence that we are monitoring these market-moving events, and we will make reasonable, tactical adjustments as necessary.

Author

Mitch York

CIO

Sources:

All performance data is generated through Morningstar.

You cannot invest directly in an index. A description of each comparative benchmark/index is available upon request.

Disclaimer: Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All data is as of the end of April 2021 unless otherwise noted. Data sources include www.morningstar.com. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided. Please Note: IF you are an IA Firm client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.