Key Observations:

- The Delta variant, supply chain constraints, and consumer sentiment bit into Q3 economic growth

- The Federal Reserve announced plans to reduce its monthly purchases of Treasury and mortgage-backed bonds

- Interest rates are still range-bound, offering low yields across the spectrum of traditional fixed income

Economic Commentary

It has been a mixed bag of economic news recently. The Labor Department reported the unemployment rate hit a new pandemic low of 4.8% at the end of Q3. That’s good news. The bad news is much of the decline in unemployment was due to workers dropping out of the labor force. (1) With the holidays fast approaching, this presents other economic challenges. The Labor Department noted that employers face their own issues persuading employees to come back in preparation for a busy holiday season. Employers are dealing with the lowest rate of American adults, 62%, that are either working or looking to work while experiencing a rising Q3 employment-cost index of 1.3% from the prior quarter, the fastest pace since 2001.

We are all very aware of the supply chain issues contributing to product shortages and significant inflation. This has consumers worried. The University of Michigan’s October survey declined 1.5% as consumers feel the most uncertainty about the year-ahead inflation rate than any time in nearly 40 years. (2) This, combined with the spread of the Delta variant, resulted in consumers slowing down. According to the U.S. Department of Commerce, consumer spending grew by only 0.6% in September and was the significant factor in third-quarter GDP coming in at 2.0%, far below the 2.6% estimate. (3)

Back to good news. The Fed doesn’t seem overly concerned about these economic headwinds. In the most recent FOMC statement, the Fed stated, “with progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen.” (4). They continue to believe inflation is “elevated, largely reflecting factors that are expected to be transitory.” Their optimism has been put into action. As expected, the Fed will immediately begin to slow down its pace of monthly purchases of Treasury and mortgage-backed securities, a.k.a. “tapering,” by $10 and $5 billion, respectively. This pace of reduction into the foreseeable future as market conditions warrant.

What makes tapering so important? By incrementally decreasing the monthly purchase of bonds until the program is ended altogether, the Fed methodically reduces the growth in money supply (i.e., monetary stimulus). It not only signals an economy that is moving towards the Fed’s goals of full employment and stable prices, but it provides a potential timeline for future rate hikes (following the end of tapering).

Market Commentary

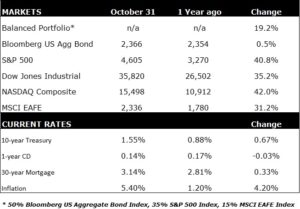

Let’s focus on bonds for a change. The Fed is now tapering, and real-life inflation is all around us. You would expect the bond market to be in a free fall and interest rates skyrocketing. Not so. The 10-year Treasury bond is yielding 1.55%, well below the recent April peak of 1.75% and far below pre-pandemic levels. Two years ago, the 10-year yielded about 1.90%, and the year before that, it hovered near or above 3% for several months. That’s remarkable considering inflation expectations are now historically high, the Fed has commenced tapering, and a series of small rate hikes are likely to begin late in 2022.

It’s not just U.S. Treasury yields that are low. Government mortgage-backed bonds are paying about 2.5% and investment-grade corporates 2.4%. One could take significantly more risk and buy junk bonds. They yield about 4.4%. That’s not exciting as they averaged an 8% yield over the past 20 years, and they have drawdowns that rival stocks. During the financial crisis of 2008, junk bonds, as measured by the Bloomberg High Yield Very Liquid Index, declined as much as 38%. During last year’s Covid crash, junk bonds declined by nearly 22%.

Final Thoughts

Don’t fight the Fed is an old investment mantra that advises investors to align their decisions with the actions of the Federal Reserve. That’s good advice, but the challenge has always been timing. When do you align your investment decisions knowing there is a lag between signaling, implementing, and finally real market consequences?

At CAM, we suggest now is the time to begin adjusting fixed-income allocations to the reality of the Federal Reserve’s intentions. We expect that interest rates, short and long-term, will methodically increase over the next year or two, and credit spreads will remain in a narrow range. Therefore, capital gains that prevail from falling rates and tightening credit spreads are less likely to lift fixed income returns.

In this environment, looking beyond traditional fixed-income allocations is warranted. For our portfolios, the addition of a multi-asset class income approach including higher-yielding, adjustable-rate debt, and risk-managed, income-generating alternative securities is on the horizon.

Author

Mitch York

CIO

Sources:

All performance data is generated through Morningstar.

You cannot invest directly in an index. A description of each comparative benchmark/index is available upon request.

Disclaimer: Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All data is as of the end of April 2021 unless otherwise noted. Data sources include www.morningstar.com. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided. Please Note: IF you are an IA Firm client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.