By Gary Aiken | April 11, 2024

My first axiom of investing philosophy is, “If you can’t explain it, don’t buy it.” I can explain how a bitcoin is manufactured. I can explain how a bitcoin is held and secured. I can explain how Bitcoin futures work. I have trouble explaining the actual utility of Bitcoin, though. It is not a practical currency. Held in trust or ETF in street name abandons the pretense of anonymity or usefulness of the blockchain. Its best use at this point is for speculation in its own price. Speculation is not our business at Concord, but since there are Bitcoin ETFs and some of our clients have or will dabble in crypto assets, I’ll attempt to describe a potential valuation methodology.

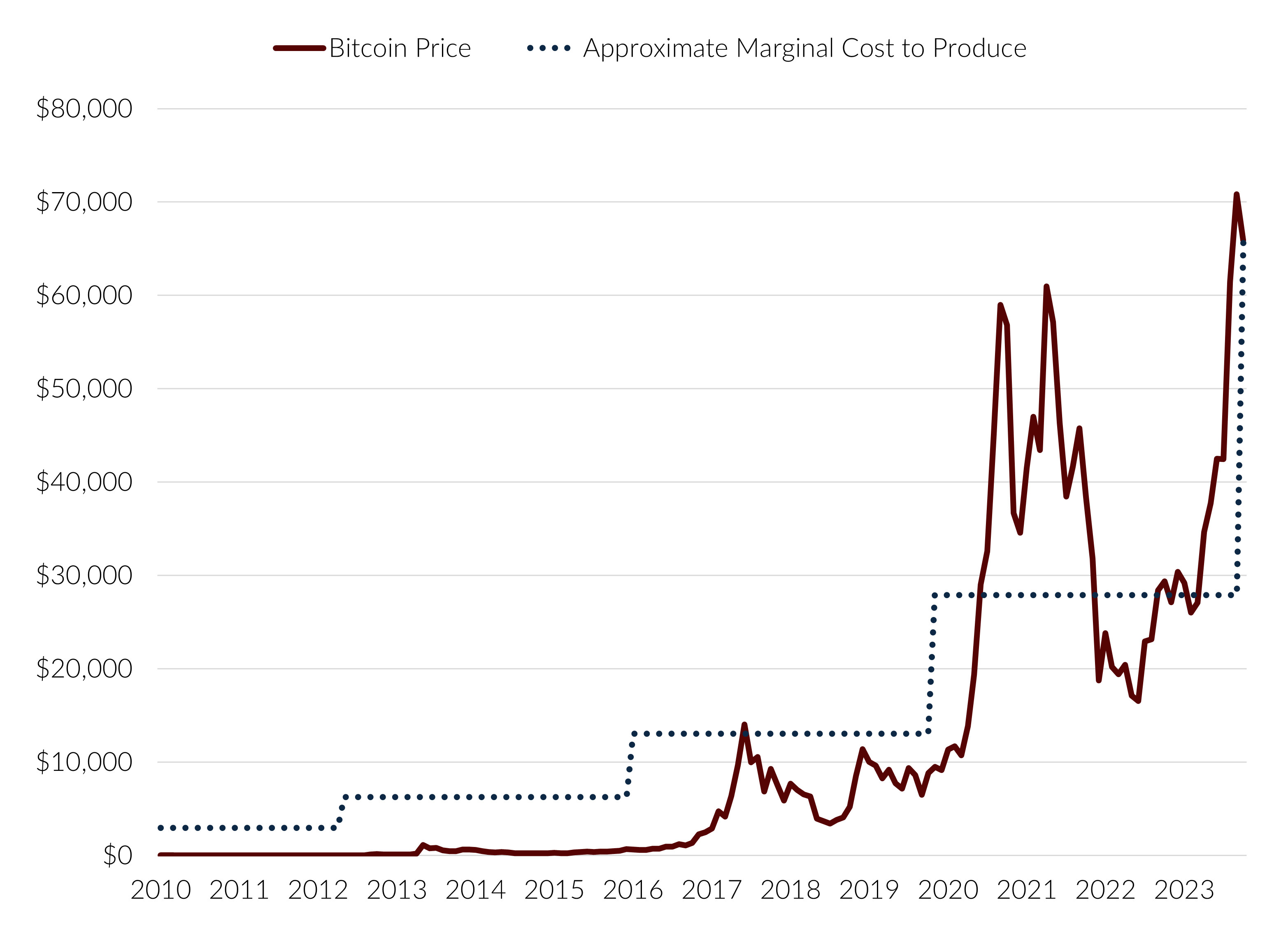

A Bitcoin halving event will occur in April 2024. As a result, the operators of computers using the fastest microprocessors and ever more electricity to calculate the solutions to the Bitcoin equation will earn only half as many bitcoins for each solution to the problem they generate. Ultimately, as of this month, nearly 94% of all the bitcoins that will ever be minted will be outstanding. This scarcity has “value,” according to Bitcoin advocates. Bitcoin has no cash flow other than at purchase and sale. It creates no value by holding it. So, let’s examine the case for supply scarcity to define a valuation methodology.

Bitcoin’s marginal supply is driven by its production economics. It costs increasingly more money over time to create a bitcoin. These costs include machinery (depreciation), rent, electricity, human oversight, and downtime. As of this halving event, the marginal cost to mine a single bitcoin will rise to approximately $62,000, according to estimates using a framework and data publicly available from Galaxy Digital and Bloomberg. With Bitcoin trading at around $64,500, this leaves little room for new entrants to justify the upfront costs of starting a new mining operation. Barriers to new miners’ entry and the fluctuating price of Bitcoin itself will cause production to rise and fall. In this way, it’s not too dissimilar from other commodities: oil producers deciding how much to drill, farmers deciding how much to plant, or copper and gold miners deciding how much to mine at current or future expected prices.

Using this marginal cost approach, we may be able to approach another investing axiom: “If someone is willing to pay you more than something is worth, sell it.” That statement requires an opinion on value. While I don’t trust completely the marginal cost framework, buying assets well below replacement cost can pay off over long periods. Buying commodity companies when the underlying commodity is in a deep bear market grants the buyer access to mines and equipment at a deep discount – just waiting for demand in that commodity to return. Vast fortunes in real estate have also been made by buying real estate below replacement cost. In both cases, though, it’s a waiting game, and time has opportunity cost. Ultimately, the world needs copper, oil, and real estate. Only time will tell if it needs Bitcoin.

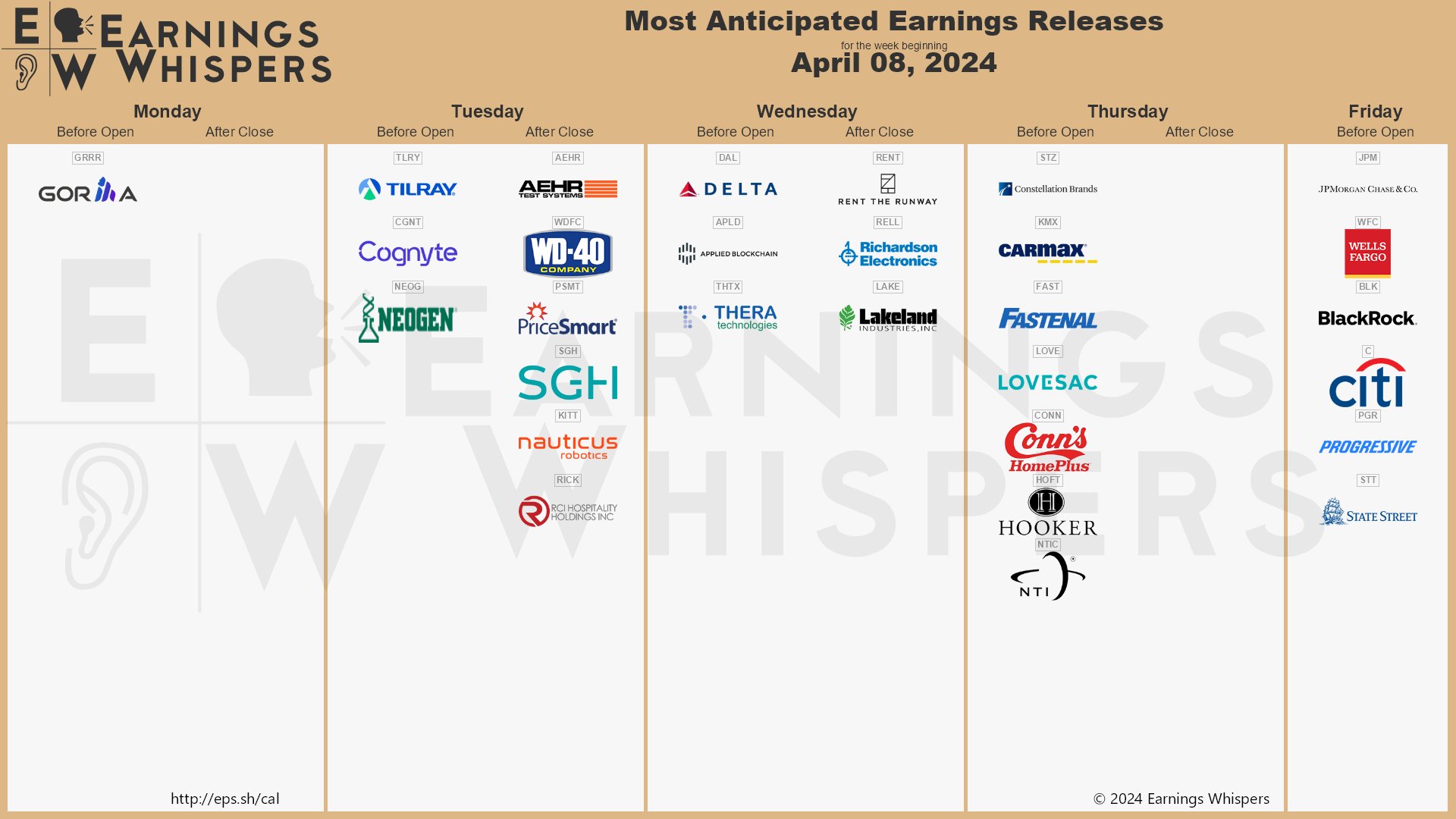

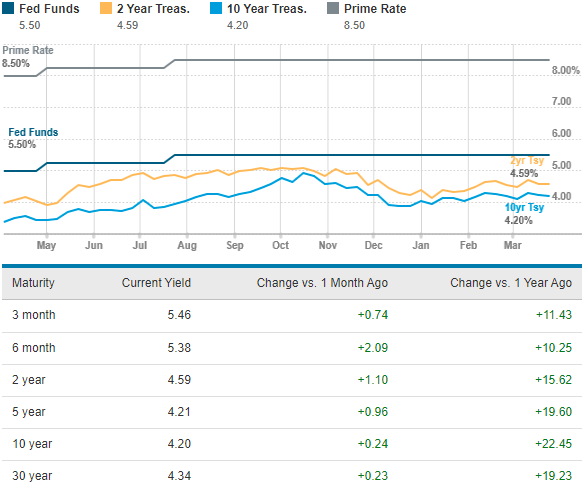

Bitcoin Prices vs. Approximate Production Costs

Sources: Bloomberg Finance, L.P., Galaxy Digital, Concord Asset Management

The marginal cost approach has some statistical validity in academic studies. Cambridge University’s study “Energy Consumption of Bitcoin Mining” in 2023 analyzed electricity costs associated with mining over time to predict (within a wide band) how Bitcoin might be valued and traded. The University of Wisconsin published another study that concluded a close relationship between the cost of production and the price of Bitcoin from 2015 until the massive price spike and collapse of 2017.

The graph above shows Concord’s estimation of average production costs between each halving event. In general, buying below replacement cost and selling above replacement cost has worked. That doesn’t mean they will work in the future. Supply must meet demand at an equilibrium price. So, let’s turn to demand.

We can easily conceptualize the demand function for energy, agricultural, or industrial metal commodities. It’s much harder to conceptualize the demand function for gold. Gold has an industrial purpose as a conductor and has numismatic value in coins or jewelry. But these uses pale in comparison to gold’s traditional status as a permanent store of value. This status is based on belief, and humans have believed in gold for thousands of years. Bitcoin hasn’t been around for nearly that long. While Bitcoin evangelists are true believers, attempts to identify a relationship between demand and price so far have yielded only a return to miners’ desire to mine more. That shallow analysis fails and provides only a circular path to the previous supply discussion.

A famous financial advisor claimed on CNBC earlier this year that 2.5% of all assets managed by advisors will be in Bitcoin one day. He believes that this investor demand will drive the price of Bitcoin higher. This analysis seems flawed to me. Flows may influence prices in the short run, but valuation matters in the long run. We just don’t know how supply will meet demand or whether the lack of additional future supply will have any actual impact on price.

Concord will continue to watch developments in Bitcoin. If the price drops significantly below replacement cost, and we have more confidence in a valuation framework, it may be something we speculate on for our most aggressive accounts; for most of our clients, stocks, bonds, and cash will continue to enable them to meet their investment objectives without the risk and volatility inherent in crypto assets.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.