By Gary Aiken | October 6, 2022

- Inflation is proving more stubborn than anticipated, with the Fed getting increasingly hawkish and markets becoming more skeptical of a “soft landing.”

- A steady decline in asset values so far this year (i.e., a collapse in growth stocks and a correction in bond prices) has created attractive valuations in many asset classes.

- Higher interest rates are having mixed impacts on the economy (e.g., the housing market has cooled significantly, but savers are now able to actually earn an attractive return on their savings).

Click to download this report

Economic Commentary

At the end of the third quarter, inflation was still the hot topic on everyone’s mind, especially after the Federal Reserve’s decision in September to implement a third consecutive rate hike of 75 basis points. Inflation ticked up in August after declining in July and stubbornly remained above 8% on an annualized basis, despite gasoline prices continuing to fall steadily since the end of June.1

The Fed is determined to get a grip on inflation and is bound to do so eventually. As Fed Chair Jerome Powell said after the group’s September meeting, they will “keep at it until the job is done.” Fed officials see rate hikes continuing into 2023, not exceeding a “terminal rate” of 4.6%, with the goal of pulling inflation back down to 2% by 2025.2

Markets now understand that the Fed’s mission, which includes a pull-back on asset purchases, will come with a short-term cost and potentially some economic pain. At a news conference in September, Powell was explicit, “We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t.” So the question becomes: how painful will it be? No one knows.

Here at CAM, we have been setting expectations for some time that the U.S. will not likely see a V-shaped recovery after any potential recession (i.e., a rapid recovery, nearly to pre-recession levels). But how deep any recession may be—and how long it lasts—will likely depend on how quickly the Fed can end its tightening policies.

This challenging economy is still somewhat of a unicorn, continuing to show many signs of strength.

Typically an economic slowdown is accompanied by rising unemployment, but today’s job market remains competitive. As inflation burned hot in August, payrolls continued to expand, with non-farm jobs expanding by 315,000. Unemployment remained below 4%, labor force participation gained, and wages rose. The chief investment strategist at Charles Schwab told CNBC, “This could very likely be a recession where you don’t see the kind of carnage in the labor market that you see in most recessions.”3

Businesses have continued to invest, with capital goods expenditures reaching a seven-month high in August, according to the U.S. Commerce Department4 — another potential argument against a deep recession.

Source: Seegrid Corporation

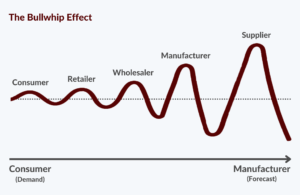

Furthermore, some of our current economic pain and price inflation can still be chalked up to the “bullwhip” effect of mismatches in supply and demand. COVID disruptions to the supply chain have yet to unwind fully, while consumer demand snapped back more quickly than expected and then slowed toward the end of summer. Such mismatches continue to roil the economy.

Ford announced last month that it has more than 40,000 pick-up trucks it can’t finish building for lack of parts.5 Consumer appliance maker Whirlpool is experiencing component shortages.6,7 Natural gas is in short supply heading into the winter season, not just because of the war in Ukraine but also because electricity providers had to draw down gas reserves to meet surging demand during an unusually hot summer.8 Supply shortages, bad weather, war, labor shortages, and high consumer demand are squeezing the markets for everything from tires9, to frozen vegetables10, to Halloween candy11 and Christmas trees.12

At the same time, some sectors of the economy definitely are showing signs of weakness.

Retailers are finding themselves with too much inventory of the things they can get as consumer spending has slowed. Amazon recently announced its second Prime Day-type sale for 2022, when it normally has only one such event per year. Walmart and Target are planning an early start to their holiday shopping sales. Such efforts, using discounts to reduce inventories, could help bring down prices over the remainder of the year.13 Overstocked inventories are also causing a ripple effect through the transportation industry, with global shipping beginning to slow as well.14

While rent remains high, the market for home purchases has finally begun to soften. Price increases are slowing, home sales dipped half a percent in August15, and the senior economist for Realtor.com recently said that “the upward momentum has lost steam, and it is clear that the market peak is now firmly behind us.”16

So, when you add it all up, it would be an understatement to say that economic signals are mixed. The Fed’s war on inflation may slow the economy and cause a marginal increase in unemployment, perhaps even a recession. However, many parts of the economy will only be slowing from a white-hot level that we believe is objectively unsustainable, and supply issues will eventually slowly sort themselves out. In sum, we’d argue it’s a time for patience and caution, not pessimism.

Market Commentary

The thing to remember about securities markets is that assets are priced on a forward-looking basis. Essentially, prices reflect future events and earnings, not current ones.

As such, market retrenchment during the third quarter was likely driven by investors finally coming to terms with the fact that the Fed will not let up any time soon on its inflation fight. Rates will continue to rise, and some sort of recession is more likely than not.

Moreover, economic forecasts for the U.S. have come down from 1.7% annual GDP growth to just about zero this year (0.2%) and less than 2% annually through 2025.17

So, even though stocks recovered from July through mid-August, they pulled back again through the end of September as a “soft landing” scenario became less and less likely. The S&P 500 peaked on August 16 at just over 4,300 and with the exception of a brief rally in mid-September, slid steadily through the quarter end, even flirting with bear market territory. The S&P 500 is off about 23% from its high in Q4 2021.

The DOW showed a similar pattern, peaking on August 16 and then sliding into bear territory on September 23, with the DOW currently off about 15% from its high in Q4 2021. The biggest losses by far, however, have been seen in the tech-heavy, growth-oriented NASDAQ, which peaked on August 15 and approached bear territory by the end of September. The NASDAQ is down about 32% from its peak in November 2021, as high inflation tends to take a bigger toll on growth stocks compared to other sectors of equity markets.

Source: BlackRock Fundamental Equities, with data from Bloomberg and the National Bureau of Economic Research (NBER)

Bond investors are also feeling the pain in 2022, with longer-term issues (10+ years) getting hit hardest in the third quarter since they are most sensitive to changes in interest rates. According to Morningstar, every one of its taxable bond categories is in the red for 2022, through mid-September. The least-impacted sector of fixed income has been ultra-short bank funds and high-yield has held up better than most, only down about 10% as of mid-September.18

The bright spot in all this negative news is that price-earnings ratios for stocks—especially growth stocks—are at some of their most attractive levels in years. In the case of a shallow recession, equities may be positioned for a strong bounce. Bond yields, which tend to overshoot in both a positive and negative direction, may now also offer significant value as the Fed’s rate hike regime approaches its finale, likely in the early part of next year.

Final Thoughts

In principle, we believe that long-term investors should remain invested across market cycles and that trying to time the ups and downs of market cycles is a fool’s errand.

This time around, the Fed has embarked on an important task. While we don’t want to underestimate the challenges of a recession, like many investors we believe that the perils of high inflation are worse. Remember that those of us under the legal retirement age have never lived through a prolonged period of high inflation. We have never seen firsthand the destruction of it. Also, remember that while inflation is high in the U.S., relative to recent history, it remains higher around the world.

We believe that the U.S. will come out of this difficult period with a stronger economy and more rational valuations across a wide range of asset classes. This may set the stage for strong investment returns:

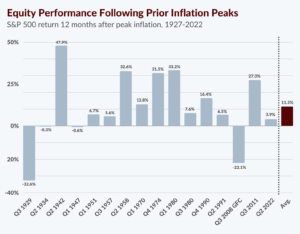

- The average S&P 500 return in the 12 months following an inflation crest was 11.5%.19

- The average 12-month [equity] return immediately following a 15% or greater decline is 55%.20

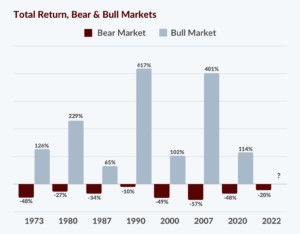

- Bear markets average 14 months in length with an average return of -33%, a relatively short time compared to bull markets that average 71 months and an average total return of 263%.20

Source: CNBC

Rather than seeing this as a time for pessimism, we see it as a time for cautious opportunism, particularly around financial planning work. For example, with interest rates on CDs creeping toward 4%21, one can finally earn an attractive return on savings. Many Americans have hesitated to even save an emergency fund given the dearth of return on savings, but now may be the time to reassess one’s allocation to cash savings, which is likely an under-invested portion of their financial plan.

Now may also be a good time for tax planning, such as exiting legacy positions that may have been difficult to liquidate when asset values were higher. Given where asset values are today, there may be an attractive opportunity to execute any pending Roth IRA conversion.

In short, we believe in staying on the long-term course. Investors are experiencing the end of the longest bull run in American history. Markets have been and will likely remain choppy. Growth is expected to be tepid. We may see a recession. Global supply issues may take longer than we’d like to work themselves out.

Recessions and market corrections are the anomalies. Recoveries, however, often happen faster than anyone expects, so steadiness and patience are key to riding out any coming storm.

About Concord Asset Management:

Concord Wealth Partners built Concord Asset Management (CAM) to bring institutional quality service to their clients and financial advisors.

CAM’s service goes beyond simply providing institutional quality investment management; our team brings deep industry knowledge, proprietary research, investment due diligence, and real-time market analysis to help clients and advisors make better and more informed decisions about their financial future.

Our core belief is that clients should always be put first and that everyone’s financial goals are unique; that means their investment strategy should be too.

—

Footnotes and Sources:

3Cox, Jeff. “Payrolls Rose 315,000 in August as Companies Keep Hiring.” CNBC, CNBC LLC, 2 Sept. 2022.

11ViaVid. “The Hershey Company Second Quarter 2022 Earnings Results Prepared Remarks.” ViaVid Communications Inc., 27 July 2022.

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications, and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/.

Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided. Please Note: If you are an IA Firm client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.