By Gary Aiken | January 6, 2023

- Inflation started to show signs of moderating. The Federal Reserve continued raising rates, but signaled a slowdown for the pace of future hikes.

- The bear market rally that started in October continued well into the late fourth quarter. Stocks and bonds both showed strong returns amid declining volatility.

- While the stock and bond markets’ direction implied optimism about a potential end to monetary tightening, inflation stressors like strong wage gains and low unemployment provide a contradictory set of data points.

Click to download this report

Economic Commentary: Inflation Still A Threat – No Cause Yet For A Party Or A Pivot

There are three concurrent stories impacting the global economy and financial markets. The first is the rise of inflation in the United States and Europe due to both the pandemic and central bank policy responses to the pandemic. The second is the continuing War between Ukraine and Russia, putting the European post-COVID- 19 recovery in jeopardy and leading to rises in the prices of energy and agricultural commodities. The third is uncertainty and tension created by China’s internal and external policies: the continued effect of COVID-19 lockdown policies on the supply of goods into and out of China, as well as the regime’s ever-present saber-rattling against Taiwanese independence.

Inflation continued to be the dominant concern impacting markets and investor risk appetite, with a decidedly risk-on mentality driving asset prices in the fourth quarter. The financial markets story was better in Q4 – with both stocks and bonds rallying and the Federal Reserve slowing the pace of rate increases to 50 basis points (0.5%) in December. Still, we believe that it’s much too early to be breaking out the champagne and streamers.

Headline inflation may be slowing, mainly due to price drops on some big ticket items (e.g., cars, energy prices). At the same time, Core CPI [Consumer Price Index – excluding food and energy] remains stubbornly elevated. Unemployment remains low with job growth posting strong gains month over month, while wages continue to accelerate. Unemployment and core inflation are key data points the Fed is watching to measure how close they might be to accomplishing their mission.

In short, there’s a case to be made that the economic data point to the potential for a U.S. wage-price spiral. The threat of such a scenario has been driving the Fed’s hawkish decision-making. As long as wage growth and core CPI are stubbornly stuck above 5%, the idea that the Fed might stop raising rates seems like wishful thinking and a lot of happy talk by folks who want to keep the party going.

Investors are wise to refer to Fed Chair Jerome Powell’s August Jackson Hole speech as the most important and reliable indicator of where the Fed is headed. Powell said explicitly that he’s going to be Paul Volker, not Arthur Burns – the former being the “stop-go” dove who led the U.S. into the “Great Inflation” of the late 1970s; the latter being the steel-nerved hawk who tamed double-digit inflation and put it in the rear-view mirror.

Chair Powell may have recently tempered his tone on rate hikes, coming across at times even a bit wishy-washy. The Fed has returned to a data-dependent framework to identify the terminal Fed Funds rate for this cycle. We caution, however, that moderation in the rate of change is not a sign that the rate hike regime is coming to an end. In his December press conference, Chair Powell reiterated that the Fed “has more work to do.”

Market participants who believe that we’re going to be in a rate-cutting cycle in late 2023 need to put down the stemware. Such an outcome would require many things to come true that are low-probability outcomes in our view. A rate-cutting regime would have to be predicated on inflation disappearing while wages and employment are still going gangbusters. That kind of quick deceleration doesn’t make much sense, mathematically.

Abroad, the war in Ukraine continues unabated, and it’s highly unlikely the war will end any time soon. That means continued dislocations in energy and agricultural commodities. Europe is facing a recession and high inflation at the same time. While the major economies built large natural gas reserves earlier in 2022 and benefited from a mild Autumn, Europe will use a lot (if not all) of that store over the winter. European industrials will have to face production cuts, which will impede profitability and result in a declining trade surplus. This puts the European Central Bank (ECB) in the unenviable position of having to raise rates into a recession; if they don’t raise rates and the U.S. does, that would bring continued strength in the dollar relative to the Euro, and while this might be positive for European exporters, it is unclear how deep production cuts will need to be as energy rationing becomes more prevalent.

In China, supply chain disruptions due to its zero- COVID-19 policy are still fueling inflation in the U.S. While at first glance, China’s normalization would seem to be positive for markets, ending those policies and fully opening up China could have negative consequences for inflation in the U.S.

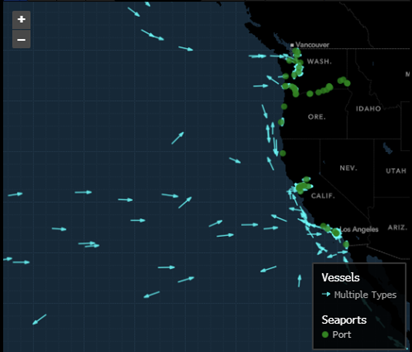

There was great hope after the conclusion of the 20th Party Congress that Chairman Xi would relax COVID-19 restrictions and China would open up again, but that has not happened yet. In the face of historic riots, it took weeks for even the barest concessions by the government. The economic impact of lingering COVID- 19 restrictions, compared to the rest of the world, marks a stark contrast: e.g., wait times for container ships at the Port of Los Angeles, which had one of the world’s worst backlogs during COVID-19, have nearly disappeared. At the same time, port congestion, cancelled sailings, and “blank” sailings continue to impede shipping goods from China to the U.S.

As a graphic display of this disparity, compare the two maps below. One shows port traffic at ports along the U.S. Pacific coast.

U.S. Destination Shipping

Source: Bloomberg Finance L.P., Mapbox, OpenStreetMap

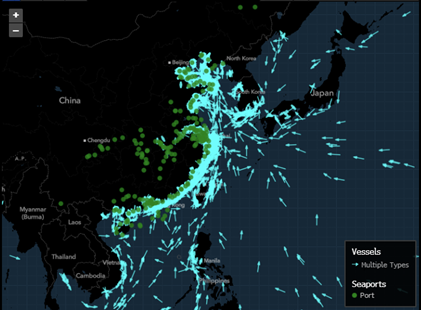

The other shows port traffic along China’s Pacific coast. COVID-19 lockdowns, which are increasing port congestion in China, have had an enormous impact on the entire Chinese economy.

Chinese Destination Shipping

Source: Bloomberg Finance L.P., Mapbox, OpenStreetMap

But even if China did fully reopen, that could set the stage for a resurgence in global inflation. Right now, in its semi-lockdown state, China is using less oil and fewer commodities (e.g., copper, iron, aggregates) than typical. If fully opened, they would be using more resources and likely push up commodity and energy prices worldwide, at a time when the U.S. strategic petroleum reserve is at its lowest since the early 1980s. Moreover, in any return to growth, China would likely export their own inflation to the rest of the world through higher prices on exported goods. That means any relaxation of China’s zero-COVID-19 policies might not be the deflationary boon that many people expect. It could be inflationary.

Market Commentary: Markets Being Irrationally Exuberant?

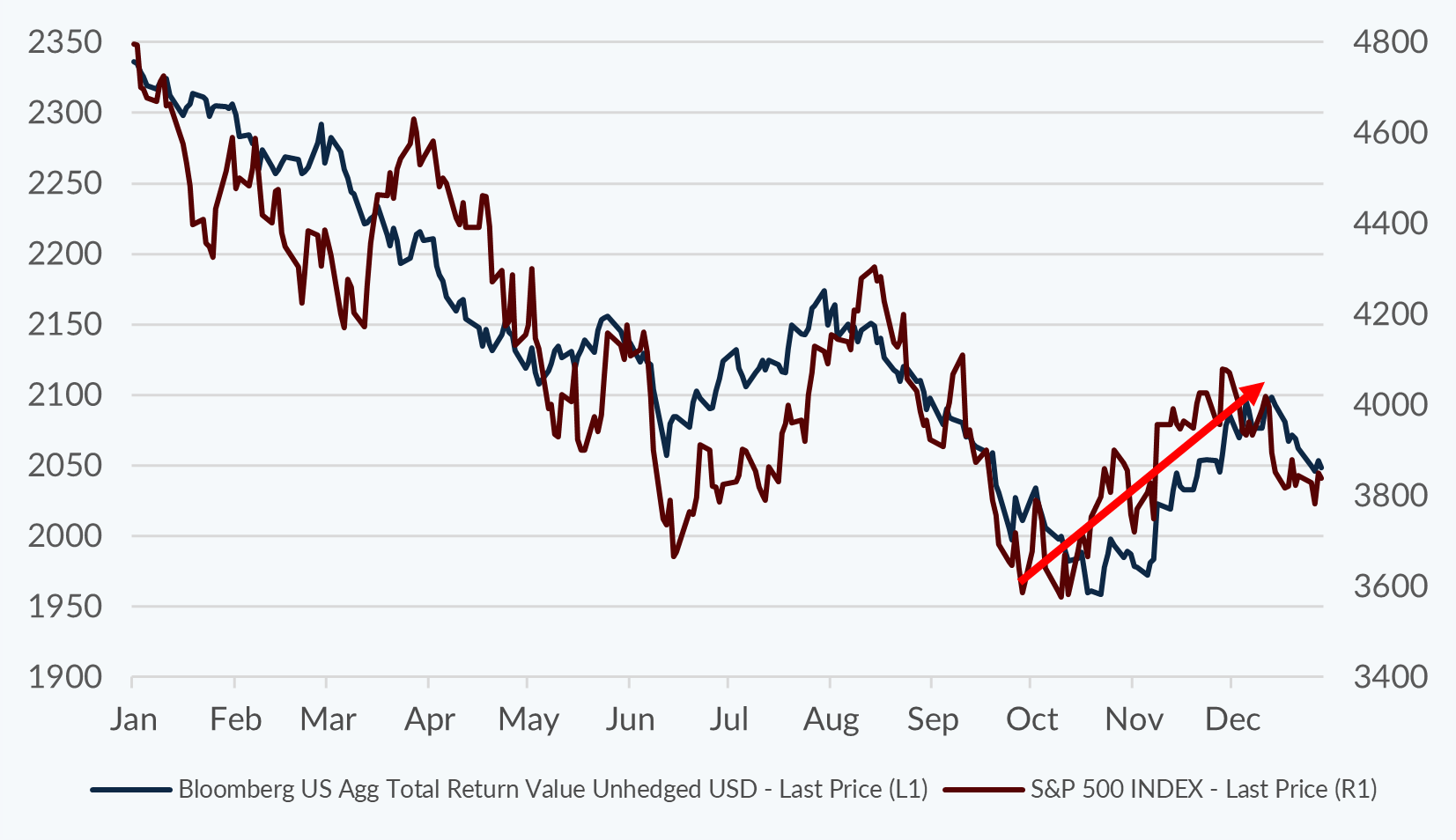

Stock and bond prices were both up in Q4, as measured by the S&P 500 Index and the Bloomberg Aggregate Bond Index. Market participants were oversold in September just as we started seeing signs that headline inflation was slowing and (hope against hope!) could roll over. The idea started to take root that we had passed “peak inflation” and that the Fed might be closer to the end of its tightening regime.

Stock and bond prices generally rose during Q4

Source: Bloomberg Finance L.P.

Thinking that we had hit bottom, giddy investors once again started buying risky assets like stocks and piling into long-duration bonds – because yields were attractive on a relative and absolute basis for the first time in over a decade. The latter also served as a hedge against an aggressive Fed causing a recession, as long-duration bonds might rally in the face of declining GDP. So, Q4 saw two trades (a risk-on trade and a flight to safety trade) driving equity and bond prices up in tandem.

As a side note, this continued 2022’s anomalous trend of highly positive correlations between stocks and bonds. Stocks and bonds typically move together with a small positive correlation. This means that if stocks are down, then bonds should go down far less and sometimes in the opposite direction. This is what creates a diversification benefit for investors. Over the past year, that correlation has been stubbornly high, meaning that investors in both stocks and bonds have suffered losses together and enjoyed the rallies together. For investors, cash and previously out of favor sectors (energy) have provided diversification benefits this year.

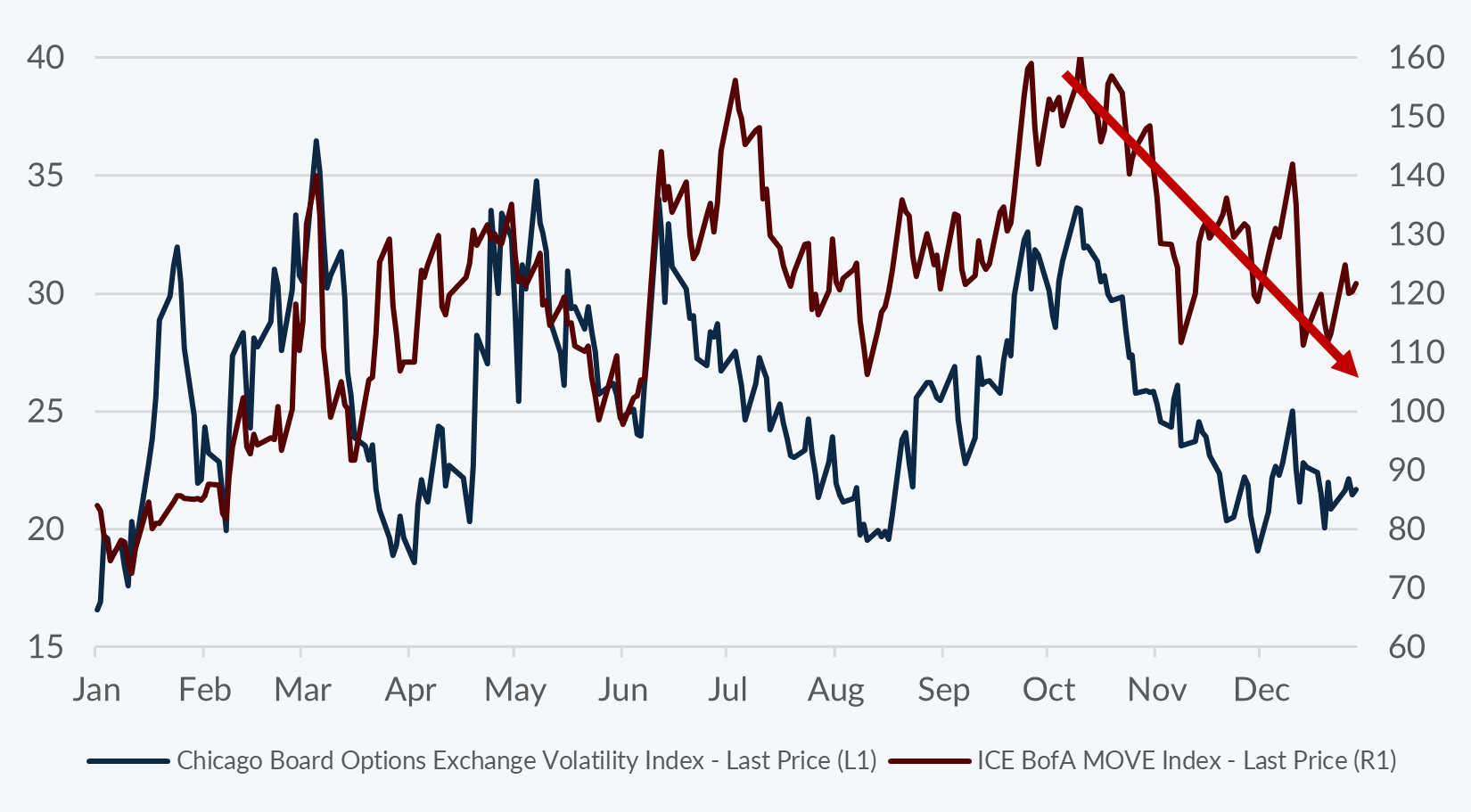

The other key development in Q4 was that market volatility declined significantly: the VIX Index, which measures expected stock volatility was down 27%, and the MOVE Index which measures bonds market volatility was down 22%. The chart above shows these indices coinciding with cycles of this year’s risk-on (bear market rallies) and risk-off (trend) periods in stocks and bonds.

Stock and bond volatility fell during Q4

Source: Bloomberg Finance L.P.

Despite all the negative economic pressures, stock market multiples at the end of 2022 are only slightly lower than where they were at the beginning of the year. Earnings and profit growth slowed during the year, but price-to-earnings (P/E) ratios remain high, at 18.6x trailing earnings to close 2022.

Based on the risk-on environment going into 2023, investors appear to be assuming higher inflation, higher interest rates, and high P/E ratios. One of those variables is going to end up being wrong. One side of that see-saw has to come down: either interest rates and inflation will decline or market multiples will have to fall. History would tell us it’s stocks that suffer: typically periods of high inflation and high interest rates yield below-average stock market returns.

Final Thoughts: Despite The 2022 Year-End Gift, Many Risks Remain

It has been humorously said that economists have predicted thirteen of the last five recessions. And it’s true that investors tend to climb the “Wall of Worry,” using that as an excuse to be negative on stocks, despite the long-run success of U.S. markets.

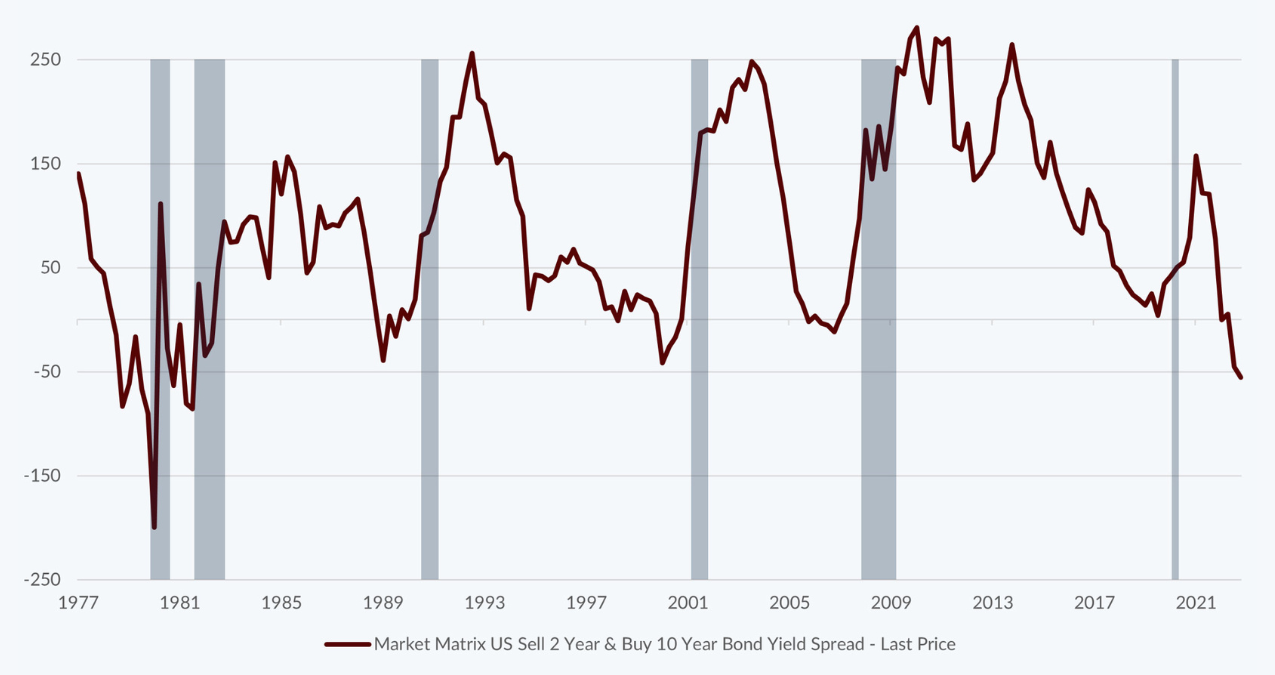

I agree with the axiom that, in the long run, the best time to buy stocks is when you have cash, but some indicators of shorter-term relative value are better than others. The spread between the 10-year Treasury yield and the 2-year Treasury yield is an indicator that is nearly perfect in predicting recessions. The chart below shows this spread against the shaded regions which are the official start and end dates of recessions. When this indicator turns negative (as it is today), it means that the yield on short-term money is higher than the yield on long-term money.

Market matrix US sell 2 year & buy 10 year bond yield spread

Source: Bloomberg Finance L.P.

Investors are paid to wait, instead of making long-term investments. Economic activity reflects this as capital allocators (CEOs and CFOs) prefer to hold cash as opposed to spending on new machines, inventories, or other investments in their businesses. Consumers prefer saving to consumption. As business activity reflects these changing sentiments and preferences, profits decline. Business leaders course correct by cutting costs—inventory and labor. This induces a general slowdown in economic activity—a recession. This is the GOAL of Chairman Powell and the Federal Reserve in their policy to combat inflation.

Investors are wise to take advantage of the rise in asset prices in the fourth quarter and rebalance their portfolios. Here at Concord Asset Management, we are evaluating client portfolio models and investment options to prepare advisors and their clients for what may be another tough year in 2023. With inflation at 7.1% (Nov 2022) vs 7.0% a year ago (Dec 2021), the Fed seems to have sufficient reason, runway, and resolve to continue raising interest rates. Even a reopening of China does not appear to have uniquely positive characteristics for investors in the upcoming year. The Ukraine/Russia stalemate portends dark times for Europe.

Still, the stock and bond markets provide opportunities for investors who are risk-aware and have a solid financial plan. Meeting with your advisor to discuss your personal situation enables you to establish an appropriate risk tolerance for short-term market volatility. We look forward to having some dry powder available for when that volatility presents opportunities in 2023.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications, and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Concord Asset Management, LLC (“CAM” or “IA Firm”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated, and shares advisory personnel, with Concord Wealth Partners. CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

The information provided in this commentary is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM or its affiliates, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM or CWP. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. IA Firm is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of IA Firm’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/.

Please Note: If you are an IA Firm client, please remember to contact IA Firm, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. IA Firm shall continue to rely on the accuracy of the information that you have provided.

Please Note: If you are an IA Firm client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.