By Gary Aiken | September 7, 2023

One year ago, I published a note dedicated almost entirely to Jerome Powell’s speech at the Federal Reserve’s annual symposium in Jackson Hole, Wyoming. Chairman Powell’s comments were short and to the point. The Federal Reserve, under his leadership, was determined to snuff out inflation using all the tools at its disposal. He was determined to be remembered as the second coming of Paul Volker, who beat back the crushing inflation of the 1970s by taking interest rates into the high teens. In summary, Powell warned investors and those who live in the economy of the United States to expect pain.

And yet, a year later, even as the Federal Reserve has done exactly what the Chairman told us he would do, I doubt many would consider the past twelve months as significantly painful. The unemployment rate has remained low (3.8% for August) as Americans continue to find jobs and more rejoin the labor force. Real GDP growth has remained positive as consumers and the government continue spending. Although prices are still rising, the pace of inflation has slowed dramatically. The stock market, as represented by the S&P 500, is 16% higher today than it was at the end of August 2022, and the Intermediate Government/Credit Bond Index has managed to eke out a small 0.4% total return over the past twelve months. By these measures, it’s hard to reconcile the Chairman’s prescription for “pain” with what materialized.

Against that backdrop and maybe with a bit of humility and introspection, Powell turned from prophet of pain to poet in this year’s August Jackson Hole keynote. He waxed philosophically, “As is often the case, we are navigating by the stars under cloudy skies.” What do we, as investors, make of this circumspect and altogether humble public servant’s work and forecast? At Concord Asset Management, we have been upfront with our clients that although our base case is for a recession at some point, that doesn’t mean we are running for the hills.

Concord Asset Management invests client portfolios in a variety of different asset classes both directly and through exchange-traded funds (ETFs). We do not navigate by the stars. We have a framework for identifying attractive investments called “Relative Value.”

Relative Value is an approach to portfolio construction comparable to an optometrist visit. While pressing your face into a cold metal device, the optometrist asks, “Do you like A or B? B or C? One or two? Three or four?” and so on. The world presents an array of data and investment choices. Investors can use that information to determine their view on the valuation of a security. But, unlike economists who apparently must use astrolabes and sextants, investors get one more crucial data point: the current price determined by market participants. We know exactly where we are at any given time and thus can compare the price and value of security A to security B and make a judgment about the relative merits of those two options.

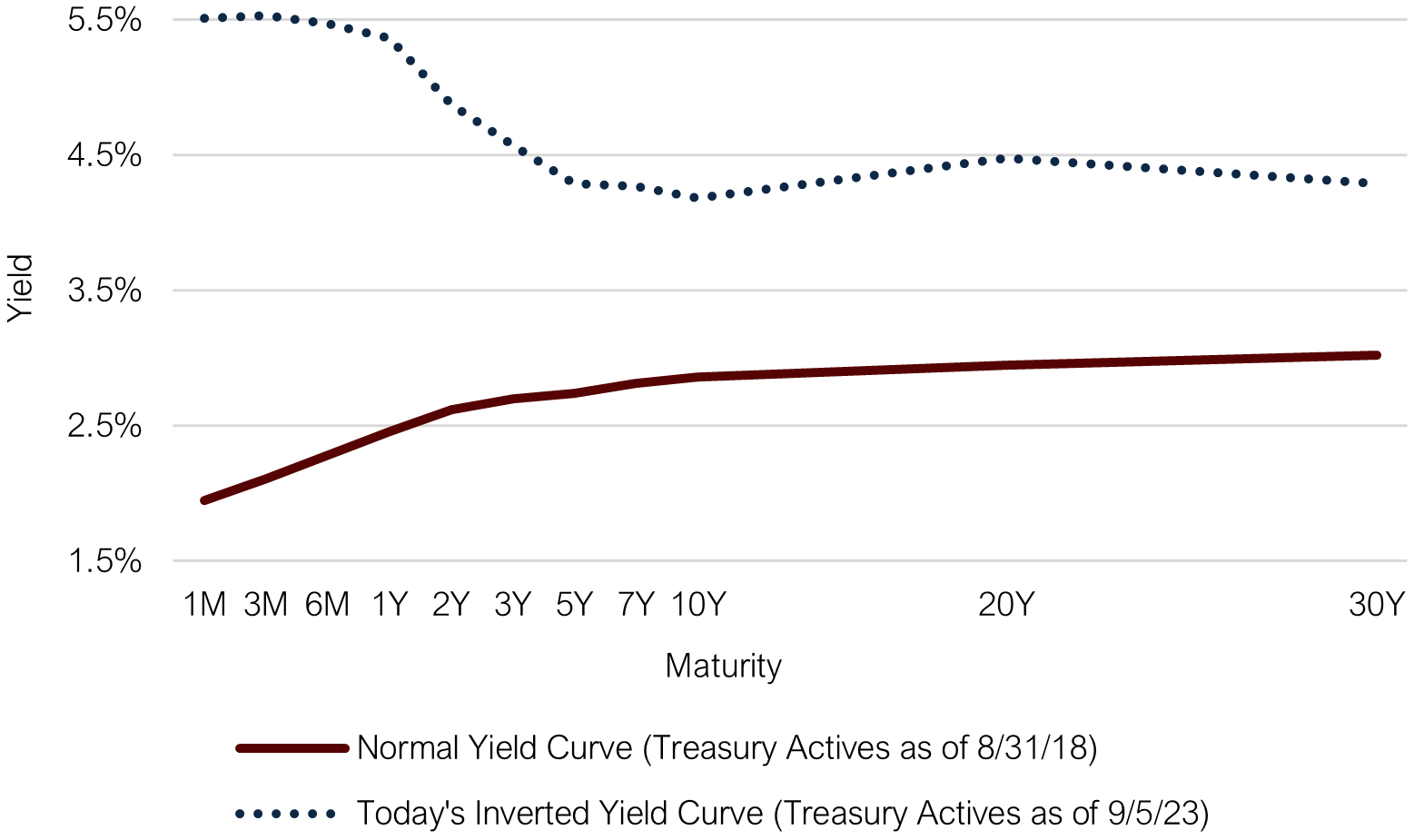

Still, relative value analysis starts with our macroeconomic view. We must consider monetary policy, the direction of inflation and interest rates, fiscal policy, trade and geopolitics, currencies, commodities, and countries. Sometimes, we use important ratios to form our base opinions. For example, the difference between short-term and long-term interest rates has meaningful properties for describing the probability-driven outcomes of the future. When short-term interest rates are higher than long-term interest rates, as they are today, historical evidence suggests that a recession is likely to follow. When short-term interest rates are higher than long-term interest rates, the yield curve is deemed to be “inverted.” The yield curve is not in its normal, upward-sloping shape.

A Normal Yield Curve is Upward Sloping

Source: Bloomberg Finance, L.P.

While the concept of an inverted yield curve is interesting, the important takeaway for investors is that this state of inversion is abnormal. Yield curve inversion is like a dissonant chord that must be resolved at some point. The resolution could be that short-term rates will go lower – a recession will eventually come, forcing the Fed to lower short-term rates quickly. Another resolution could also be that the Fed chooses to abandon, either publicly or effectively, its 2% inflation target. In this case, long-term interest rates would likely move higher to reflect higher future inflation expectations. Of course, there are alternatives in between and around these two extremes.

To discover relative value opportunities in this scenario, we analyze the two extremes. If a recession ensues, short-term rates will decline, inducing profits in short-term bonds. Further, in a recession defaults and distress increase. The highest quality bonds will be in greater relative demand than riskier junk bonds. Long-term rates will likely fall as inflation and real rates decline, meaning even greater profits for those willing to buy long-term bonds – whose primary thesis anticipates this particular outcome. In this scenario, investors at both the long and short ends of the yield curve will make money, but investors positioned at the long end will make more.

What if a recession is more elusive and inflation is resurgent or “sticky”? In that event, both short-term and long-term interest rates are likely to rise. Investors in the short end, with rates at current levels, may continue to make money even as short-term rates rise. They may find variable-rate bonds whose coupons reset higher along with interest rates. Our friends investing in long-term, fixed-rate debt will lose money quickly. Viewing this choice (Do you like “A” or “B”?) in this fashion, short-term, high-quality, and variable-rate bonds present value relative to intermediate and long-term fixed-rate bonds, and the bonds of the riskiest companies. That is how Concord Asset Management has positioned its clients this year, how we’ve framed our view in our 2023 Forecast and Halftime Reports, and how, until facts change, we will continue to invest.

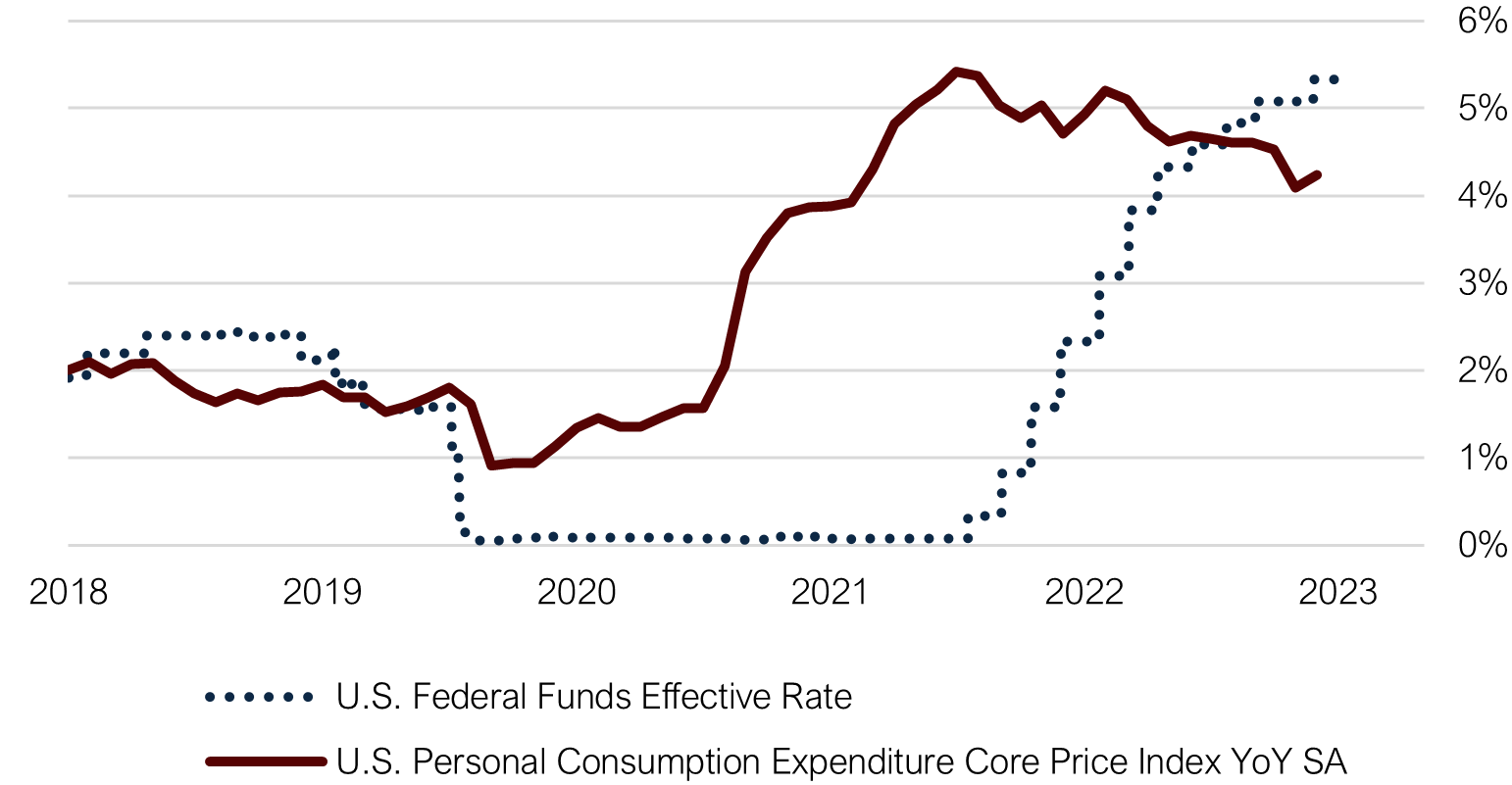

It is likely that short-term interest rates will stay higher for longer in the face of persistent and sticky inflation. Chairman Powell remains committed to battling inflation through restrictive monetary policy. In our 2023 Halftime Report, we discussed the Fed’s favored inflation measure, Core Personal Consumption Expenditures (PCE). On the last day of August, this number was reported at 4.2%, well above the Fed’s target of 2%. So, interest rates will likely remain at their present level or move even higher until the effects of restrictive monetary policy have run their course.

Fed Policy is Restrictive

Source: Bloomberg Finance, L.P.

Just because we are risk-averse when it comes to fixed-income investing, doesn’t mean that we aren’t bullish when it comes to the stock market. Relative value in stock investing means comparing the prospects of U.S. stocks versus International Developed and Emerging Markets opportunities, then thinking about which sectors or trends are more favorable for investor prospects in both the short and long term. From this standpoint, we use relative value to determine our “overweight” and “underweight” positions.

At the beginning of the second half, we moved client portfolios to have about equal weight technology exposure. We thought that technology stocks had a terrific and somewhat surprising run in the first half of 2023, so we were rather cautious going into July and August. Still, we did not want to be underweight technology stocks because the long-term trends that make those companies attractive remain in place despite their seemingly high prices. At the same time, we thought energy stocks, which had been neglected during the year’s first half, were primed for a comeback in the face of oil prices gaining momentum. Finally, we continued to underweight banks and real estate as those sectors face challenges given the macroeconomic picture.

We are constantly reviewing these types of relative value sector and security positions. While our overall macroeconomic view is slow to change, markets are quick to reprice securities. Concord Asset Management strives to maintain a nimble approach to the securities in our client portfolios, taking gains when positions have grown too large (indicating their prices have climbed quickly) and buying positions we like when their prices have fallen.

Relative Value tends to have two positive side effects over the long run. First, it forces investors to act – buying low and selling high. Secondly, it restrains investors from unnecessary trading – introducing the discipline to let winners run and focus on tax efficiency. These two sides of the same coin emerge not because we are prescient, but because by looking at positions relative to other investment options, we are getting a fuller picture of the investment seascape. We allow the ship of our portfolio to rise and fall with the seas while course correcting when appropriate to stay in our risk tolerance lane and meet our long-term investment objectives.

I’ve purposefully returned to Chairman Powell’s nautical theme. It is hurricane season again on the East Coast of the United States. Despite the happy talk about “soft landings,” restrictive monetary policy is beginning to negatively influence segments of the economy. Some data points are starting to indicate growing stress on the U.S. consumer here at home, in Chinese real estate and business activity, and in near recessionary conditions throughout most of Europe. A tropical depression might be forming on the horizon – and it is unclear whether it will blow over quickly or develop into something more significant and pernicious.

The navigator on your financial journey is your Concord advisor. Having a plan, reviewing that plan, and working with your advisor during times of joy and stress are crucially important to your long-term investment success. I am honored to be working with incredible fiduciaries here at Concord Wealth Partners, who put our clients’ interests first. I appreciate the trust you’ve placed in me and my team.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.