By Gary Aiken | October 5, 2023

I was driving home from my younger son’s soccer practice. He plugged his iPhone into the car stereo and started playing “September” by Earth, Wind & Fire. The horns blazed, and the smooth vocals of Maurice White asked the question that inspired my son to play the song, “Do you remember the 21st night of September?” It was indeed the 21st night of September. The air smelled more like a teenager after soccer practice than love, but the joke was made and was, to some extent, funny.

Bond markets, stock markets, and currency markets stumbled their way through the tumult of an altogether familiar September experience. When markets go down, as they often do, I lean on the elements of a strong investment. Earth, Wind & Fire leave out the fourth classical element: Water. In investments, I search for an element that flows like water, but its consistency and color are printed fabric and green. Of course, I refer to cash and cash flow.

From an accounting perspective, Free Cash Flow is defined as what is left over after operating costs, taxes, and replenishing working capital are subtracted from revenue. Businesses that can grow revenue while keeping operating costs and taxes low, and that require only minimal capital to operate, can generate enormous free cash flow and value to their investors.

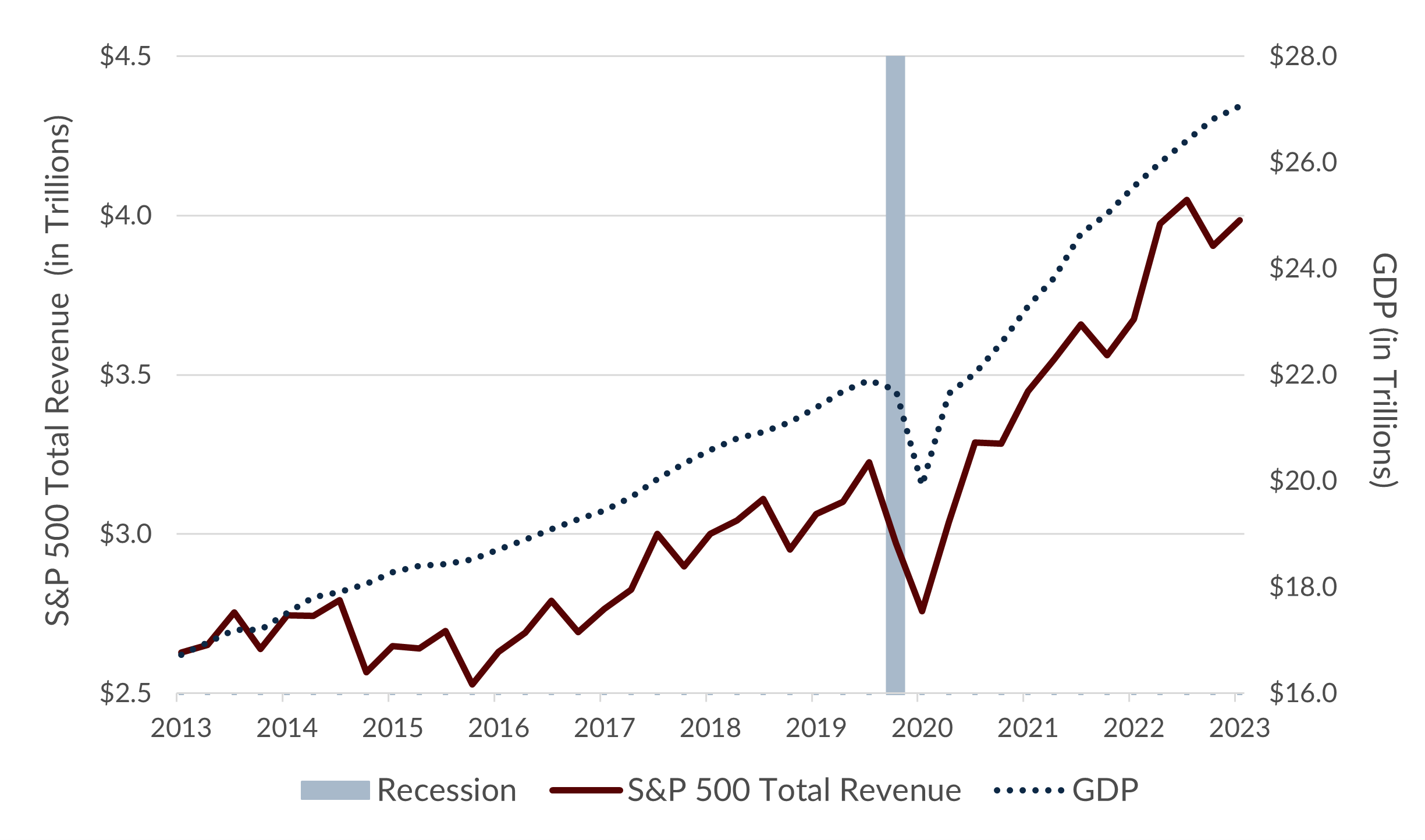

Revenues for S&P 500 companies grew 8.4% for the twelve months ending June 30th. Gross Domestic Product (GDP) in current dollars grew by 5.9% for the same period. Generally, revenues for the market follow the growth of the economy. The chart below illustrates the close relationship between GDP growth and revenue growth for U.S. companies. The chart also demonstrates a point we often make to clients worried about inflation. Stocks have tended to be a decent inflation hedge because, during inflationary periods, many companies can pass on higher costs to end consumers. Those higher prices show up in revenues.

S&P 500 Total Revenues Follow GDP

Source: Bloomberg Finance L.P.

Not all companies see the same kind of growth. We were somewhat perplexed by government statistics purporting to show strong retail sales numbers over the summer. Department stores, retailers, airliners, restaurants, auto sellers, and other consumer-facing businesses painted a very different picture during earnings conference calls. This month, the government released a significant downward revision from 1.7% to 0.8% for retail sales during the second quarter. We expect that trend to continue and that rising gasoline prices may account for any acceleration in the third quarter for retail sales.

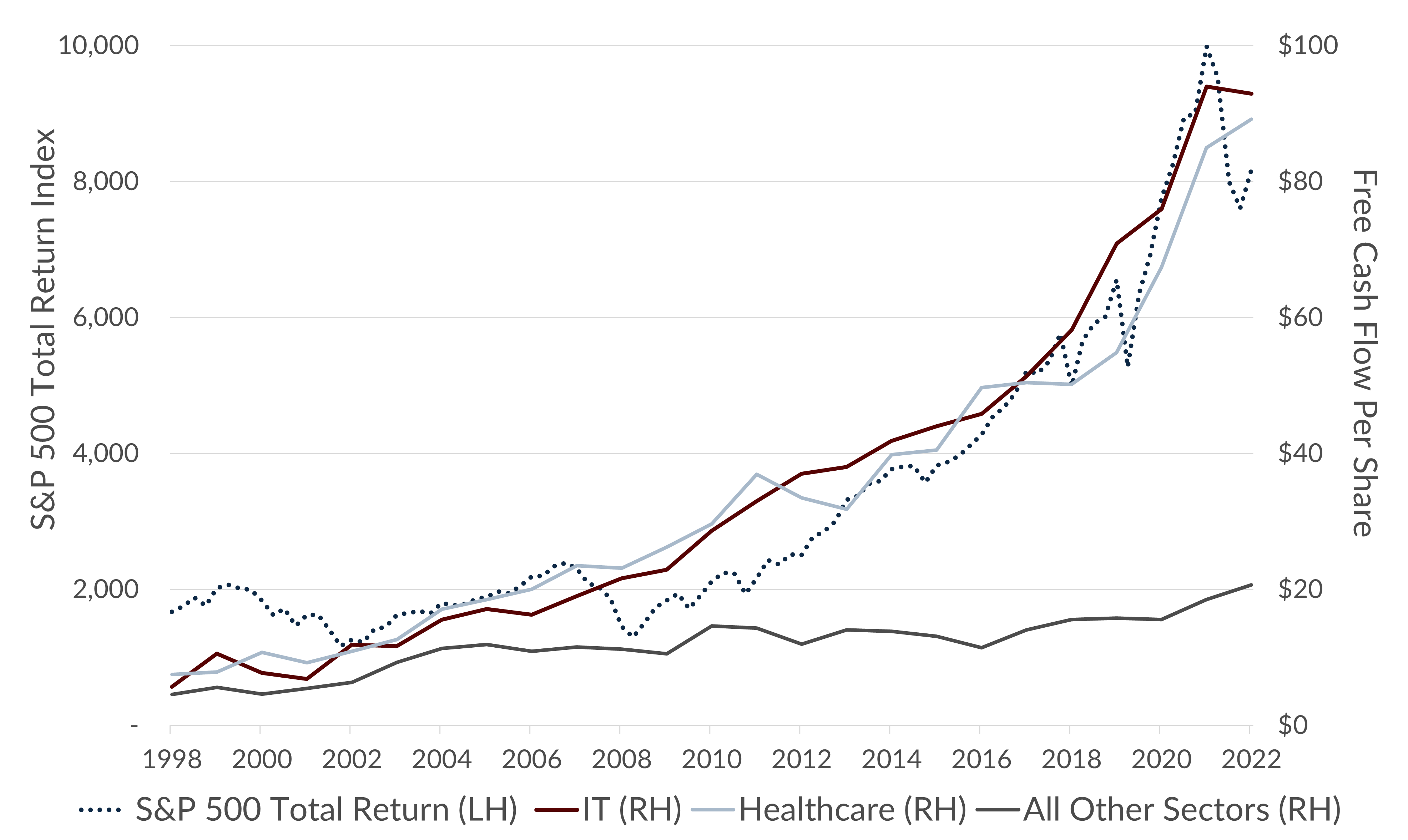

Free cash flow has grown fastest in two sectors over the past ten years – Information Technology and Healthcare. A nearly mandatory upgrade cycle and the obvious benefits to user productivity drives technology sector growth. Both demographics and the healthcare payment structure (government and employment-driven insurance) ensure growing revenues in that sector. While the cycle of reinvestment for these companies is primarily in Research and Development, those costs can be capitalized and depreciated over time. The actual costs of production, the manufacturing of drugs or software, are muted by comparison, so working capital needs are generally low, and corresponding debt levels are low. That depreciation that we spoke of helps to defray tax expenses. What is left over? Superior free cash flow growth that has driven above-average returns. Unsurprisingly, at the end of the third quarter, Healthcare and Technology stocks represented almost 45% of the S&P 500 Index.

The chart below displays this point. We see the rise in the price of the S&P 500, but also the growth of Free Cash Flow per share in the Healthcare and Information Technology sectors. The average of all the other sectors lags by comparison. On a technical note, the financial sector does not typically use the “free cash flow” methodology as their revenue, expense, and working capital are all essentially money-based. Financial companies (banks in particular) are unique animals that we’ve discussed in previous letters and, for this discussion, are relatively unimportant.

Free Cash Flow Per Share Growth Drives Long-Term Value

Source: Bloomberg Finance L.P.

As September ended, I noted to Concord advisors that since 1987, there have only been three instances where the Bloomberg Aggregate Bond Index has declined for five months in a row. This is one of them. In 2022, we experienced this price action, and before that, we would have to return all the way to Alan Greenspan’s inflation fight in 1994. I wrote about what I think is driving these negative bond returns in my August commentary on the yield curve. One of the scenarios I imagined was if inflation might be deemed to be sticky or that the Fed (and other central banks?) would tacitly give up on trying to move inflation down to their targets quickly.

September included meetings of the Federal Reserve Open Market Committee (the Fed), the Bank of England (BOE), the European Central Bank (ECB), and the Bank of Japan (BOJ). Each central bank seemed confused about what to do in the face of their unique situations in terms of growth, but similar situations in the face of persistent inflation. Our central bank, the Fed, seemed to be hawkish on keeping short-term rates elevated to fight inflation but painted a picture of a growing economy that did not quite match the inflation-fighting rhetoric. In Europe, persistent inflation in the face of deteriorating economic conditions left the ECB Chair, Madame Lagarde, nearly throwing up her hands in frustrated capitulation. The BOJ, on the other hand, seems to be relishing Japanese inflation after battling deflation for a generation.

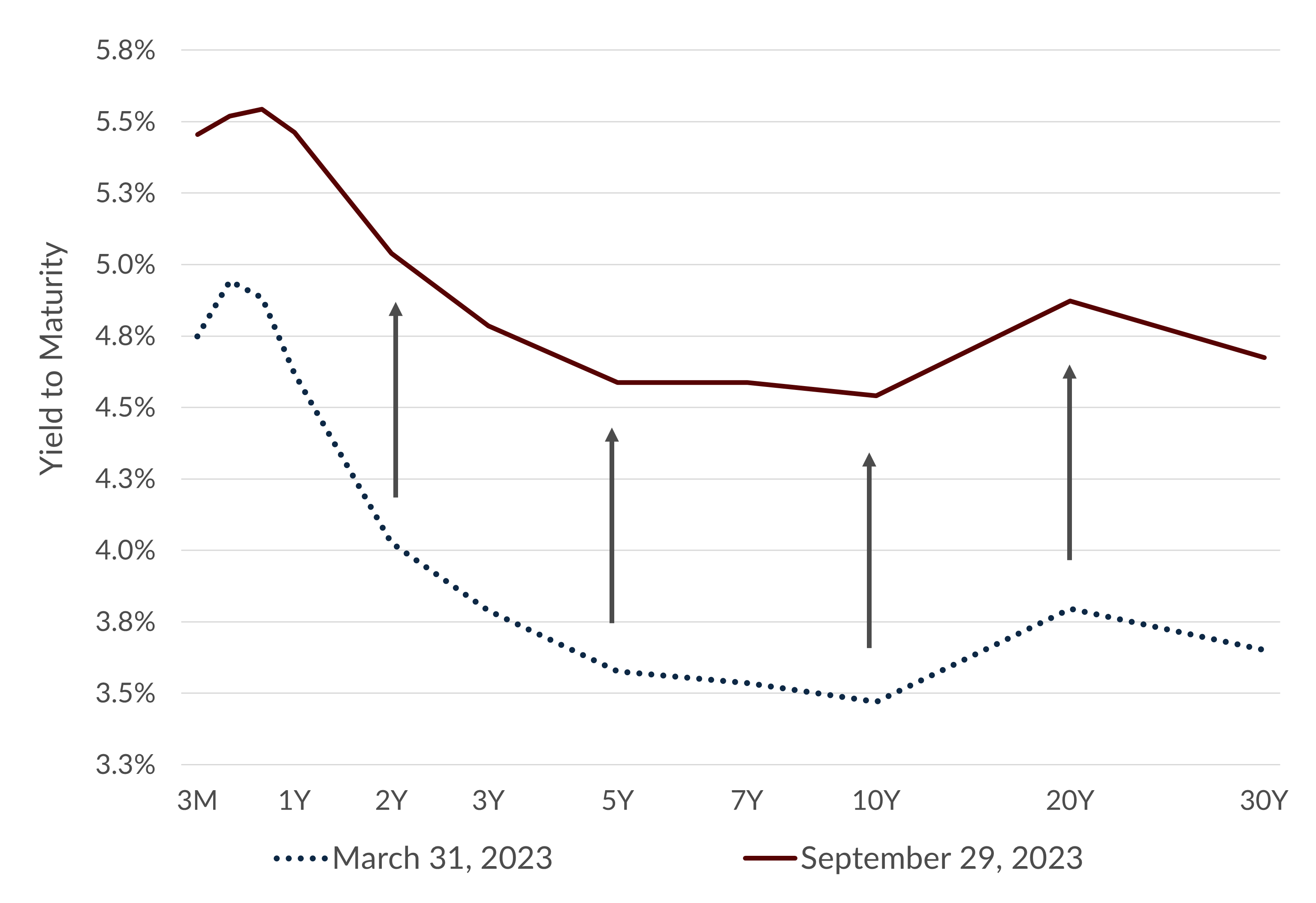

Concord Asset Management favors underweighting international stocks against this backdrop. Rising interest rates and a stronger economy in the United States mean strength for the dollar and U.S. stocks versus other currencies and stock markets. We continue to favor a bond portfolio constructed with short-duration bonds. We believe that the inverted yield is more likely resolved by a bear flattening – that long-term rates are likely to go up faster than short-term rates. The chart below shows this flattening playing out in the U.S. Treasury yield curve from March to September this year.

U.S. Treasury Yield Curve

Source: Bloomberg Finance L.P.

Energy stocks performed well this summer. While we did not anticipate oil prices rising significantly, we summarized our thesis that there was most likely a near-term floor in the price of oil in our Halftime Report. Global energy demand continues to grow, albeit at a slower pace. At the same time, supply seems relatively constrained by an OPEC that wants to cut supply, a U.S. industry happy to earn increasing profits on existing infrastructure, and a Russia that is realizing a smaller discount to the global price now than when the War in Ukraine first started.

The rising prices of oil and gasoline are not nearly as severe a growth dampener as they were in the 1970s. These price increases will certainly impact retail sales though as more dollars shift to gasoline. Naturally, energy costs will drive a greater persistence in U.S. inflation. While the price of oil at its current level should not have much of an impact on economic growth in the United States, I am reminded of research done by The Northern Trust Company, which concluded that three things generally cause recessions: a central bank mistake, a geopolitical crisis, and an energy shock. West Texas Intermediate crude oil at $90 per barrel does not seem like a giant shock, especially on an inflation-adjusted basis, but a spike higher is a risk.

Finally, September has historically been a bad month for stocks. Since 1987, September has recorded a negative 0.75% return for the S&P 500 Index on average. This September, the S&P 500 was down 4.8%. Over the summer, stocks cooled off after a tremendous run that saw stocks try to approach new highs through mid-July. At that time, many pundits were calling this a new bull market. Given our generally cautious view, I wonder if it was merely a bear market rally and if the next leg could be lower. Timing markets is difficult, though, and seasonally speaking, October, November, and December tend to be very good months on average for stocks.

When I was young, my mother gave me a book of classic Broadway tunes for piano players (I count myself among them, although I don’t practice nearly as much as I used to!). Among the songs in that book, I played for her one from a musical called The Fantasticks. The song starts, “Try to remember the kind of September…” We’ve wrapped up a traditional kind of September in markets. The Summer doldrums lead to lackluster returns and a coincident drop off in sentiment. We long backward for vacations as we return to our desks and school. The song implores us to “Try to remember, and if you remember, then follow.” A new earnings season follows September. Information Technology and Healthcare stocks will be reporting, and more likely than not, those companies will report higher profits and higher free cash flows. Thanksgiving and Christmas will start to appear in our sights, and markets may follow on to look towards the future.

Do you remember the times when you were bearish in September? If you remember that kind of September and what is likely to follow in the months, quarters, and years to come, the kind of September we had may be a chance to buy great companies at reasonable prices.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.