By Gary Aiken | August 10, 2023

The United States Dollar is the world’s reserve currency, true or false? Partly true. The Dollar is one of many reserve currencies. Reserve currencies are units of money held by central banks around the world to facilitate trade and ensure the relative stability of their own country’s currency. The U.S. Dollar holds its place as the dominant reserve currency because the preponderance of trade around the globe is settled ultimately in dollars. Reserve currency status does not necessarily flow from military or political hegemony. Our country’s relative economic standing in world trade holds more importance. Reserve currencies are relatively stable. Importantly for citizens, demand from foreign investors for dollar-denominated investments helps U.S. companies and consumers get easier financing terms, all else equal.

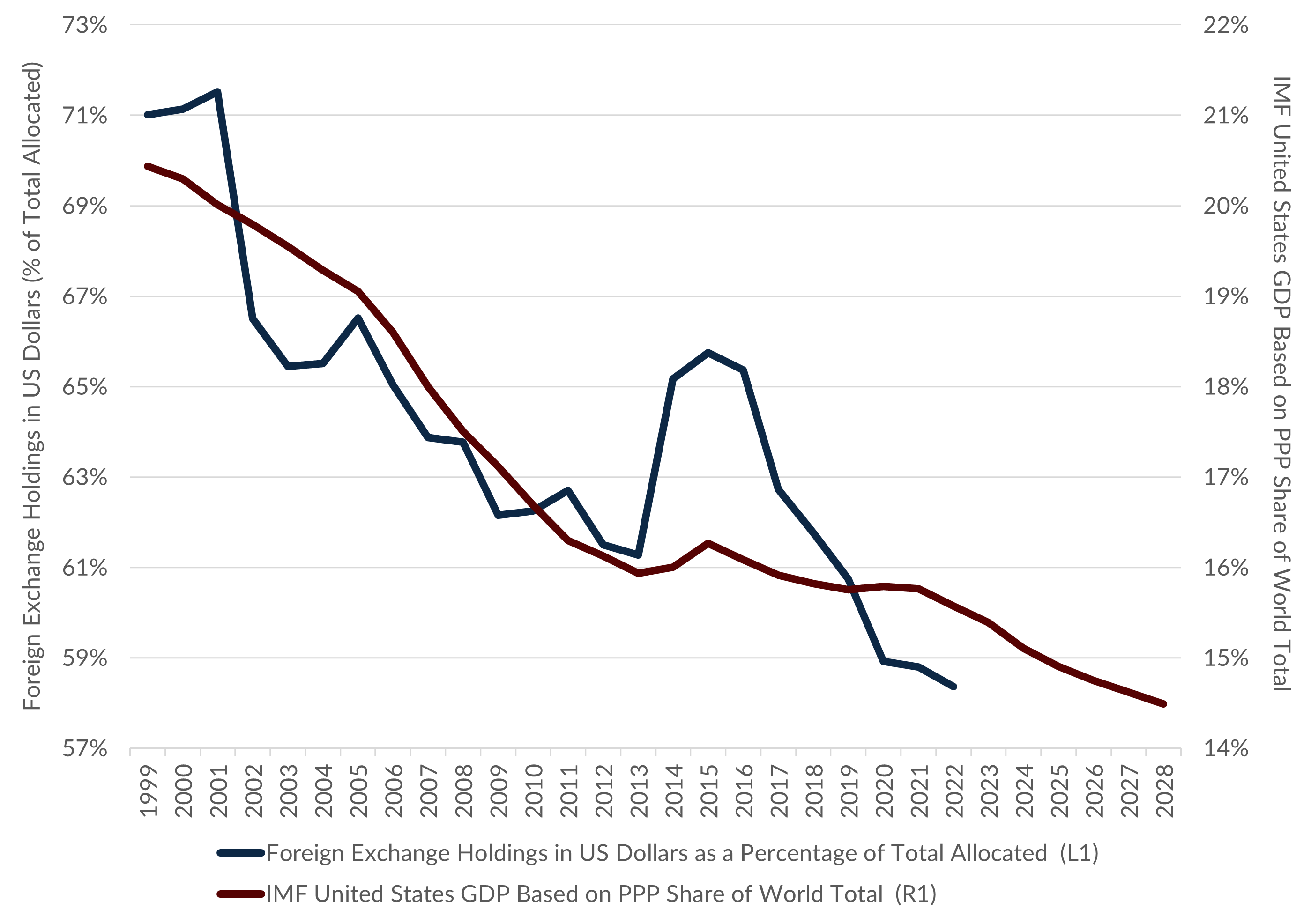

Those tweeting about the demise of the Dollar are quite late to the game. The Dollar’s place in the hierarchy of reserve currencies has been declining for over twenty years. The chart below shows the percentage of global reserves held in U.S. Dollars. It also shows the U.S. share of global, inflation-adjusted GDP over the same time period. The trend of lower weightings of the U.S. Dollar is consistent with U.S. GDP share declines since the Euro was introduced. However, let’s not read too much gloom and doom into this relationship.

US Share of Global GDP and Dollar Reserves

Source: Bloomberg Finance, L.P.

Over the past 25 years that the Euro, the Yen, and a host of other currencies have eroded the dollar’s reserve standings, the U.S. economy has grown at an average real rate of 2.2% per year. The Eurozone grew only at a 1.5% average annual pace during that time. So, the economic growth of the United States has not been hindered by the decline in the Dollar’s share of global reserves. It seems that economic growth is not strongly correlated with a country’s reserve standings or status.

Politics drives the direst projections. China and a league of other countries are beginning to talk about trading certain commodities, including oil, in their own currencies. Political and military struggles have had an impact on inflation and the relative value of the Dollar in trade in the past. The expense of the Great Society and the Vietnam War caused the U.S.’s trading partners to doubt the United States’ capacity to meet its obligations in the late 1960s and early 1970s. At that time, the U.S. dollar was directly convertible into gold. As our trading partners began to withdraw their gold deposits in the U.S., the amount of gold supporting the U.S. Dollar became untenably low. President Richard Nixon canceled the convertibility of dollars into gold, leading ultimately to a system of floating exchange rates.

As bad as it was, it could have been worse if the world wasn’t so connected by trade. More dollars were held by foreigners than by U.S. citizens. A gigantic amount of dollar-denominated debt was owed by foreigners to foreigners. This “euro-dollar” system meant that the world – even our enemies, the Soviets – had a vested interest in ensuring that the Dollar retained its place as the dominant reserve currency. Today, over $1 trillion of greenbacks are held by foreigners outside the United States, and over $12.8 trillion of debt denominated in dollars is owed by foreign non-bank entities. The winding down of this system will take a long time, even if our current adversaries wish it otherwise.

China’s currency, the Renminbi, is pegged at a particular exchange rate to the U.S. Dollar. In the past decade or so, there have been calls for China to liberalize its currency and allow the renminbi to float – that is, for the market to determine the number of renminbi it takes to equal a dollar, a euro, a pound, or yen. China has not yet fully opted to do this. This practice has confounded economists and investors alike over the years, who guessed, based upon opaque data from China, that if China were to float its currency that it would appreciate massively against the dollar, only to watch China devalue its own currency in dollar terms over the ensuing period.

The Saudis could sell their oil to China in Renminbi, but unless they were buying goods and services directly from China, they would have to exchange their Renminbi for other more useful currencies – Euros and Dollars. The dollar is used to price oil because it’s efficient. The U.S. is the largest consumer of oil – we consume 21% of the world’s oil. So, it’s convenient for sellers to price the commodity in the currency of the largest global customer. Most trading in commodities is not in physical stock but in derivatives contracts. Most of those contracts are denominated in U.S. dollars. While the second largest user of oil is China at 15%, because China’s currency is a substitute for a set number of dollars and because there are no derivatives settled in renminbi, it is unlikely that a small number of trades in alternative currency would derail the dominant place of the dollar in the oil trade. That same logic prevails for any number of other commodities.

For now, the efficiency of the dollar as a medium of exchange, the dominant status of the United States as the largest economy, and the interconnectedness of a system whose lifeblood is dollars should prevent any meaningful change to the current system. However, that dominance depends in the long run on global confidence in the soundness of our fiscal and monetary policy. At Concord Asset Management, we’re not particularly concerned about the dollar’s reserve status when making investment decisions.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Footnotes and Sources:

1Neely, Christopher. Federal Reserve. “On Economy Blog” October 18, 2022

2Bank for International Settlements. Q4 2022

3U.S. Energy Information Administration

Concord Asset Management, LLC (“CAM”) is a registered investment advisor with the Securities and Exchange Commission. CAM is affiliated and shares advisory personnel with Concord Wealth Partners (“CWP”). CAM offers advisory services, including customized sub-advisory solutions, to other registered investment advisers and/or institutional managers, including its affiliate, Concord Wealth Partners, LLC. CAM’s investment advisory services are only offered to current or prospective clients where CAM and its investment adviser representatives are properly licensed or exempt from licensure.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CAM, or any non-investment related content, made reference to directly or indirectly in this newsletter) will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from CAM.

To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, he/she is encouraged to consult with the professional advisor of their choosing. CAM and CWP are neither law firms, nor certified public accounting firms, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of CAM’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.concordassetmgmt.com. Please Note: If you are a CAM or CWP client, please remember to contact us, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. CAM and CWP shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a CAM or CWP client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.