By Gary Aiken | December 12, 2024

With the U.S. election behind us and some policy uncertainty still ahead, economic data point to steady growth. Weekly jobless claims remain low, with initial claims holding steady around 220 thousand and continuing claims just below 2 million in the weeks following the election. These resilient figures persist despite challenges such as union strikes and hurricanes in the Southeast. Meanwhile, personal income, particularly real personal income, continues to show steady gains as inflation gradually eases.

The latest data comes from the University of Michigan’s Consumer Sentiment Index, which tracks how consumers and businesses perceive their current situation and future outlook. Before the election, we advised clients to keep an eye on this key indicator, as it often reflects broader sentiment shifts. Following the election, consumer sentiment has shown noticeable improvement—a pattern that’s far from surprising. Uncertainty about the future tends to weigh on consumers before an election, a fear often captured in surveys. But once the election concludes, regardless of the outcome, this uncertainty dissipates, as an element of uncertainty is resolved.

The Federal Reserve should pay close attention to the inflation expectations portion of the University of Michigan survey. December inflation expectations increased from 2.6% in November to 2.9% for the year ahead starting in December. This may reflect participants’ beliefs about President Trump’s across-the-board tariffs. Many economists estimate tariffs may raise the price level by approximately 0.4% if fully enacted. Participants’ short-term views may also be drifting towards their sticky five-to-ten-year inflation expectation, which seems to be stuck above 3%. While the Federal Reserve may have a stated goal of 2% inflation, both Wall Street and Main Street market expectations indicate widespread skepticism.1

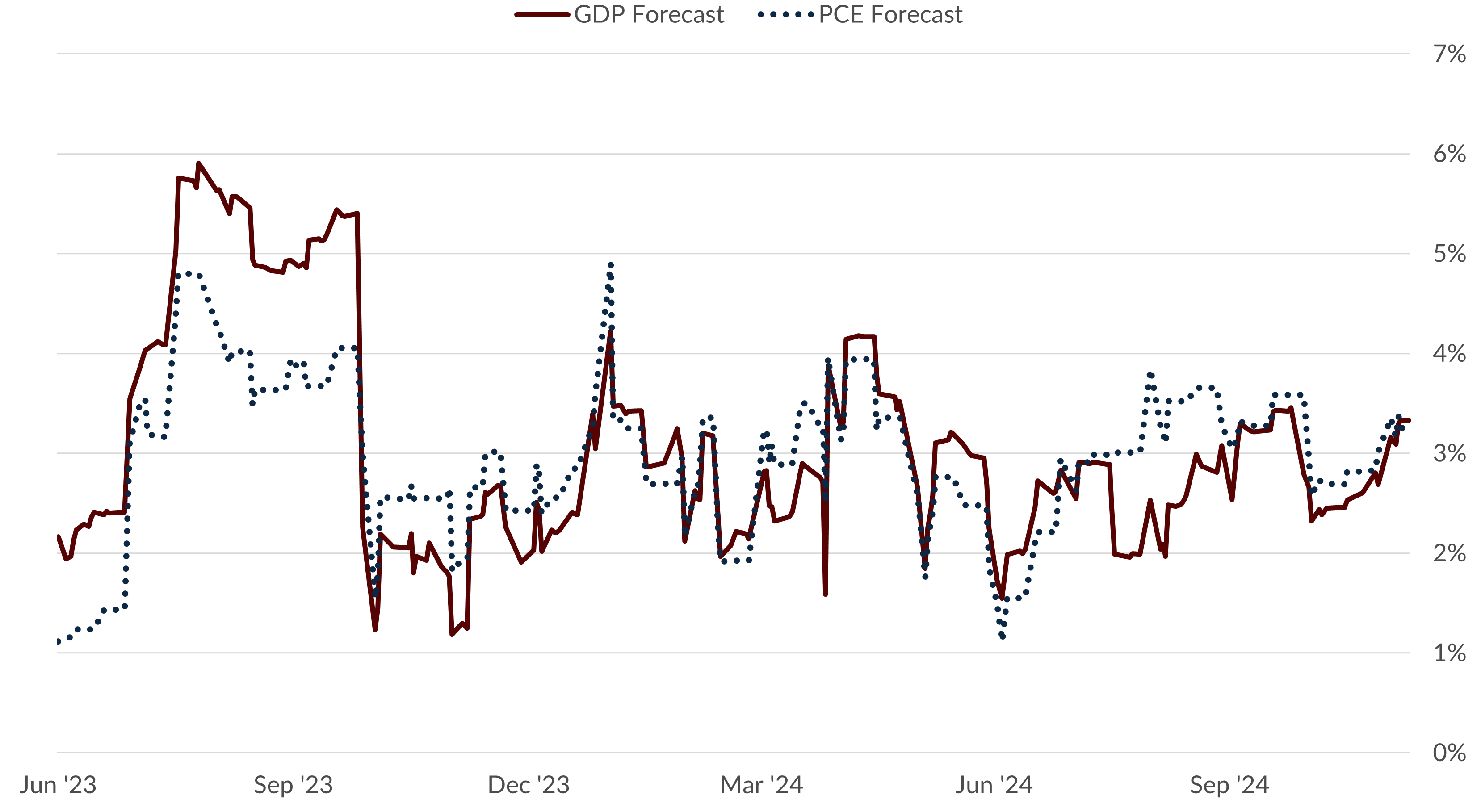

Atlanta Fed’s GDPNow and PCENow Estimate Growth and Inflation

Source: Board of Governors of the Federal Reserve System (U.S.) and Bloomberg Finance, L.P.

The Atlanta Fed’s PCENow Indicator uses incoming data to continually update a quarterly forecast. The Fed’s estimates show inflation rising from 2.6% to 3.2%. The PCE is the Federal Reserve’s preferred inflation measure. The chart also shows that economic growth (GDPNow) is similarly trending higher as well. If these estimates are close to quarter end actuals, fourth quarter nominal GDP will be about 6.5%. As many economists have rightly said, it’s hard to imagine a recessionary scenario when nominal GDP growth is that high.

Nevertheless, the Federal Reserve is likely to cut interest rates one more time this year at its December 18 meeting for three reasons. First, actual inflation is still moderating even as expected inflation is rising. Second, the Federal Funds rate is well above PCE inflation (and inflation expectations), indicating monetary policy is still restrictive at a time when the unemployment rate is slowly rising. Finally, the Trump Administration will implement policies initially that lower net immigration and raise uncertainty with respect to tariffs. Giving the economy one more rate cut could offset some of that potential shock before the medicine of tax, spending, and regulatory cuts induce another potential growth spurt.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

1Surveys of Consumers, University of Michigan: Consumer Sentiment (Accessed on December 9, 2024)

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.concordassetmgmt.com. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.