By Gary Aiken | June 5, 2025

The most powerful think tanks in the United States are the Brookings Institution (on the left) and the Heritage Foundation (on the right). Can you imagine a single issue where these two groups would agree? In 2007, they agreed with former Comptroller of the Currency David Walker that the national debt was on an unsustainable path and that not dealing with spending issues would ultimately have significant negative consequences. In 2007, Walker led the effort to put together a movie which an unfortunately small audience viewed called “I.O.U.S.A.” At that time the national debt was $8.7 trillion, or 64.4% of GDP. Eighteen years later, the national debt is $36.9 trillion, or 122.9% of GDP. Neither Brookings nor Heritage, despite their enormous influence was any match for the spendthrift American voter.

Alexis de Tocqueville and Alexander Tytler wrote in the early 1800s that “A democracy… can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury…” I’ve omitted the direst parts of the quote where Tytler concludes that the result is collapse and dictatorship, mostly because I’m an optimist and I think there’s a way out. However, the way through is bound to be messy.

In the 2000 election debates, George Bush and Saturday Night Live poked fun at Al Gore’s notion of a “lockbox” that held the enormous sums accumulated in the Social Security and Medicare trust funds. Of course, once we opened the proverbial box, all that remained were I.O.U.s from Congress. All the money’s gone. All that remains is a debt that must be paid.

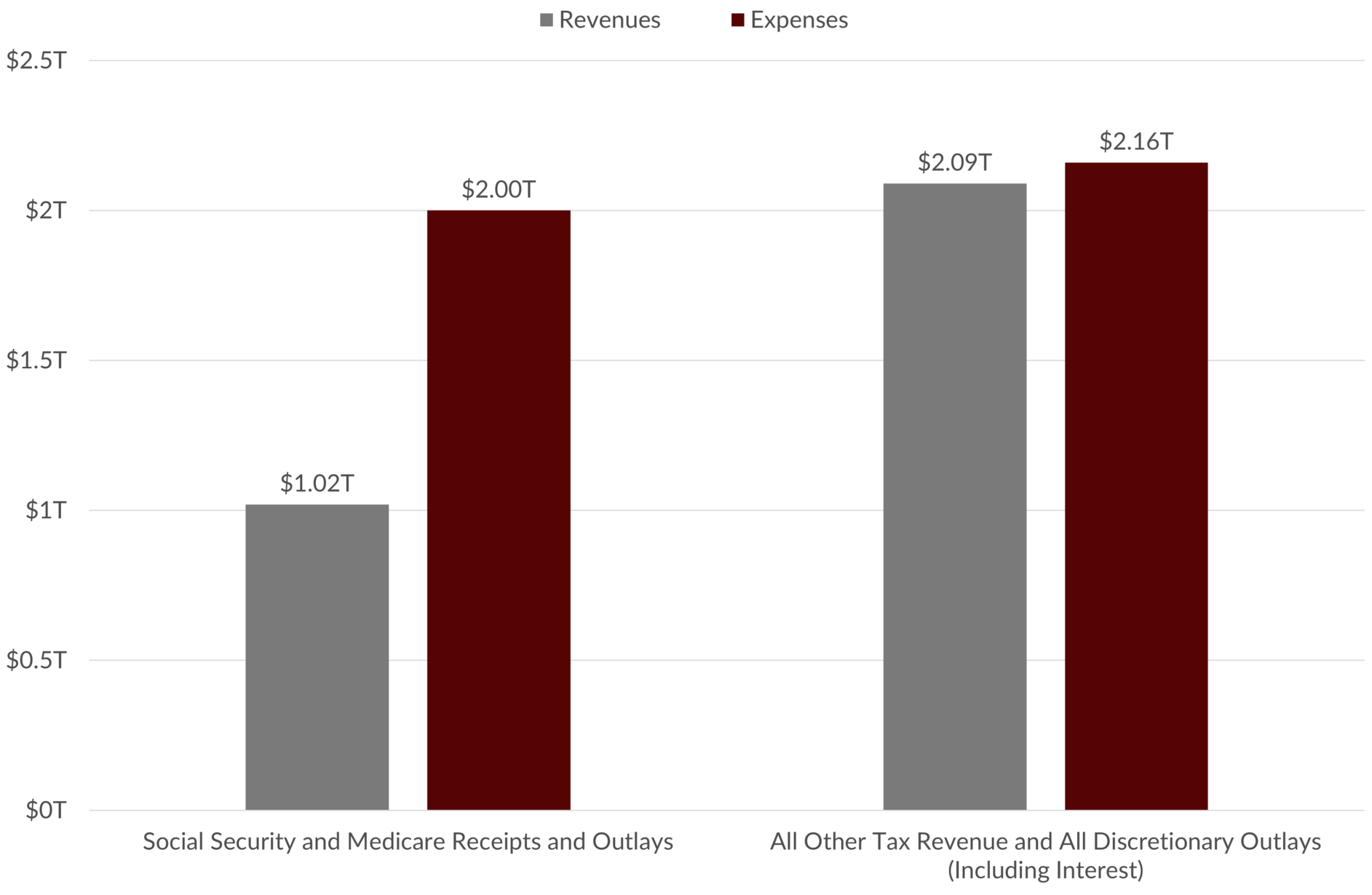

And now we’ve passed the point of no return. Exacerbated by the pandemic, that point has come a few years earlier than expected. The sum of spending in Fiscal 2025 YTD (October to April) by the Department of Health and Human Services and Social Security Administration was $2T. Taxes to support mandatory Social Security and Medicare programs were only $1T. This number matches (almost exactly) the Fiscal Deficit for the same period.

Mandatory Spending is the Driver of Future Deficits

Source: Bureau of the Fiscal Service, U.S. Department of the Treasury, April 2025, Monthly Treasury Statement. Tables 1 and 9. Figures are Fiscal 2025 YTD.

Fiscal deficits going forward are not going to be the result of out-of-control discretionary spending or too-low-tax revenue. The main driver will be the imbalance between the working population paying into the social safety net and retired populations consuming their promised benefits. There’s no lockbox, so the government must borrow money every year for the next 20-plus years to fund the growing difference.

While artificial intelligence and innovation can bend the cost curve ever so slightly, demographics are the overwhelming force of actuarial nature propelling our nation’s finances. Larger deficits and debt are the future. The economic term that describes the ensuing effect is called “crowding out.” Interest rates on government debt will rise over time as investors require a higher rate. As this happens, more investors will choose to buy government bonds instead of investing in new projects whose returns are less competitive on a relative basis. This doesn’t mean that all resources go to buying government bonds, just that on the margin those decisions aren’t as easy as they were in the past. The growth rate of the economy doesn’t crash, but it slows. A slowing economy with less dynamism also means the government interest rate doesn’t need to climb a huge amount to present relative value.

One other fear that derives from the abundance of debt financing is that it will be accompanied by higher inflation. This does not necessarily need to be the case. Congress cannot print dollars; it has delegated that authority to the Federal Reserve. The inflation of 2021-23 was the direct result of the Federal Reserve buying 100% of the marginal supply of debt and issuing currency to the public to spend. If the Federal Reserve does its job prudently instead of the foolish way it acted in 2021-23 and does not monetize the coming wave of debt, then we should not see too much money chasing too few goods. Instead, we should see benefit dollars replacing salary income and chasing services (healthcare) spending in relatively equal proportion. If anything, we might expect the savings rate to increase and some of that money to be recycled into treasury bonds.

In the meantime, at Concord, we have made the following provisions generally in client model portfolios:

- We are short duration on bonds. We are buying corporate bonds with quality balance sheets in lieu of volatile long maturity treasuries.

- We have increased our holdings in non-U.S. stocks to diversify from U.S. dollar investments and to lessen overall volatility.

- We continue to believe that the artificial intelligence investment thesis is intact and that U.S. tech companies are still the overwhelming engine of productivity and profit growth.

There will be demand at some price to fund deficits as far as the eye can see. That price will be determined by interest rates, foreign exchange rates, or a combination of the two. There are an enormous number of complicated interactions between here and the point where there are more Millennials and Gen Zers working than Boomers in retirement. The actuarial pendulum will swing the other way. Will they have learned a lesson to save their surpluses for the next rainy day 100 years from now? Teach your children well. Our republic’s future depends on their collective decision.

This year so far has certainly been the “grind” we anticipated, with ample headline risk and increased volatility. I look forward to reviewing the first half of the year and extending our “crystal ball” to the second half with our clients in early July.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.concordassetmgmt.com. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.