By Gary Aiken | November 8, 2023

I have sung Hatikvah, the national anthem of Israel, many times this month—more times than I can recall having ever sung that song before. October was a disastrous month for global democracy. The sole democracy in the Middle East was savagely attacked in a pogrom that killed more Jews in one day than any day since the Holocaust. In America, legislation to deliver war-fighting supplies to the Ukrainian democracy battling for its independence against Russia was sidelined. While the House of Representatives finally elected a new Speaker, the people’s chamber did nothing of substance for the entire month.

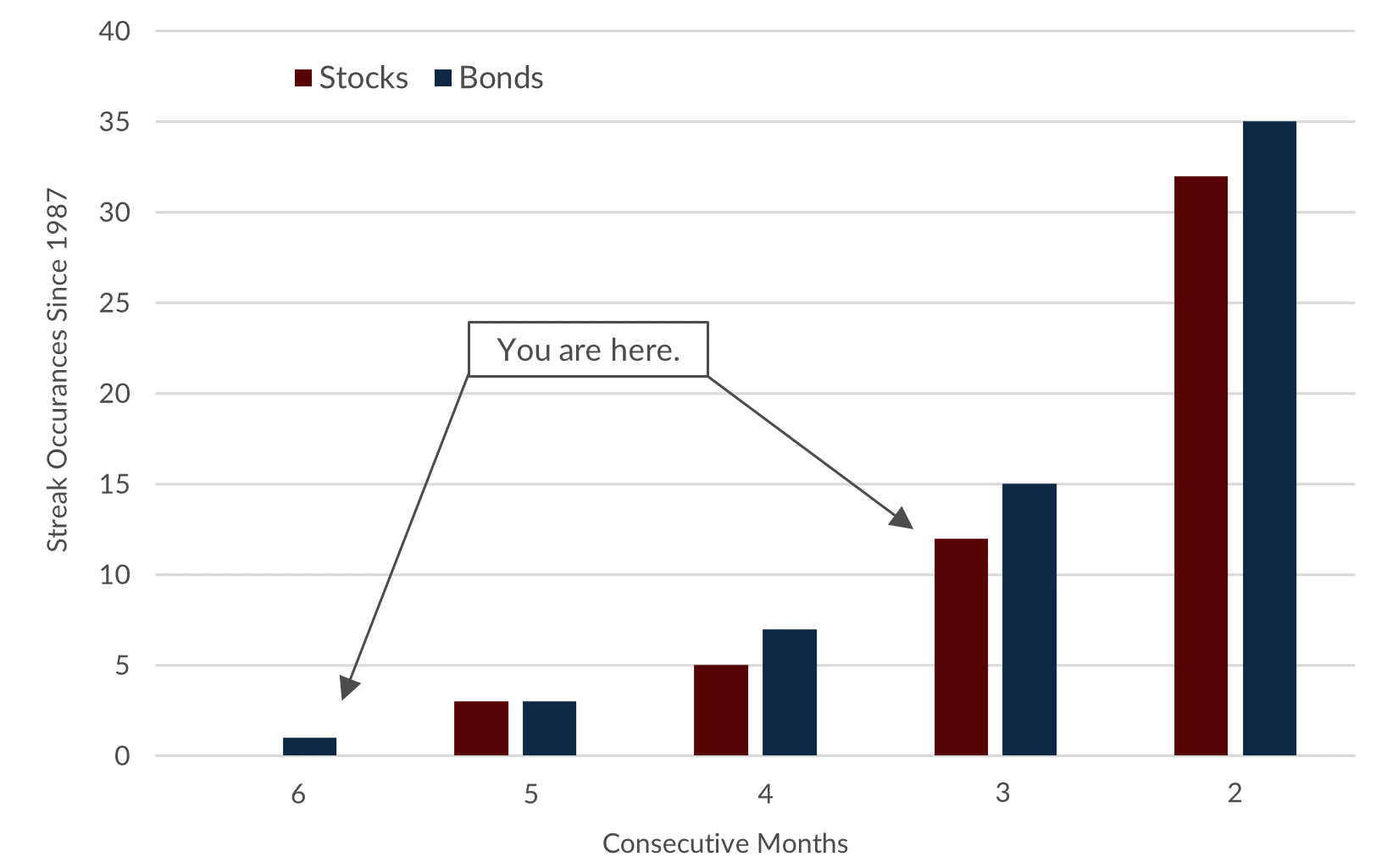

In markets, U.S. stocks declined for the third month in a row, and U.S. bonds declined for the sixth month in a row. The rout in the bond market is one for the record books – we have not experienced six straight monthly declines in the bond market at any time since 1987, and I have not found any data to replicate a similar period in history. Non-U.S. stocks were down 11% in the three months since July, and global bond markets were down 5%1. Financial assets have had a rough summer, and the beginning of the fall has not been much better.

Negative Total Return Months in a Row Since 1987

Source: Bloomberg Finance, L.P.

The Hebrew translation of “Hatikvah” into English is “the Hope.” I hope and pray for the peace that will come after defeating terrorism. But, as Vince Lombardi once said, “Hope is not a strategy.” At Concord Asset Management, we are focused on delivering customized investment strategies that can withstand the challenges of our times and turn risk into opportunity.

In my September commentary, I noted that earnings season was just around the corner. By the end of October, half of the companies in the S&P 500 will have reported earnings. The earnings news has been good. Given all that’s happening in the world, this may be tough to hear, so I want to repeat myself – good news! According to FactSet, 78% of companies that have reported so far have exceeded Wall Street estimates. More importantly, if the trend holds, companies’ earnings will have grown year-over-year for the first time in several quarters. Rising profits are undoubtedly a good thing.

Rising profits enable companies to invest in equipment and labor to grow their business. Profits empower management to return more cash to shareholders through buybacks and dividends. Rising profits mean increased taxes to be paid into federal and state treasuries – and although no one likes paying taxes, it is necessary to start to slow down the rising budget deficits.

Concord manages strategies that invest directly in the common stocks of U.S. companies. We label our strategies that invest directly “Enhanced.” Sixty companies in our Enhanced Strategies reported earnings in October. Fifty-four of them showed profits that beat Wall Street analyst consensus estimates. Thirty-six have reported earnings higher than the same quarter a year ago. Thirty-two (roughly half) have reported earnings growth for the full year ending this quarter versus the full year a year ago. So, our client portfolios are experiencing an earnings trend like the broader market.

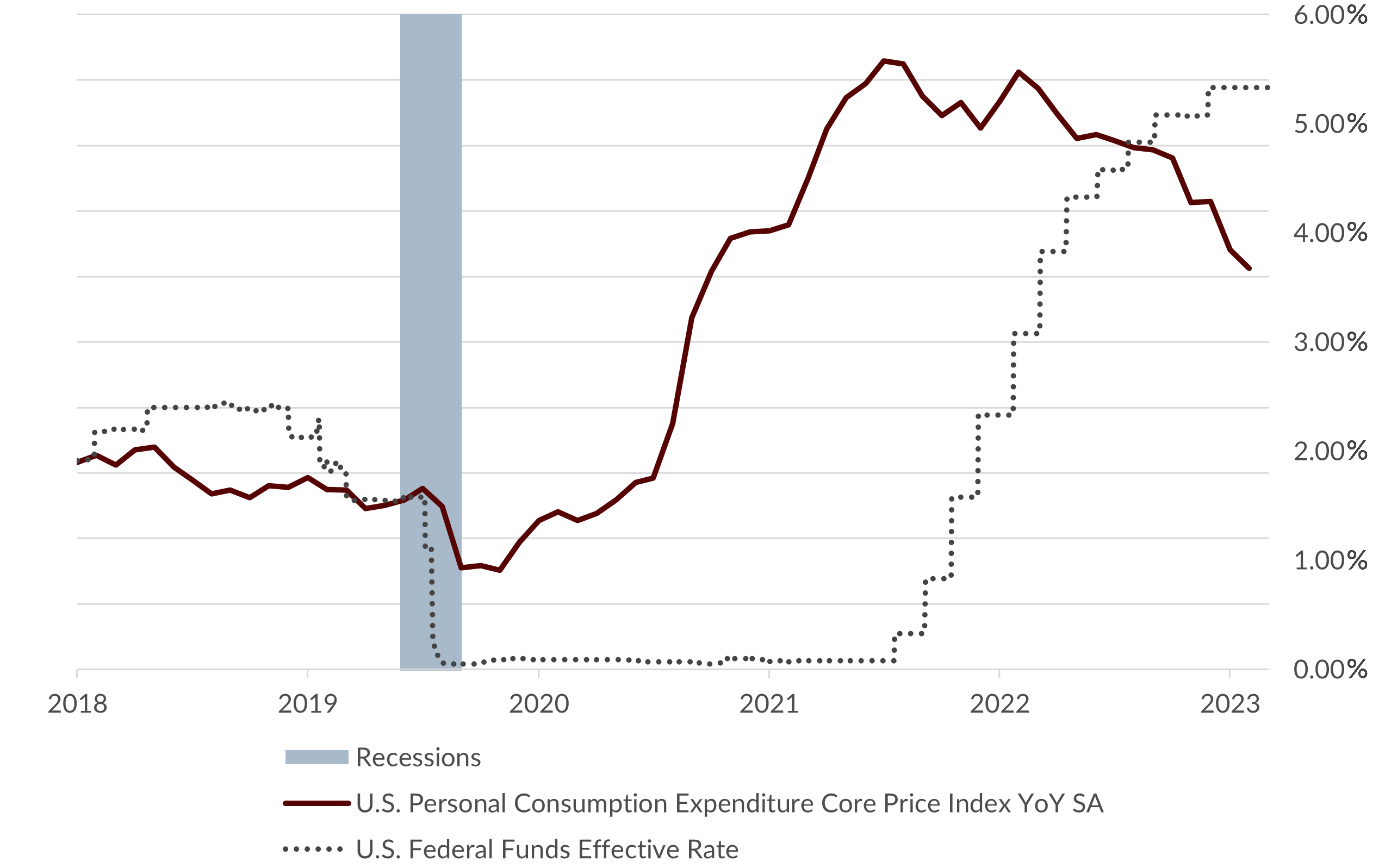

Profits are a bright spot. Let me point to two others: falling inflation and dazzling economic growth. Data received for the Federal Reserve’s preferred inflation measure in September showed continued improvement. The Core Personal Consumption Expenditures (PCE) Index fell to a 3.7% year-over-year rate. When the Fed Funds interest rate target is above Core PCE, Fed policy is deemed to be tight. By this measure and looking at the chart below, Fed policy has been tight now for almost six months.

Fed Policy is Tight

Sources: Bloomberg Finance, L.P., The Federal Reserve System, U.S. Bureau of Economic Analysis

We ought to be seeing some signs of the economy slowing, but dynamism prevails. GDP rose at a real rate of 2.9% for the last twelve months, and corporate profits are finally rising again. The good news story continues in the job market as well. The unemployment rate (3.8%) is lower than the “frictional” unemployment rate. My Econ 101 textbook described frictional unemployment as the rate below which inflation might accelerate because labor is scarce. My textbook theorized that this rate was in the vicinity of 5 or 6%. So, 3.8% is at once both excellent and somewhat inflationary. The job market also seems to be delivering strong wage gains (4.2% in September), and the Average Work Week remained steady at about 41 hours.

Americans are working. They’re earning. They’re saving. They’re spending. Their dollar is starting to go farther, and their savings are earning interest. The U.S. economy is in a rhythm, and to slightly alter George Gershwin’s lyrics, “Who could hope for anything more?”

Economists and investors have struggled to identify our specific location in the business cycle. Business cycles have been difficult to peg in the aftermath of the Great Financial Crisis. Global central banks delivered economic life support via extremely low and sometimes negative interest rates. This enabled households and corporations to refinance their debt and extend maturities. This flexibility is paying dividends now.

Even though mortgage rates are at multi-decade highs and interest rates on credit cards and auto loans are also much higher than the teaser rates, the issuance of these loans is way down. There aren’t a lot of people paying 8% on their mortgage. Many mortgages have a 3, 4, or 5% interest rate fixed for 30 years. On an inflation-adjusted basis, the cost of housing for those borrowers has declined. Even as Tik-Tok social media influencers decry the rental market, government statistics show that current rents are still relatively affordable, given the rise in incomes. Household balance sheets are in great shape.

These economic facts enable the Fed and other central banks to return to a more normal interest rate environment. In 2019, Chairman Powell embarked on a path of normalizing interest rates, i.e., making them positive on a nominal and “real” (after inflation) basis. The stock market and President Trump lashed out harshly with rapidly declining prices and “mean tweets.” The inflationary aftermath of COVID-19 policy decisions has given Powell and other central bankers the green light to normalize interest rates.

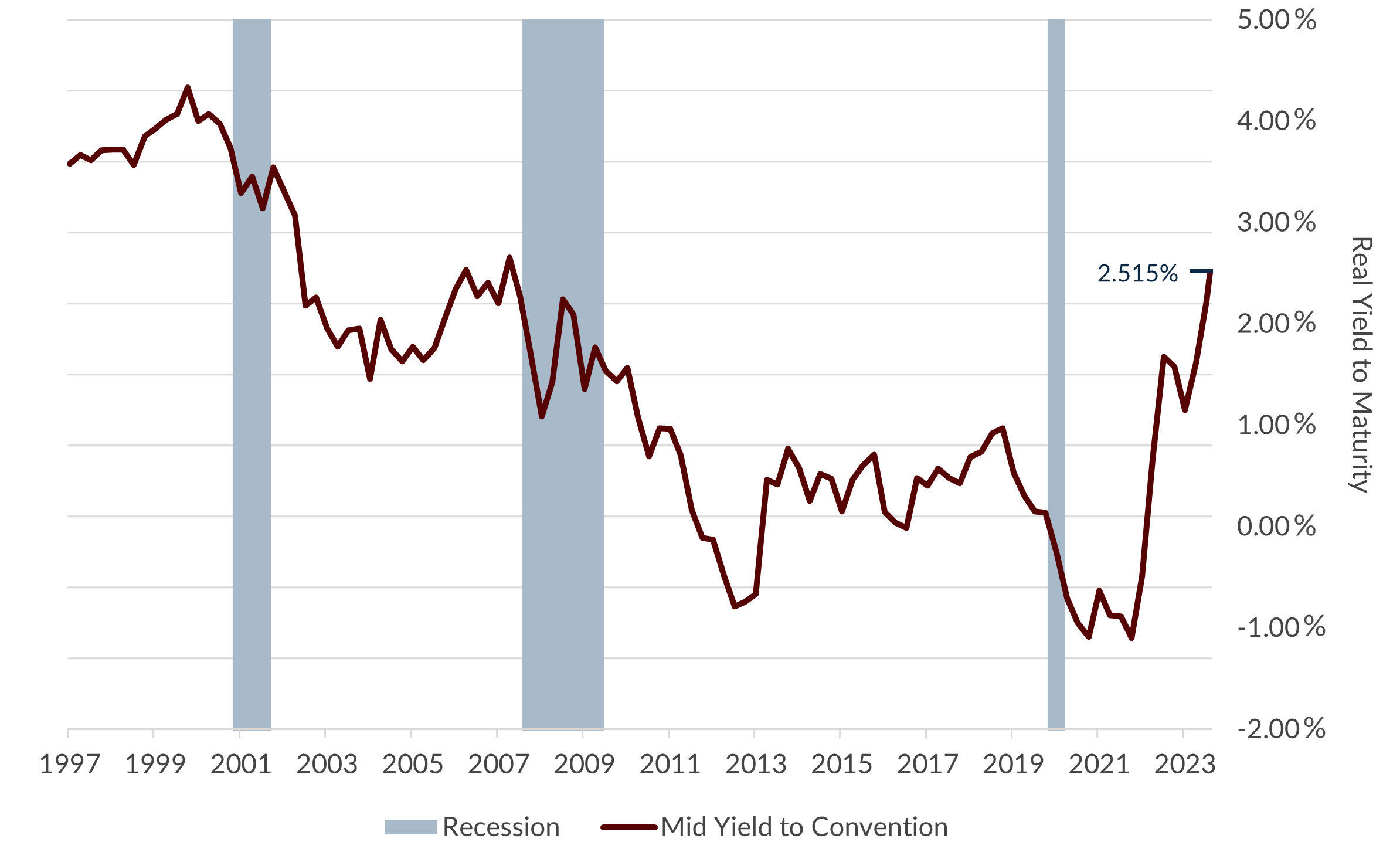

One way to visualize this normalization is by reviewing a 10-year real interest rate chart. The chart below shows the real rate defined as the yield on a 10-year U.S. Treasury Inflation Protected Security (TIPS). TIPS gives investors a real interest rate at a fixed coupon. Over time, the par amount of the bond is increased by inflation (CPI-U), so both the coupon payments and the amount the investor gets at maturity are inflation-protected. That doesn’t mean that investors can’t lose money in TIPS (in 2022, TIPS were down 11.8%, and this year through September, down 1.9%). No investment is without risk.

History of Real Yields on 10-Year TIPS

Source: Bloomberg Finance, L.P.

Real rates reflect market expectations for future economic growth. At the end of October, 10-year real rates stood at 2.52%. This rate is just slightly higher than the 2.4% rate of economic growth anticipated by the Congressional Budget Office (CBO) for the next five years, after which the forecasted growth rate declines to 1.8% per year for the next five years out to 2033.2 The Philadelphia Fed surveys economic forecasters. The surveyed economists indicate a more pessimistic group of prognosticators than found in the CBO. The Philadelphia Fed survey predicts real GDP growth declining to average only 1.7% over the next three years.3 Either way, the bond market may be running the risk of current real yields overshooting future potential economic growth, the same way yields undershot economic growth in the past few years. Investors need to consider that economists think gloomier days may lie ahead for the U.S. economy.

For now, Concord’s strategy remains the same. We think the Federal Reserve will likely be on hold for some time. Fed policy is already restrictive, and rightly so, as inflation is above their long-term target. Barring a surprise in the path of core inflation, the Fed will be unlikely to raise short-term interest rates for the remainder of this year. With next year being an election year, the window is short for the Fed to act one way or another. Holding Fed Funds at 5.3% for a year after holding it at zero for a year (and longer for the period after the Great Financial Crisis) seems like it ought to balance out the risk of inflation without stifling reasonable economic growth.

Normalization of interest rates is not altogether a bad thing. History has shown that if rates go up because the economy is improving, stocks tend to do well. If interest rates remain near their current level, financial asset prices and market participants (companies and consumers) will adjust to those rates. We have started to see acquisitions in the energy sector. If rates stabilize and cost control becomes ever more important, small and medium-sized capitalization U.S. companies may finally stage a comeback. Acquisition fever may spread as companies try to gain scale to combat rising costs.

We continue to think that interest-sensitive sectors of the economy are more likely to be hurt during the adjustment period, though. These include banks, real estate, and industrial companies that rely heavily on debt financing. On the flip side, select information technology companies, whose prices have come down substantially, and healthcare companies provide excellent value. Finally, we see no reason to depart for overseas markets. Neither prices nor prospects seem attractive enough to ditch American companies. In bonds, we are satisfied to take very little risk in exchange for current yields offered in short-duration, high-quality bonds.

It is difficult to be an optimist in troubled times, but the greatest investments are found where the average investor dares not tread. Concord clients need not take outsized risks at this juncture. A steady course in alignment with your financial plan will yield fine results over the next five and ten years. The future is almost certainly not so bleak as the picture painted in October. We do not have to hope for this to be true. America provides a solid foundation and fertile ground for great ideas and wealth creation for patient investors.

Author

Gary Aiken, Chief Investment Officer

Gary Aiken is the Chief Investment Officer for Concord Asset Management and is responsible for macroeconomic analysis, asset allocation, and security selection, as well as trading and investment operations.

Gary has over 21 years of investment experience and holds an undergraduate degree in economics from the University of Maryland and an MBA from The George Washington University School of Business.

—

Sources:

1U.S. Stocks (S&P 500 Index), U.S. Bonds (Bloomberg Aggregate Bond Index), Non-U.S. Stocks (Bloomberg World ex US Large, Mid & Small Cap Index), Global Bonds (Bloomberg Global Agg Index). All data July 31 – October 31, 2023.

2The Budget and Economic Outlook: 2023 to 2033 (February 2023). Congressional Budget Office.

3Third Quarter 2023 Survey of Professional Forecasters (August 2023). Philadelphia Federal Reserve.

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of this content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordassetmgmt.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.