Tariff and Inflation News Shape a Volatile Week for Stocks:

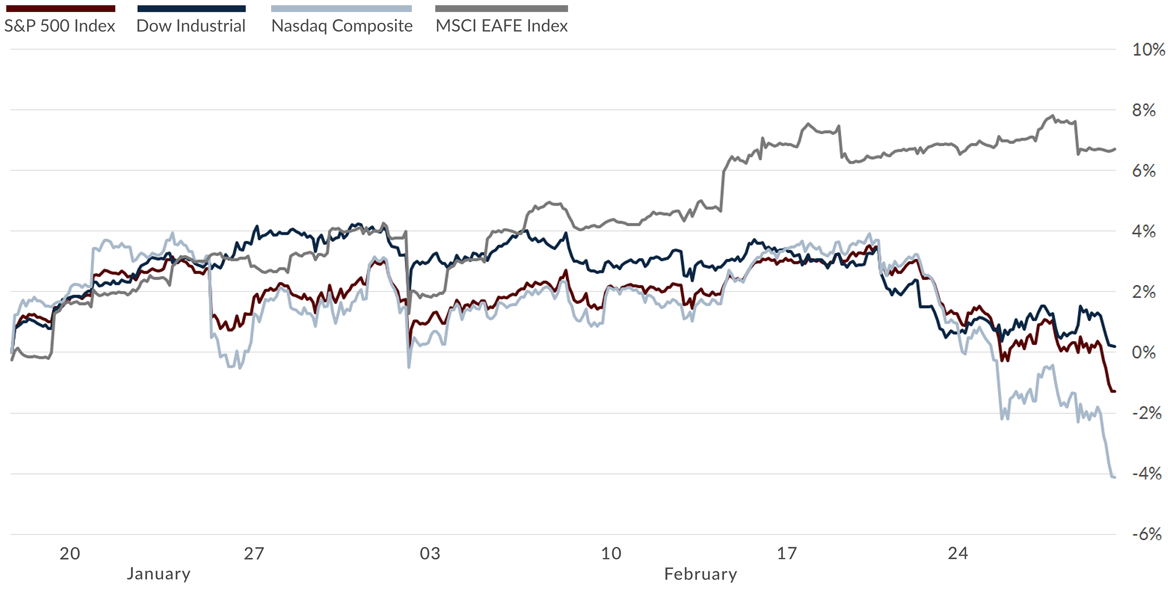

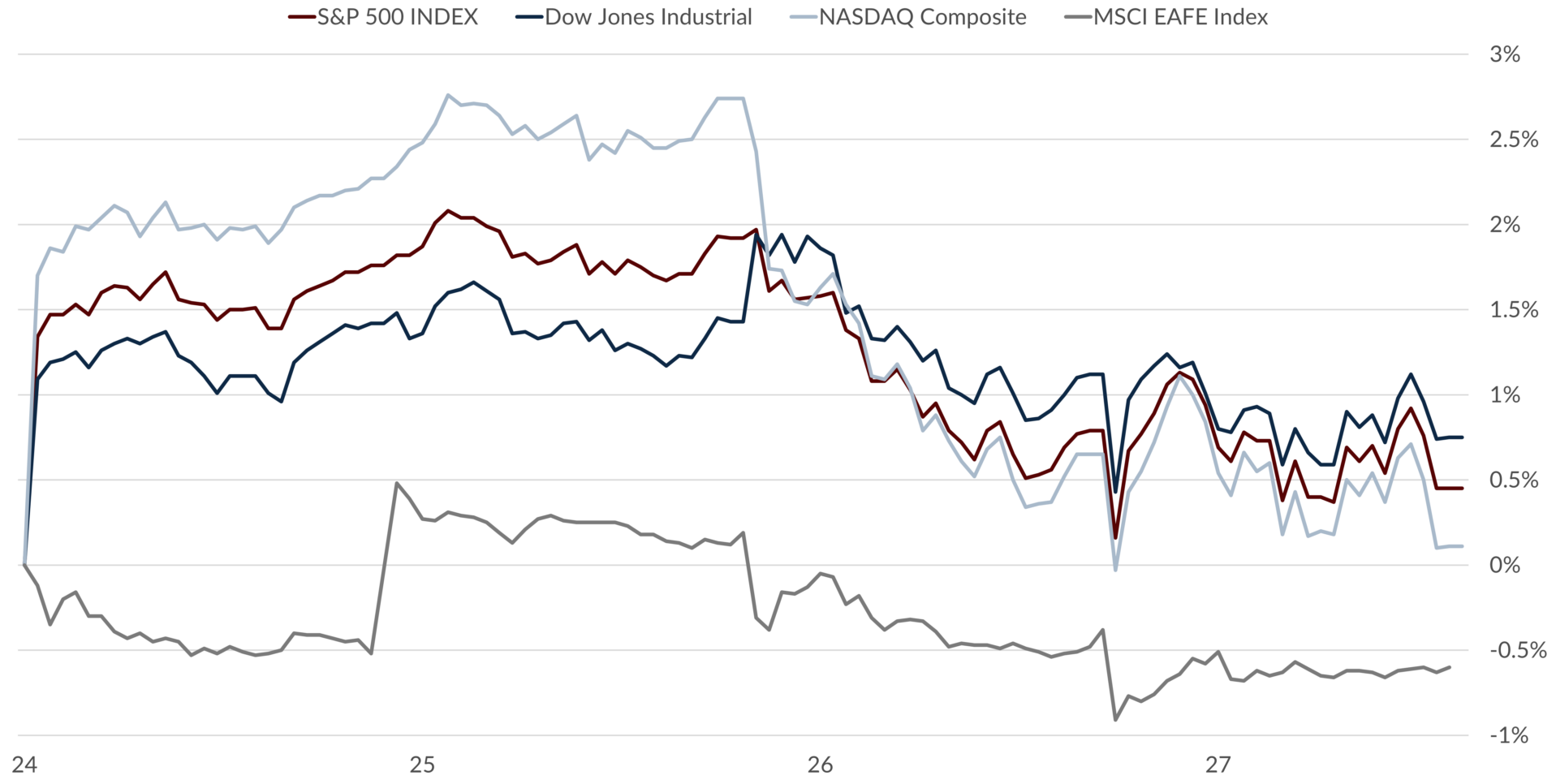

Stocks declined last week as investor sentiment fluctuated between optimism and disappointment. These shifts were largely driven by ongoing tariff developments and new inflation data, which raised concerns about potential trade disruptions and fueled uncertainty about future interest rate hikes.

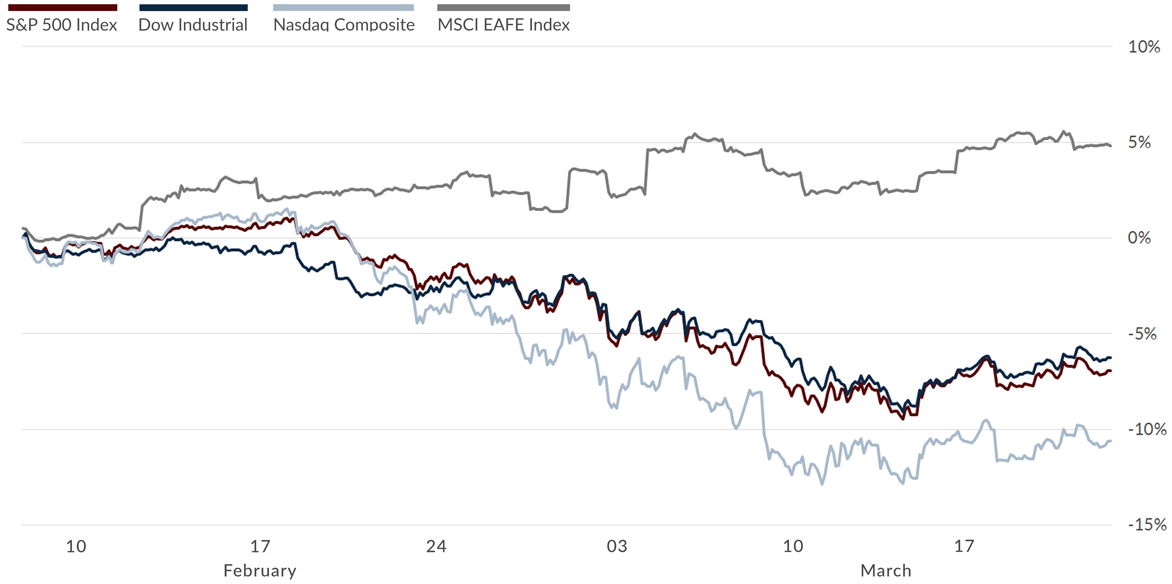

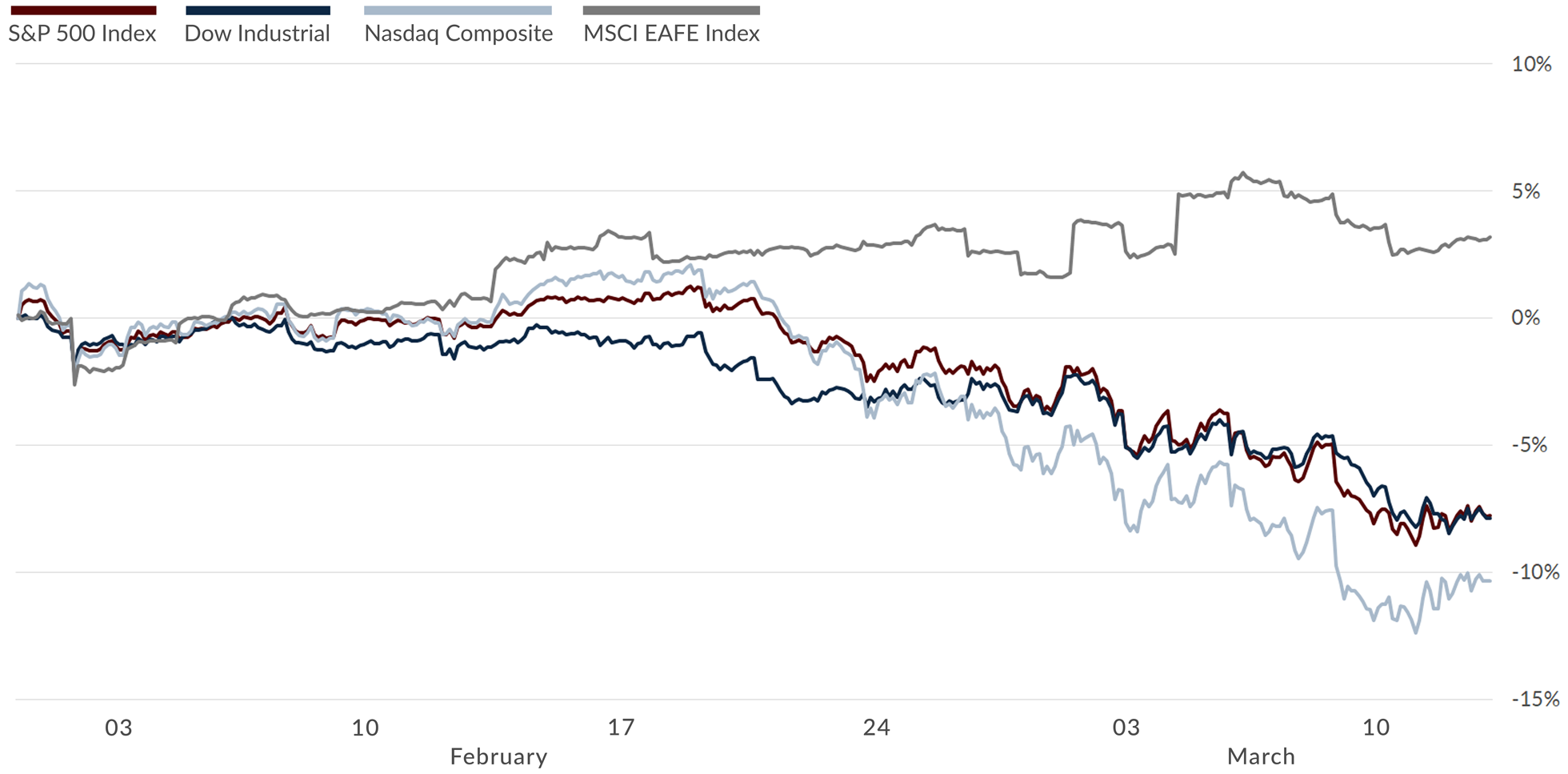

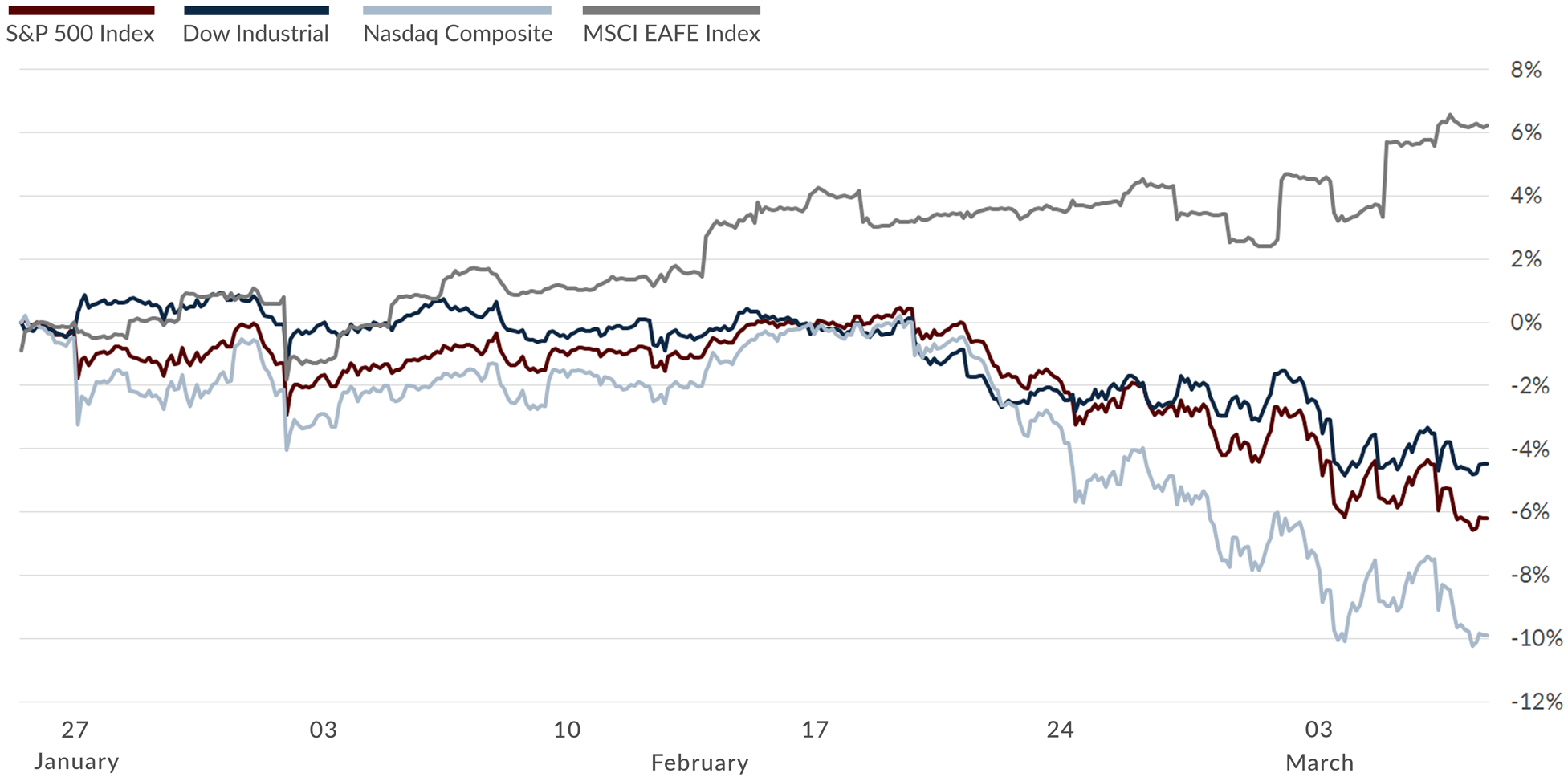

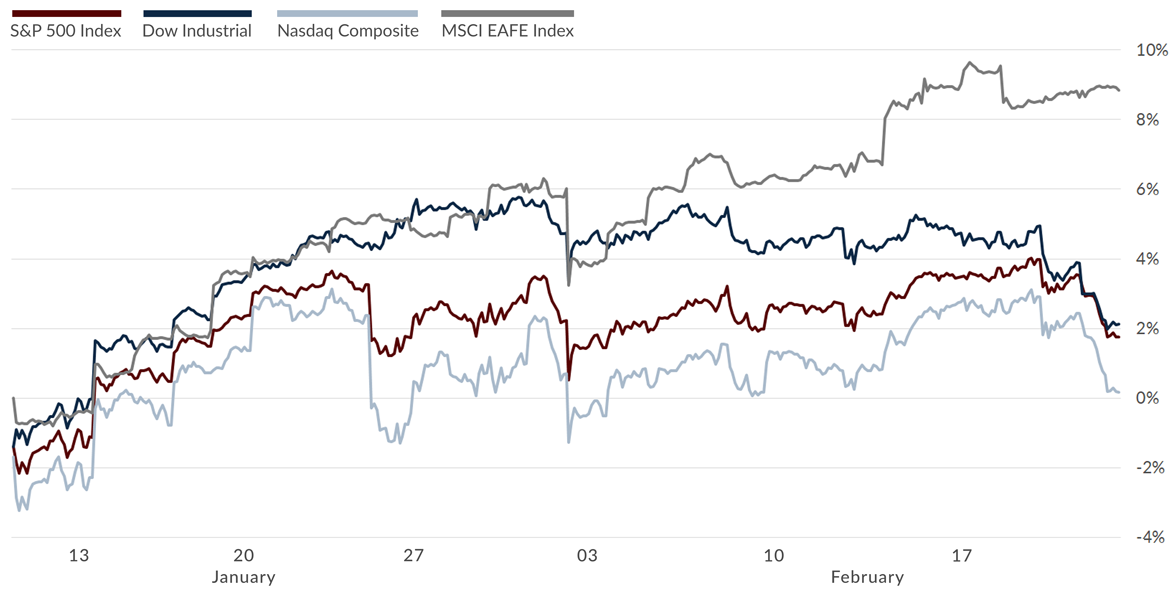

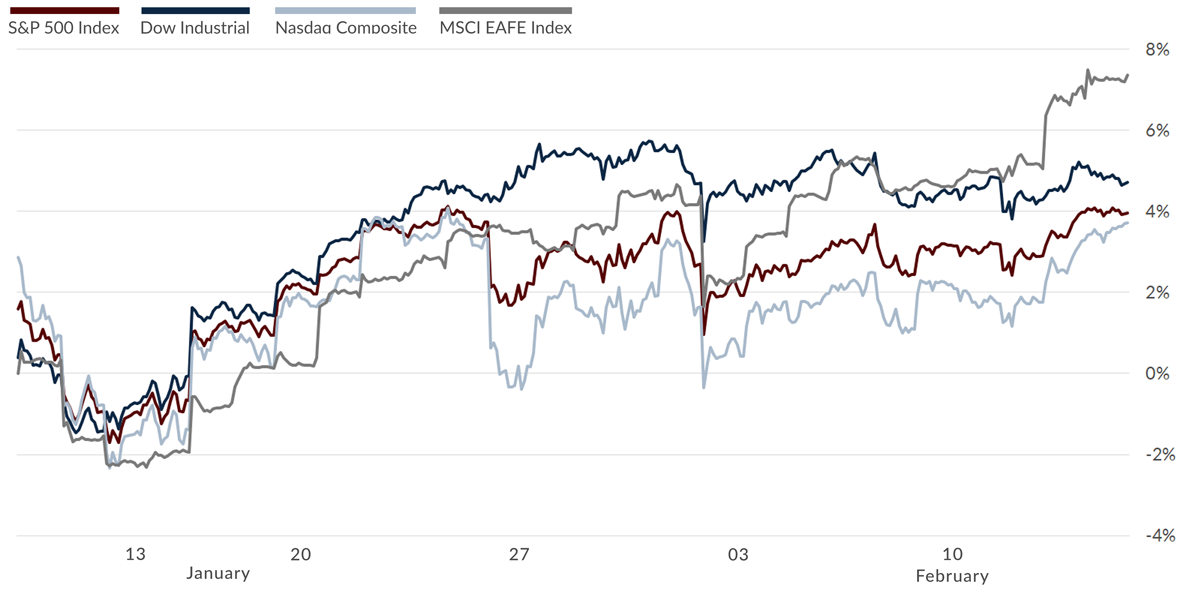

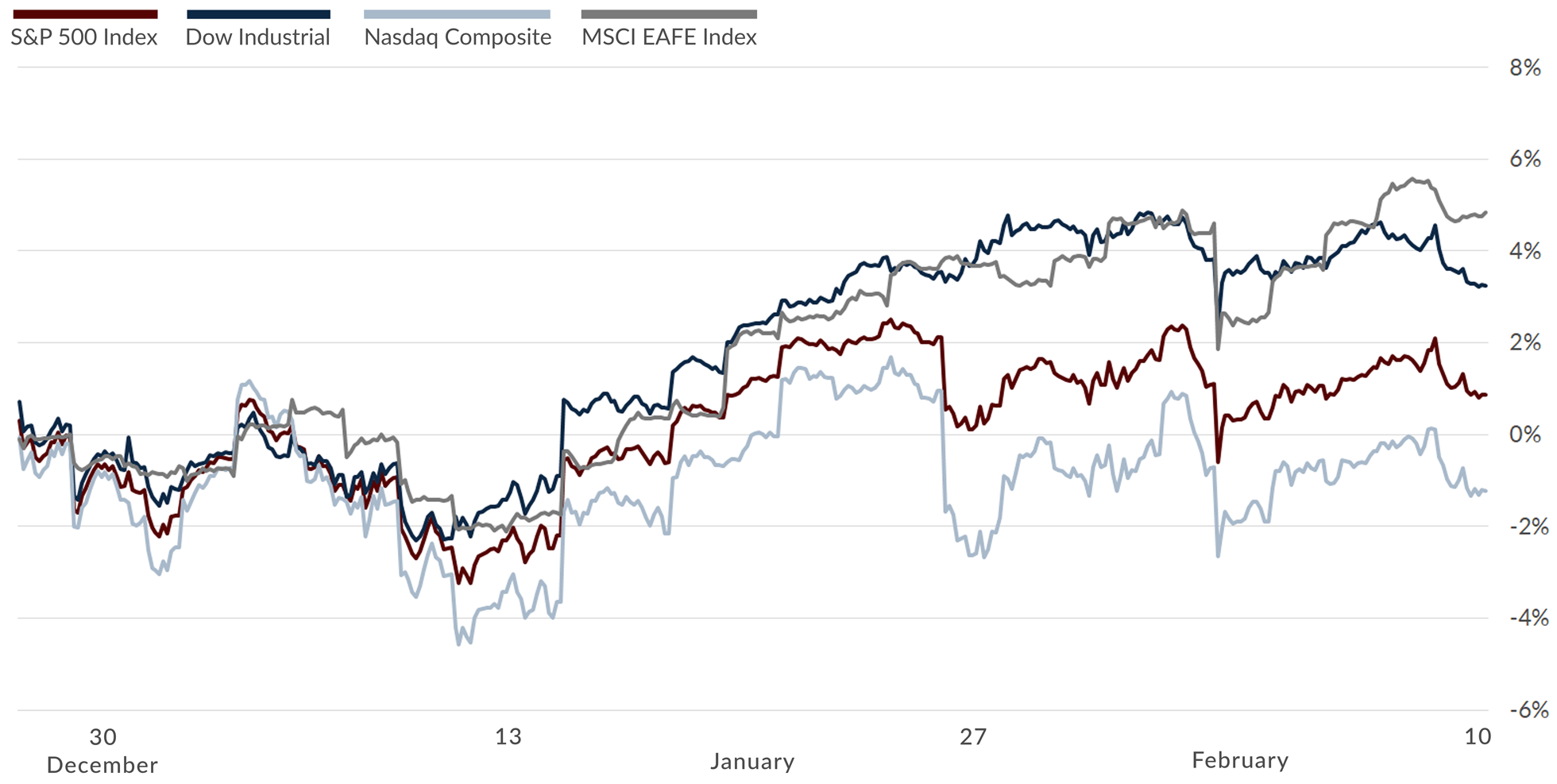

The S&P 500 Index fell 1.53%, while the Nasdaq Composite Index retreated 2.59%. The Dow Jones Industrial Average slid 0.96%. The MSCI EAFE Index, which tracks developed overseas stock markets, declined 1.29%.1,2

Source: Bloomberg Finance, L.P. (Performance data normalized 3/24/25 = 0)

An Up and Down Week

Stocks started the week with a sharp rally after the White House said it may “give a lot of countries breaks” on reciprocal tariffs. The positive momentum continued into Tuesday, with the Nasdaq and S&P 500 outpacing the Dow.3

Then, midweek, news that the White House was planning additional tariffs on all cars made outside the U.S. rattled markets.4,5

On Friday, investors reacted to a warmer-than-expected inflation report and lower consumer sentiment, putting further pressure on stocks as the week closed.6

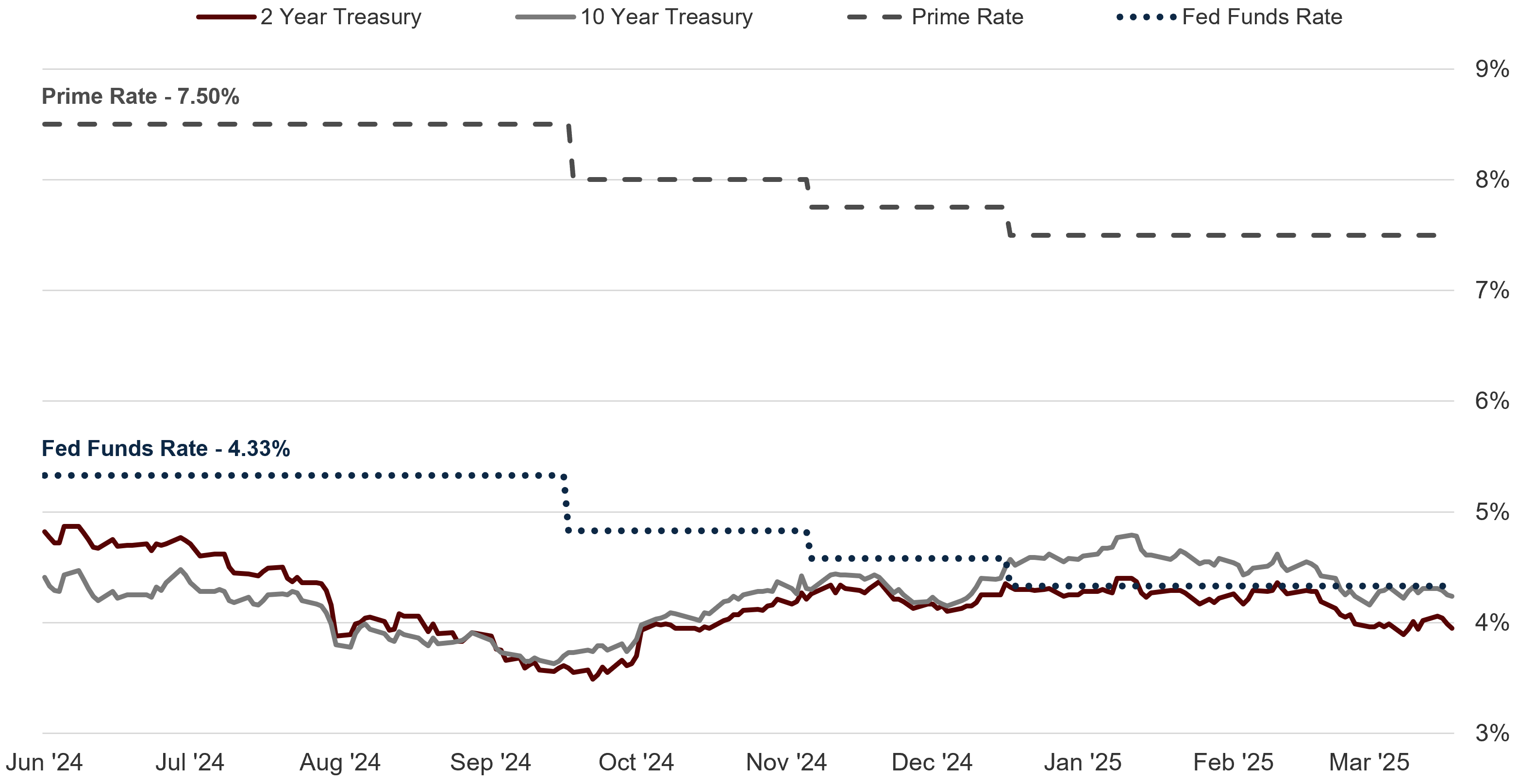

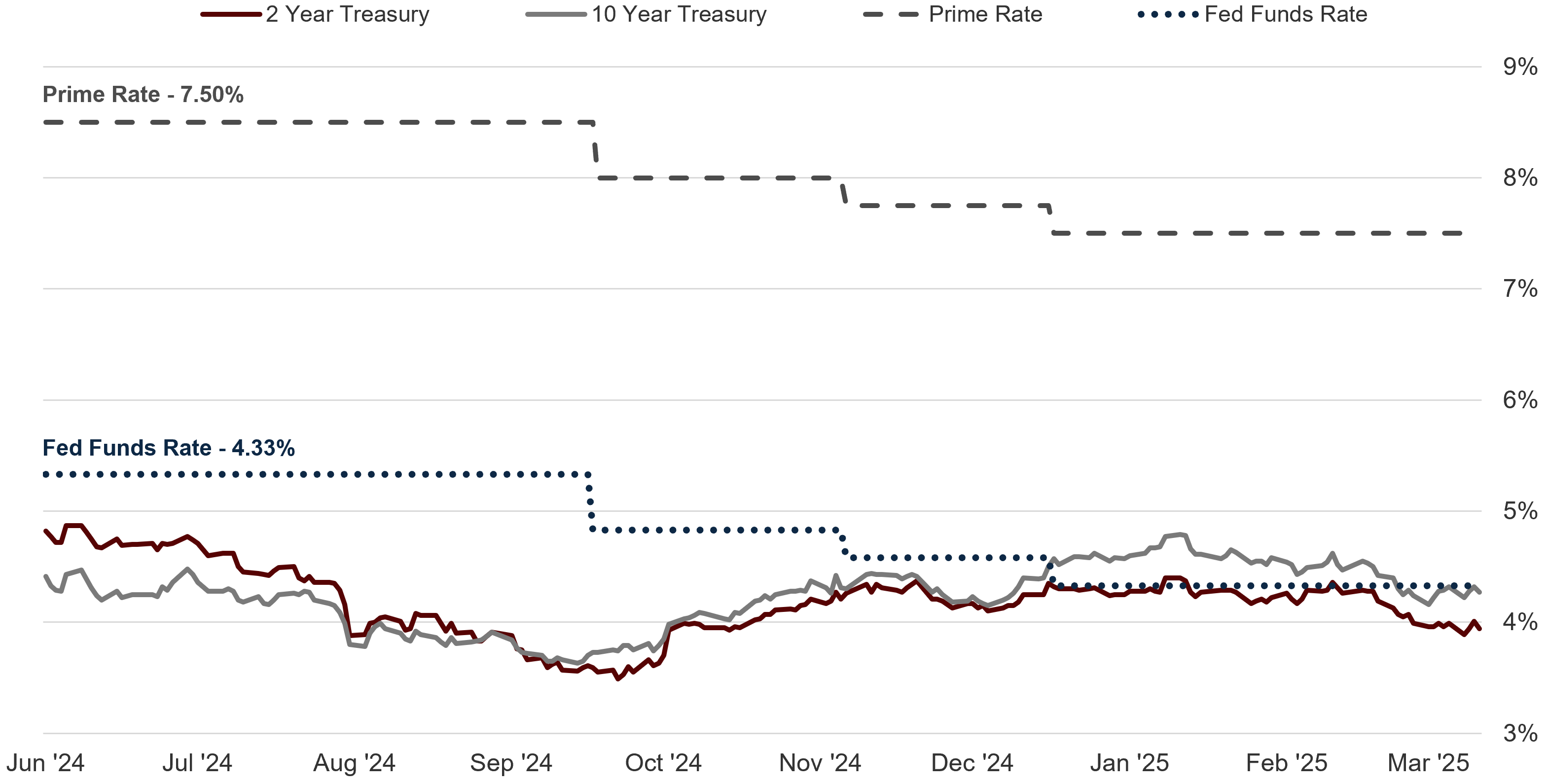

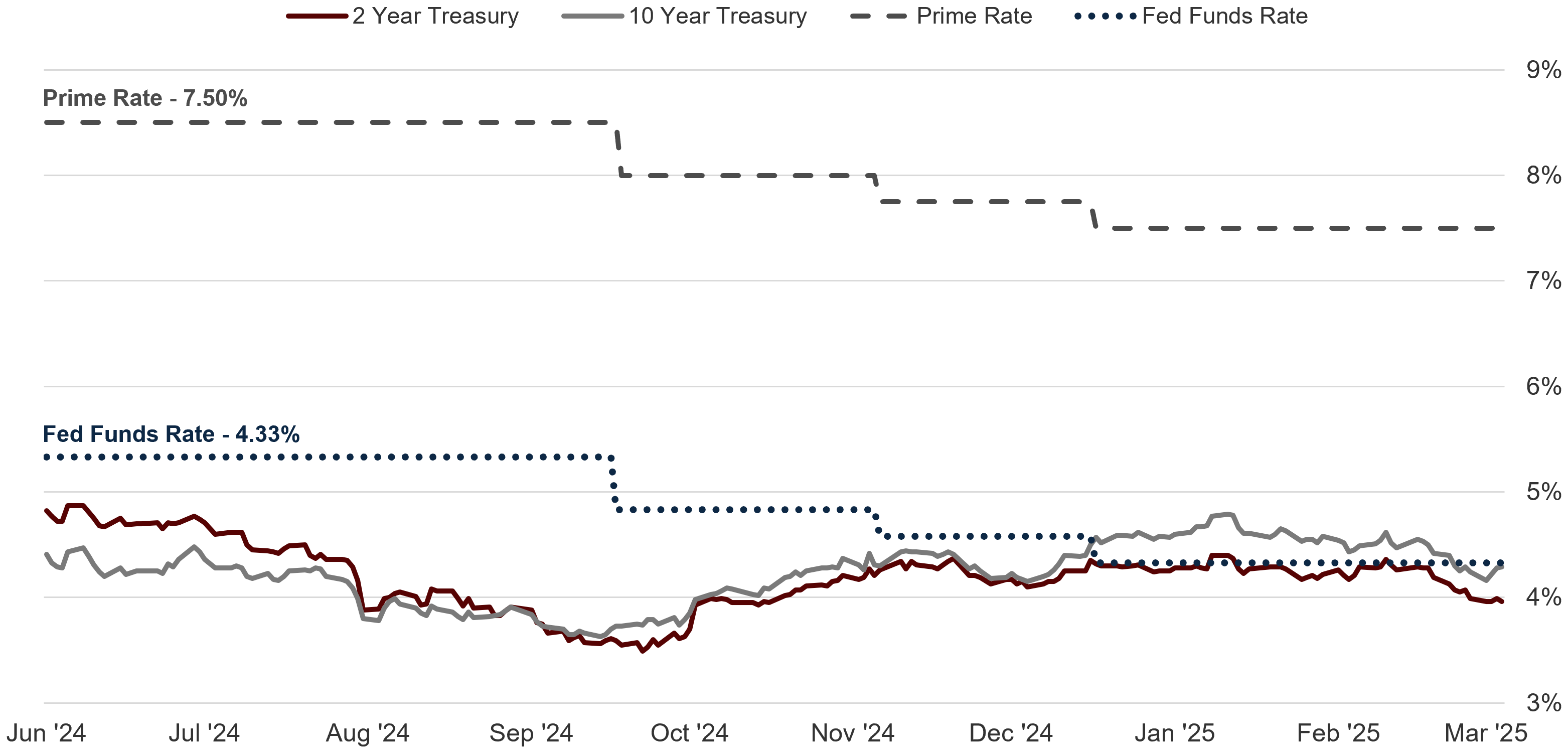

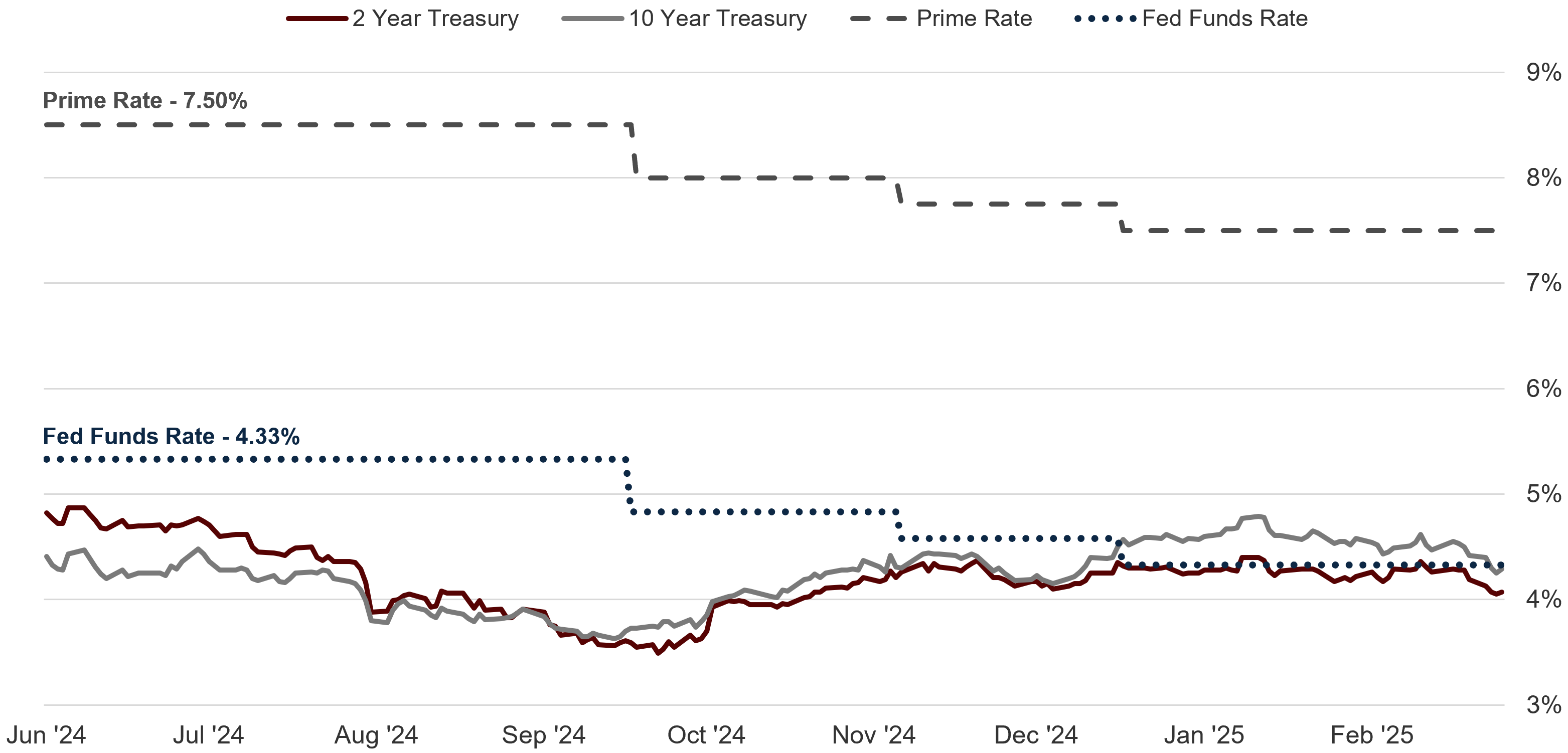

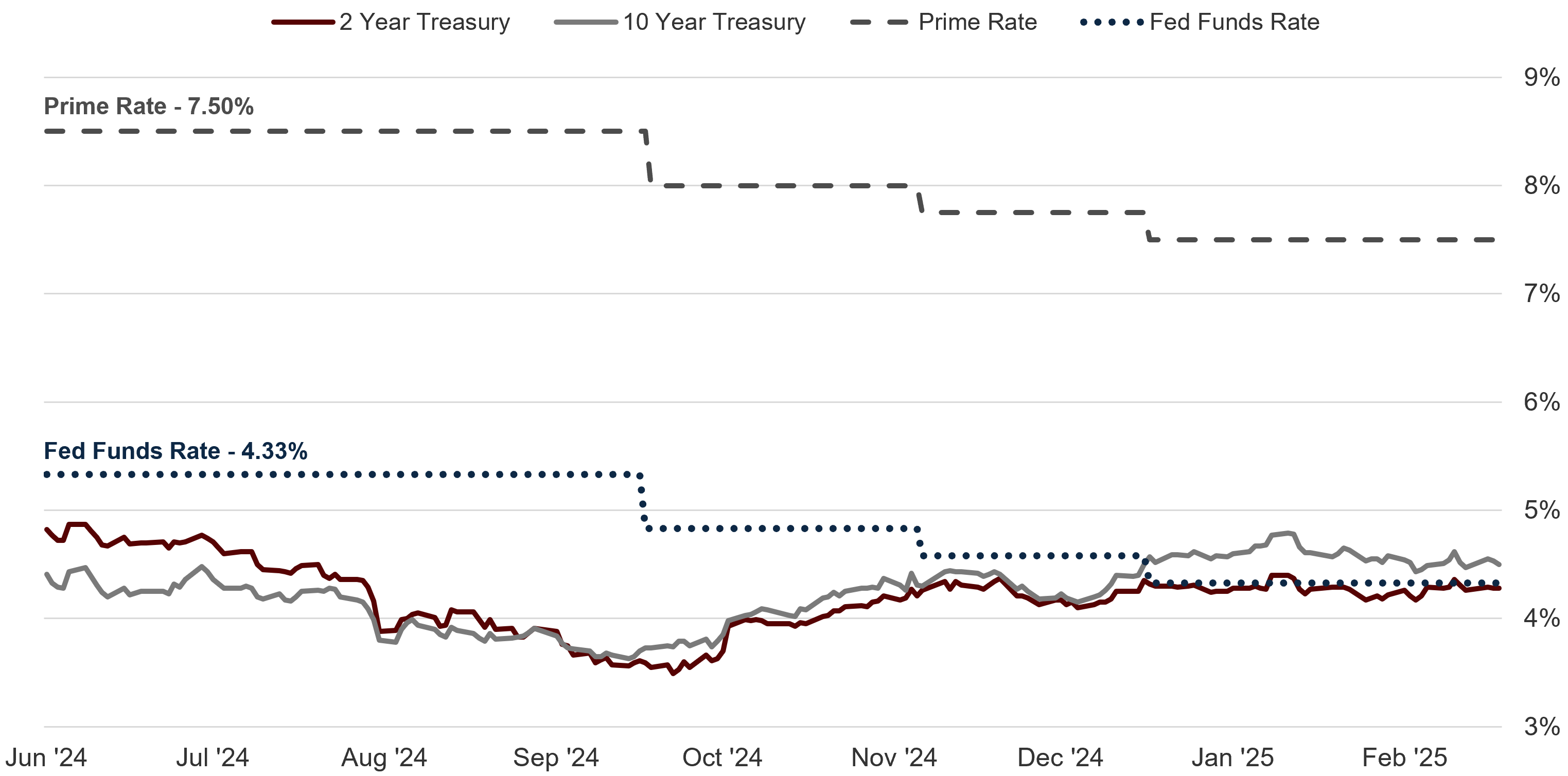

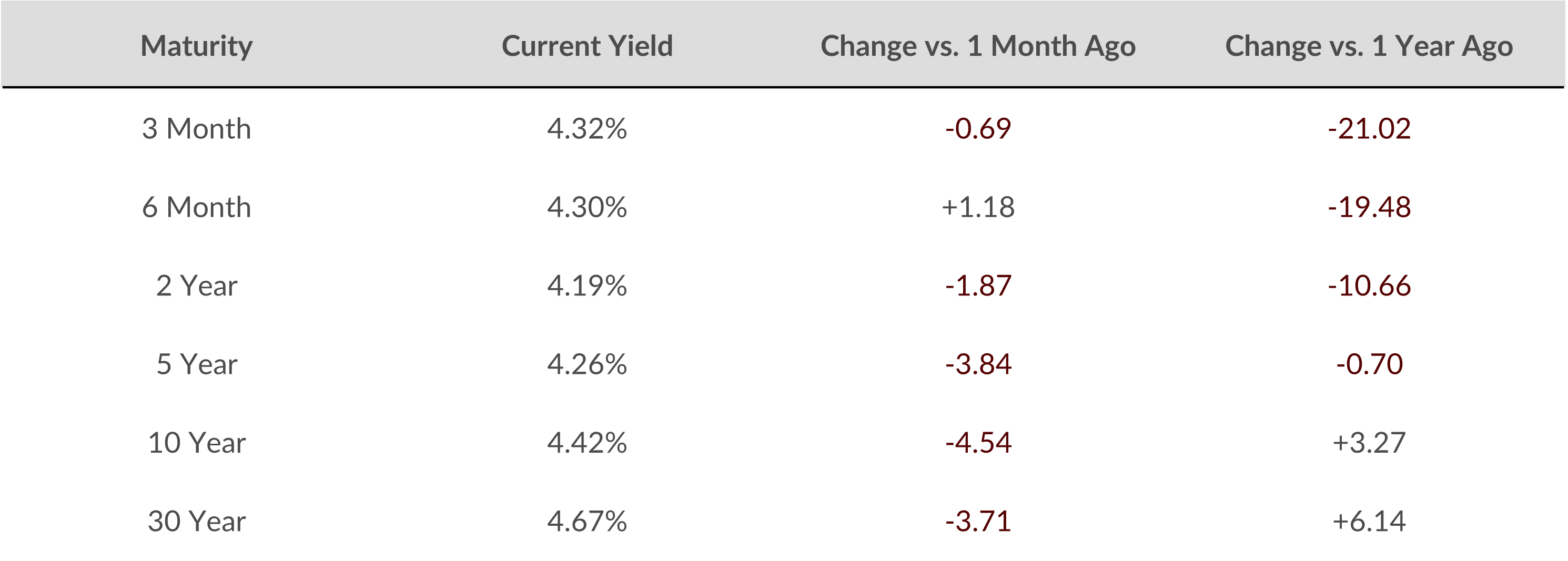

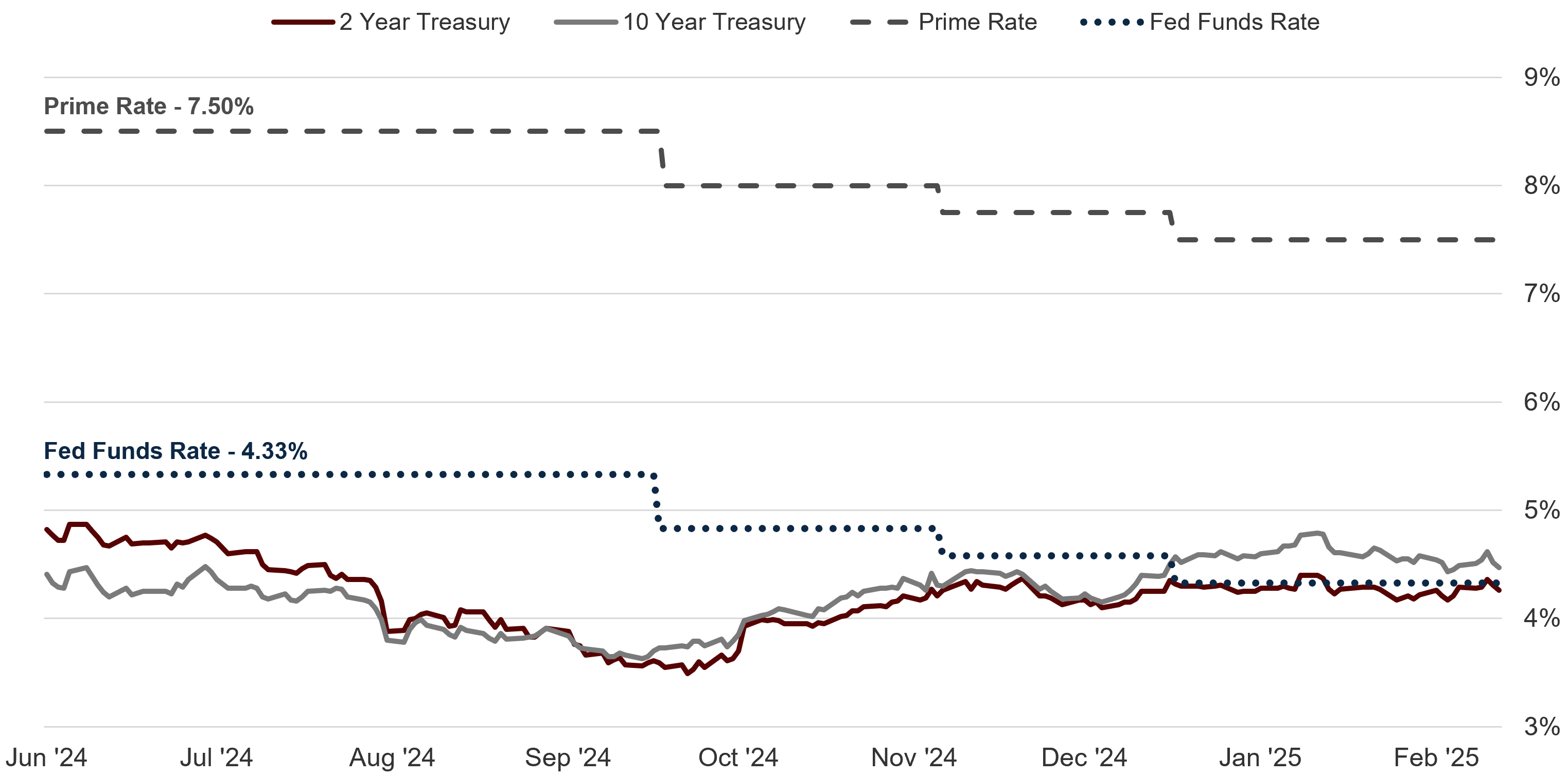

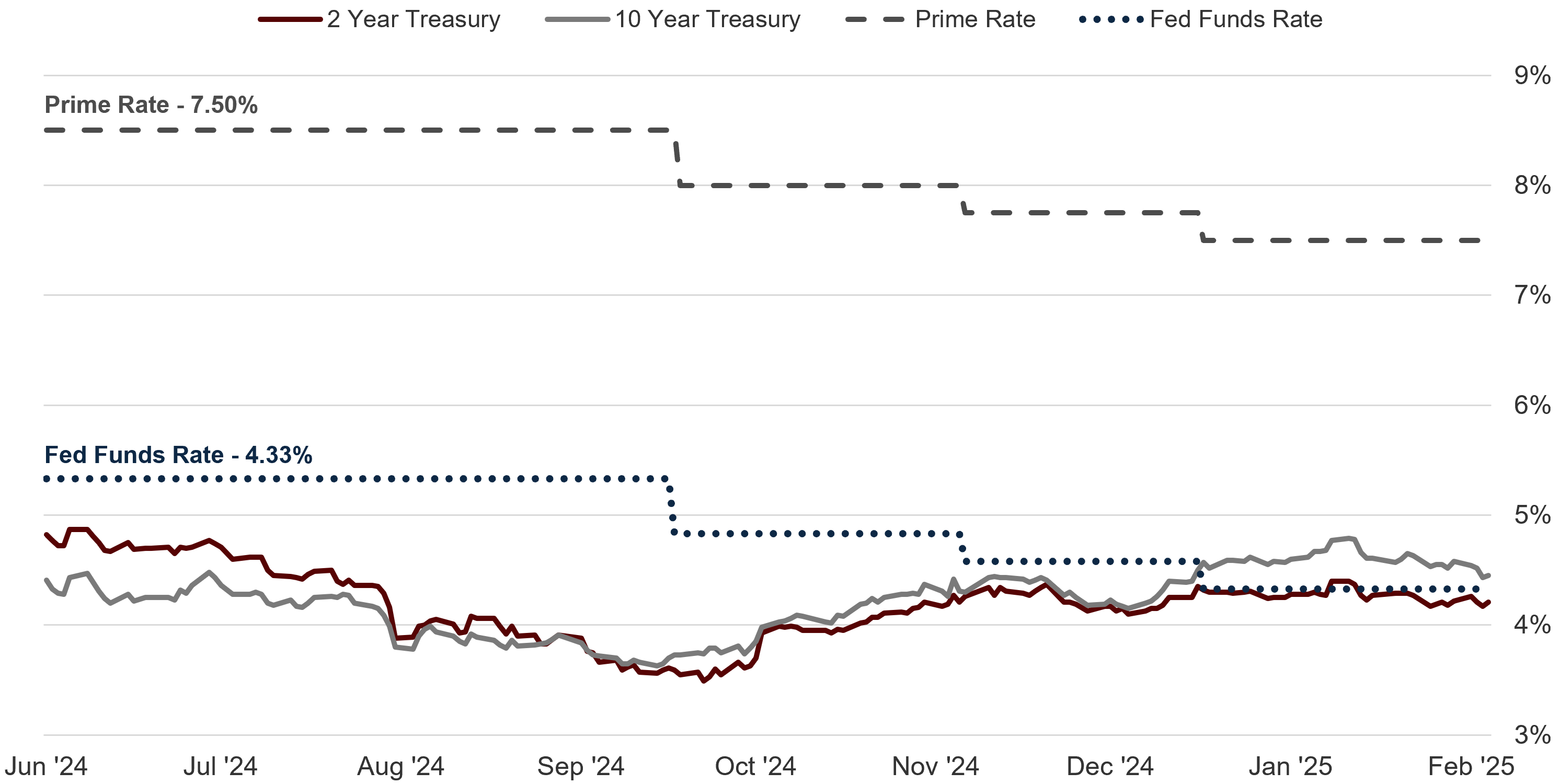

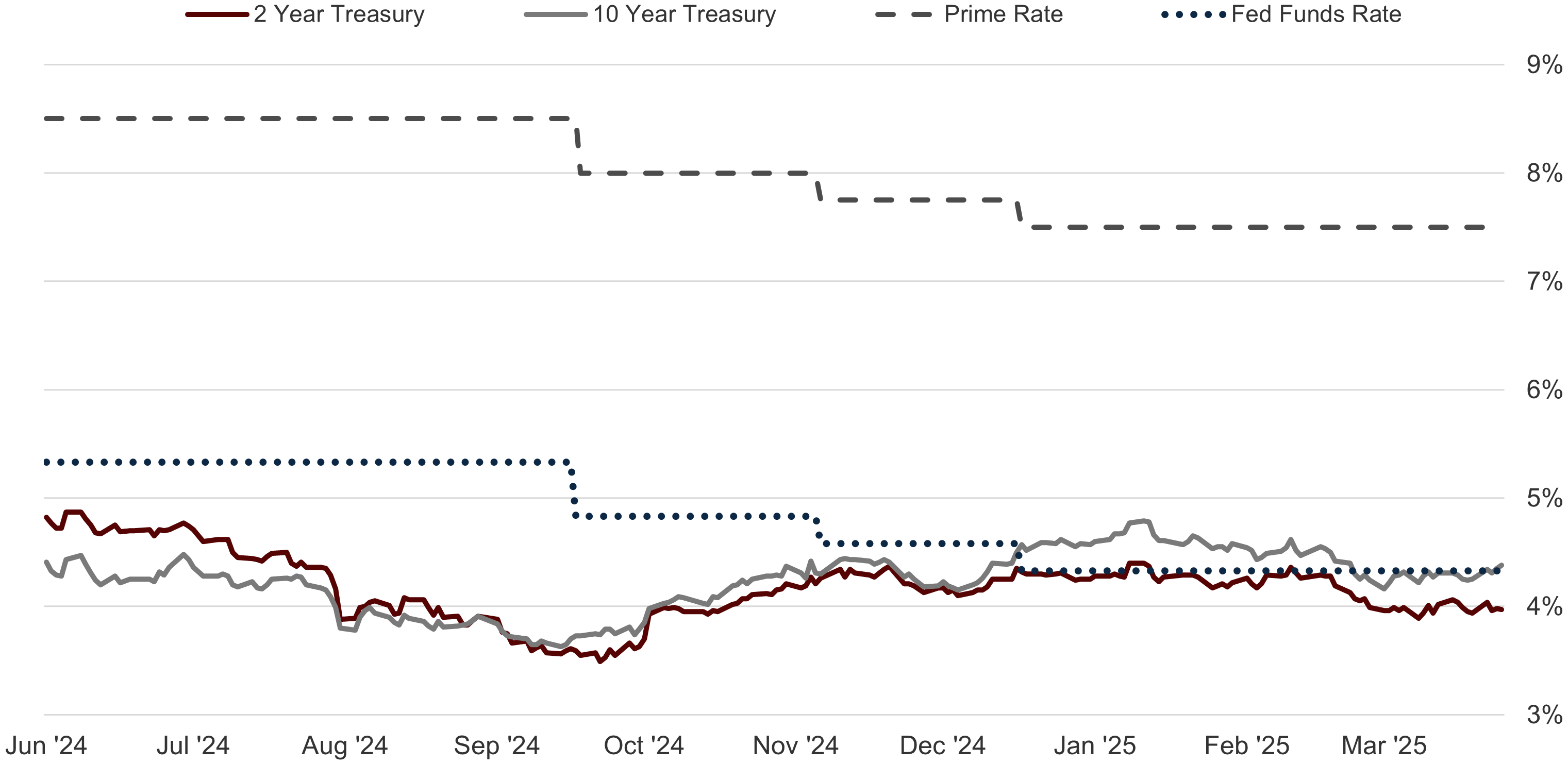

Sources: U.S. Department of the Treasury, Board of Governors of the Federal Reserve System, Charles Schwab

Noise vs. Signal

There can be a lot of noise in the market from time to time. This can make it hard for investors to interpret information as they search for the actual signal.

Last week, investors were trying to interpret the White House decision to impose tariffs on all cars and some car parts made outside of the U.S. While some automakers are domestic and others are foreign-based, the question is whether companies will absorb the additional costs, pass them on to consumers, or look to build factories in the United States.7

Separating the noise from the signal may take time, which can be more challenging when the markets react to new tariff updates as they are announced.

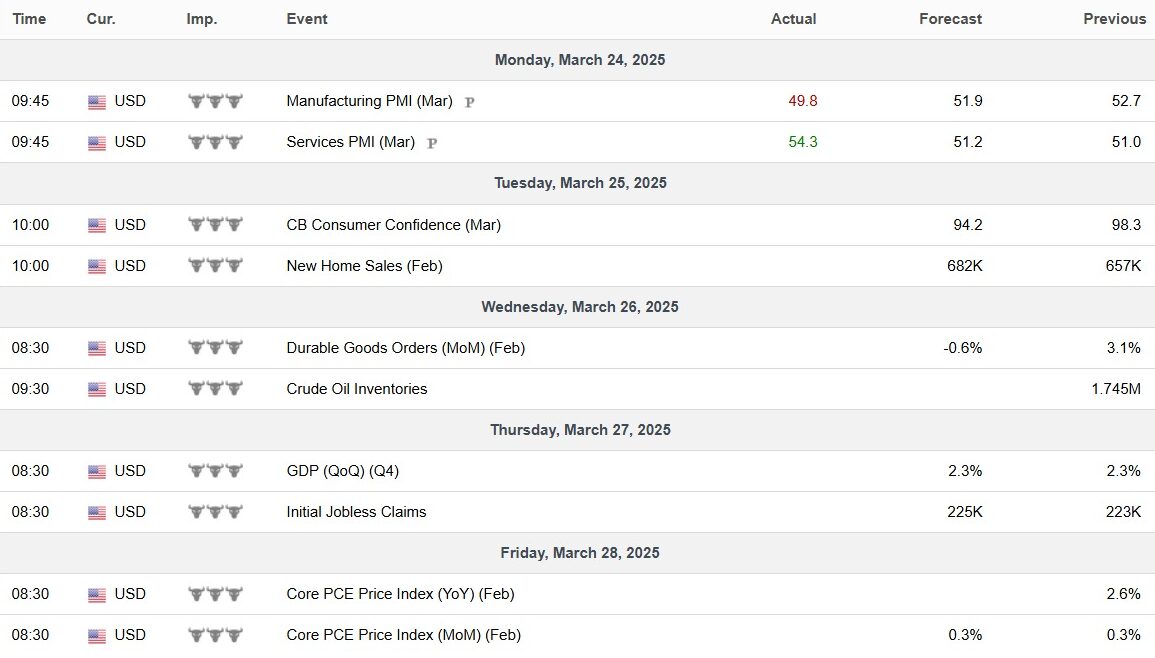

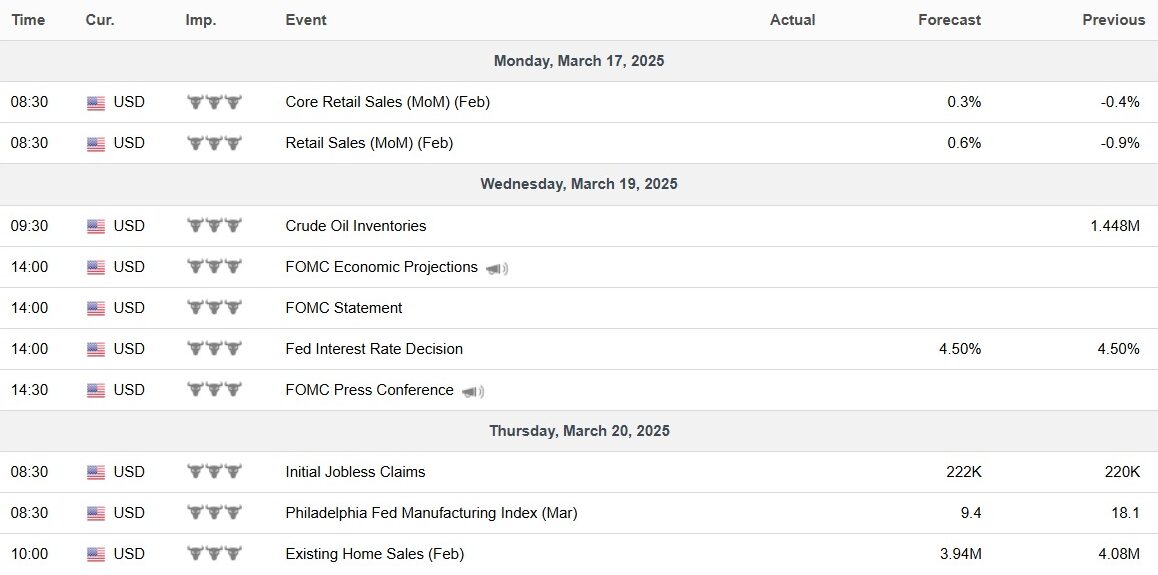

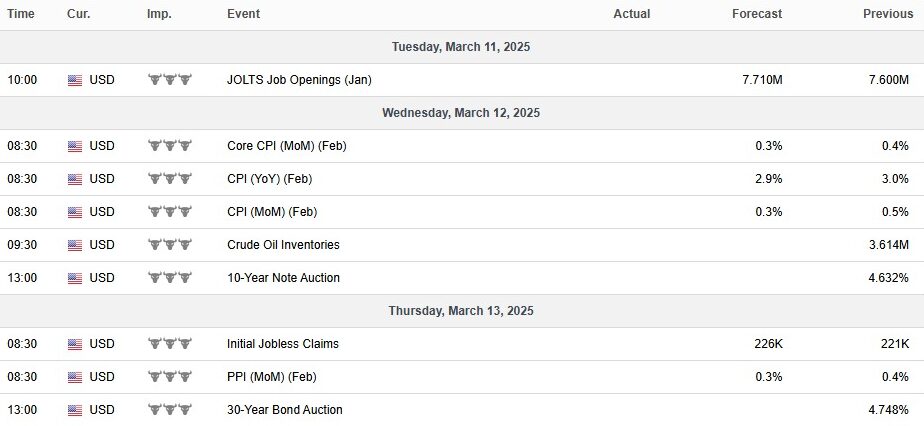

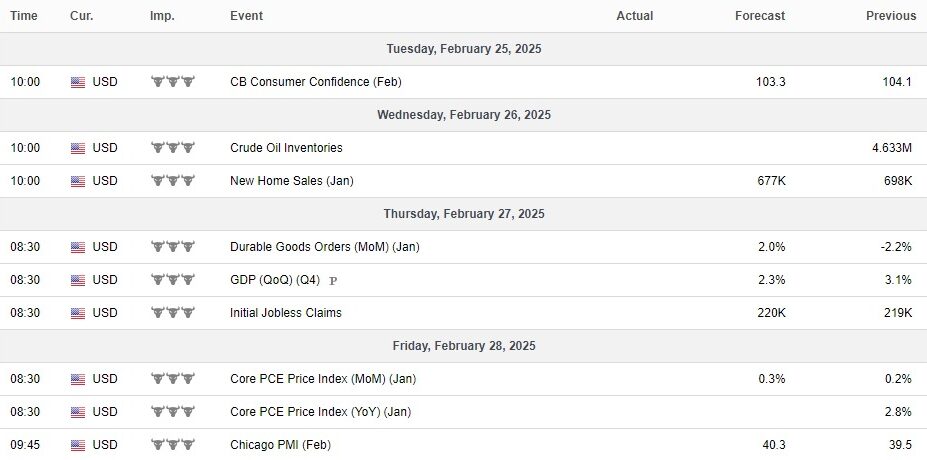

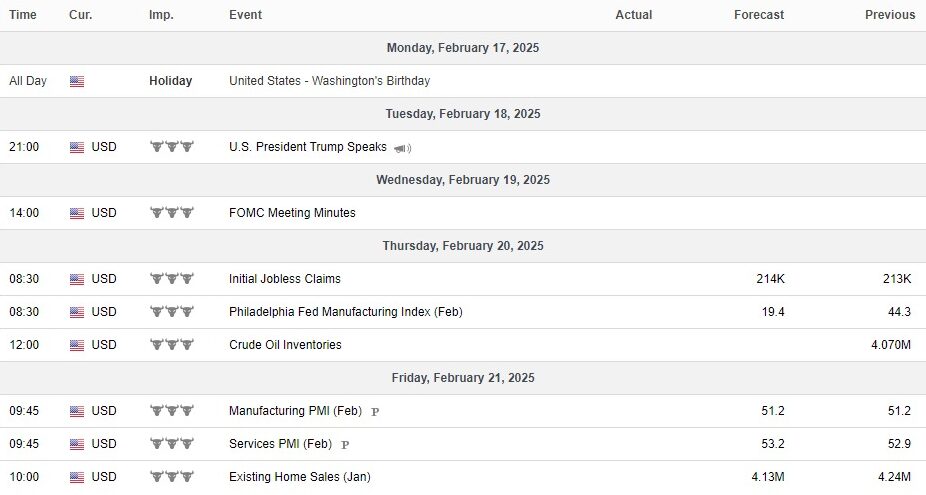

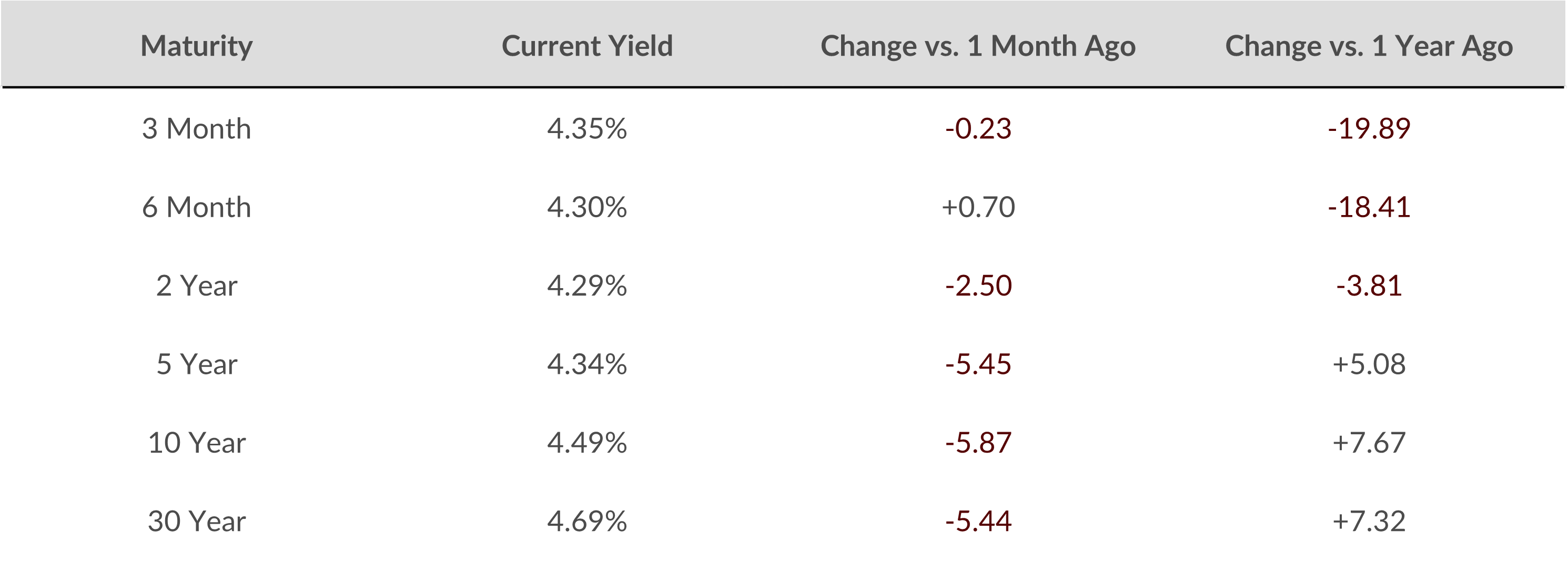

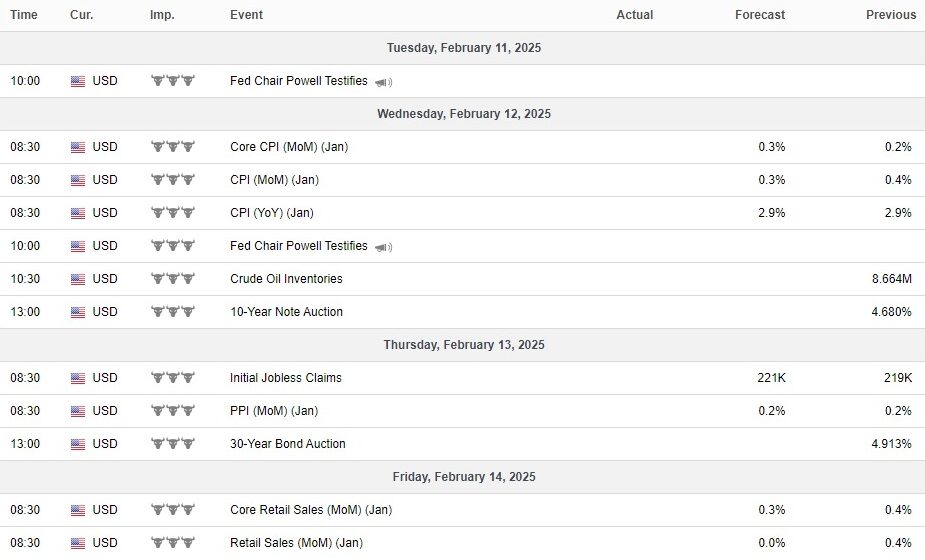

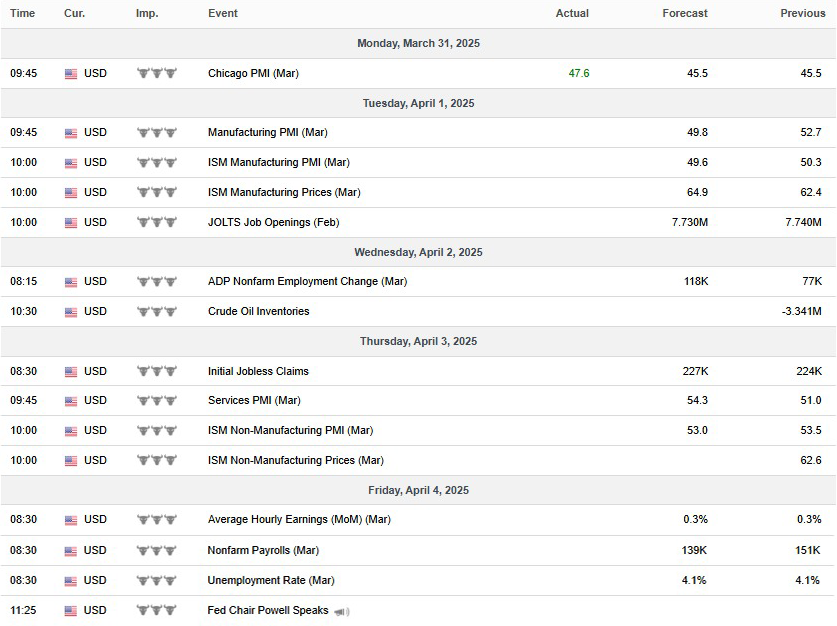

This Week: Key Economic Data

Source: Bloomberg Finance L.P.

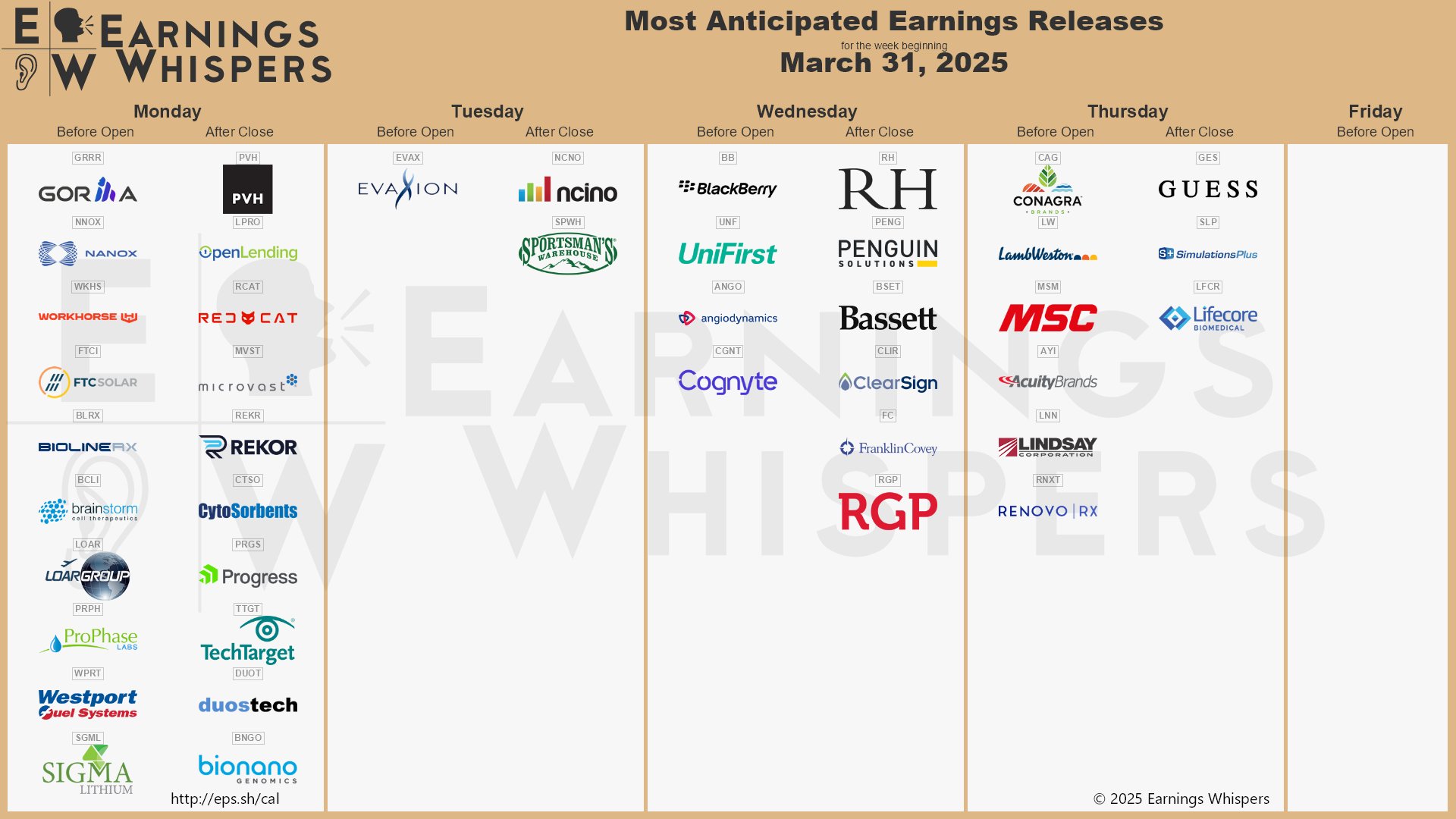

This Week: Companies Reporting Earnings

Source: EarningsWhispers

Author

Gary Aiken

Chief Investment Officer

Concord Asset Management

—

Footnotes and Sources

1The Wall Street Journal, March 28, 2025

2Investing.com, March 28, 2025

3CNBC.com, March 25, 2025

4CNBC.com, March 26, 2025

5CNBC.com, March 27, 2025

6The Wall Street Journal, March 28, 2025

7MarketWatch.com, March 27, 2025

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Concord Asset Management, or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Concord Asset Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of any specific securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks, including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications, and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information.

Concord Asset Management is neither a law firm, nor a certified public accounting firm, and no portion of the content should be construed as legal or accounting advice. A copy of Concord Asset Management’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at https://concordwealthpartners.com/. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please remember to contact the firm in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, and/or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Concord Asset Management and Concord Wealth Partners shall continue to rely on the accuracy of information that you have provided. Please Note: If you are a Concord Asset Management or Concord Wealth Partners client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.